HSBC 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

– the use of a one-day holding period assumes that all

positions can be liquidated or hedged in one day, which

may not fully reflect the market risk arising at times of

severe illiquidity, when a one day holding period may

be insufficient to liquidate or hedge all positions fully;

– the use of a 99% confidence level, by definition,

does not take into account losses that might occur

beyond this level of confidence;

– VaR is calculated on the basis of exposures

outstanding at the close of business and therefore

does not necessarily reflect intra-day exposures; and

– VaR is unlikely to reflect loss potential on exposures

that only arise under significant market moves.

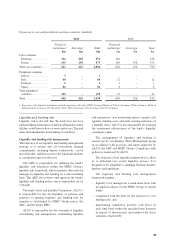

In 2010, the HSBC Group’s policy regarding the

VaR calculation was expanded to include Idiosyncratic

Credit VaR (‘ICVaR’) from trading positions. ICVaR

captures the residual market risk of a specific issuer that

is not captured in the historical simulation credit VaR.

Effective 1 January 2013, the bank has included ICVaR

within the VaR information presented in the table and

graph below.

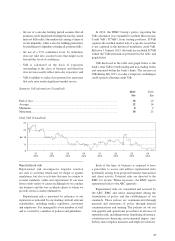

VaR disclosed in the table and graph below is the

bank’s total VaR for both trading and non-trading books

and remained within the bank’s limits. The increase in

VaR during July 2013, was due a temporary widening in

credit spreads effecting credit VaR.

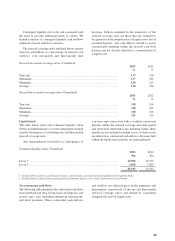

Summary VaR information (Unaudited)

2013

$m

2012

$m

End of year ..................................................................................................................... 10 10

Average .......................................................................................................................... 12 16

Minimum........................................................................................................................ 89

Maximum ....................................................................................................................... 18 23

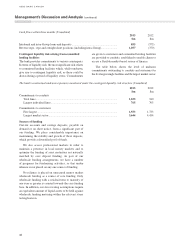

Daily VaR (Unaudited)

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

24

20

$m 16

12

8

Reputational risk

Reputational risk encompasses negative reaction

not only to activities which may be illegal or against

regulations, but also to activities that may be counter to

societal standards, values and expectations. It can arise

from a wide variety of causes including how we conduct

our business and the way in which clients to whom we

provide services conduct themselves.

Reputational risk is measured by reference to our

reputation as indicated by our dealings with all relevant

stakeholders, including media, regulators, customers

and employees. It is managed by every member of staff

and is covered by a number of policies and guidelines.

Each of the lines of business is required to have

a procedure to assess and address reputational risks

potentially arising from proposed business transactions

and client activity. Potential risks are directed to the

RMC for review. Where necessary, the RMC reports

reputational risks to the ARC quarterly.

Reputational risks are considered and assessed by

the ARC, RMC and senior management during the

formulation of policy and the establishment of our

standards. These polices are communicated through

manuals and statements of policy through internal

communications and training. The policies set out our

risk appetite and operational procedures in all areas of

reputation risk, including money laundering deterrence,

counterterrorist financing, environmental impact, anti-

bribery and corruption measures and employee relations.