HSBC 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

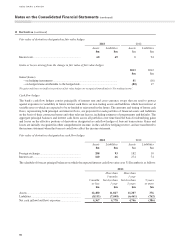

HSBC BANK CANADA

86

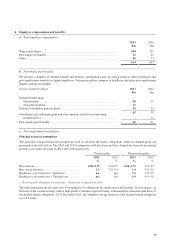

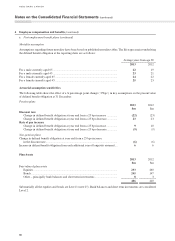

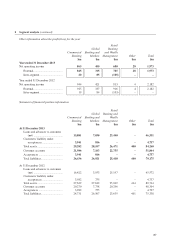

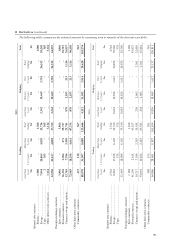

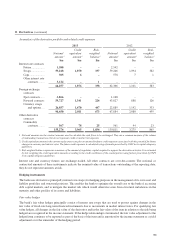

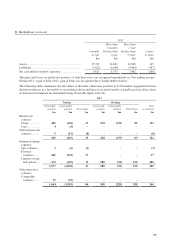

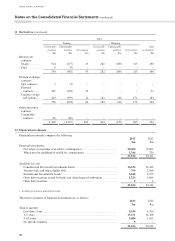

8 Segment analysis (continued)

2013

$m

2012

$m

Commercial Banking

Net interest income ........................................................................................................ 675 710

Net fee income ............................................................................................................... 317 307

Net trading income ......................................................................................................... 28 31

Other operating loss ....................................................................................................... (31) (25)

Net operating income before loan impairment charges and other credit risk provisions 989 1,023

Loan impairment charges and other credit risk provisions ............................................ (124) (79)

Net operating income ..................................................................................................... 865 944

Total operating expenses ................................................................................................ (373) (377)

Operating profit .............................................................................................................. 492 567

Share of profit in associates ........................................................................................... 31 5

Profit before income tax expense ................................................................................... 523 572

Global Banking and Markets

Net interest income ........................................................................................................ 159 167

Net fee income ............................................................................................................... 83 87

Net trading income ......................................................................................................... 103 106

Gains less losses from financial investments ................................................................. 54 51

Other operating income .................................................................................................. 12

Gain on sale of full service brokerage ........................................................................... –8

Net operating income ..................................................................................................... 400 421

Total operating expenses ................................................................................................ (113) (112)

Profit before income tax expense ................................................................................... 287 309

Retail Banking and Wealth Management

Net interest income ........................................................................................................ 505 629

Net fee income ............................................................................................................... 203 207

Net trading income ......................................................................................................... 19 12

Gain less losses from financial investments .................................................................. 41

Other operating income .................................................................................................. 13 16

Gain on sale of full service brokerage ........................................................................... –80

Net operating income before loan impairment charges and other credit risk provisions 744 945

Loan impairment charges and other credit risk provisions ............................................ (64) (132)

Net operating income ..................................................................................................... 680 813

Operating expenses excluding restructuring charges ..................................................... (549) (589)

Restructuring charges ..................................................................................................... –(36)

Profit before income tax expense ................................................................................... 131 188

Other

Net interest expense ....................................................................................................... (28) (31)

Net trading income ......................................................................................................... 28 31

Net expense from financial instruments designated at fair value .................................. (5) (27)

Other operating income .................................................................................................. 33 31

Net operating income ....................................................................................................... 28 4

Total operating expenses ................................................................................................ (35) (44)

Loss before income tax expense .................................................................................... (7) (40)

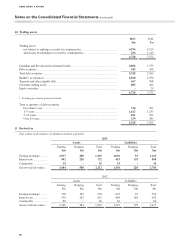

Notes on the Consolidated Financial Statements (continued)

HSBC BANK CANADA