HSBC 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

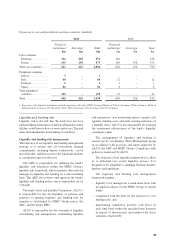

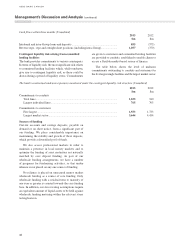

Our liquidity and funding management processes

include:

– projecting cash flows under various stress scenarios

and considering the level of liquid assets necessary in

relation thereto;

– monitoring the statement of financial position

liquidity ratios against internal measures;

– maintaining a diverse range of funding sources;

– managing the concentration and profile of debt

maturities;

– managing contingent liquidity commitment

exposures within predetermined caps;

– maintaining debt financing plans;

– monitoring depositor concentration in order to avoid

undue reliance on large individual depositors and

ensuring a satisfactory overall funding mix; and

– maintaining liquidity and funding contingency plans.

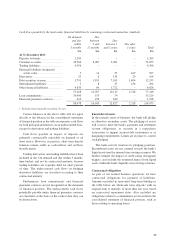

Liquidity regulation

In 2010, the Basel Committee on Banking Supervision

(‘BCBS’) published a framework document prescribing

two liquidity standards: the liquidity coverage ratio

(‘LCR’) and the net stable funding ratio (‘NSFR’),

together referred to as the Basel liquidity standards. The

LCR estimates the adequacy of liquidity over a 30 day

stress period. The NSFR estimates the extent to which

assets are funded by longer-term stable liabilities.

In January 2013, the BCBS released its final rules for

LCR. In January 2014, the BCBS issued a consultation

document on a revised framework for the NSFR.

In November 2013, OSFI issued a draft guideline

Liquidity Adequacy Requirements. The guideline,

expected to be finalized in 2014, incorporates the Basel

liquidity standards, introduces a suite of additional

liquidity monitoring tools, and formalizes OSFI’s use of

the Net Cumulative Cash Flow (‘NCCF’) supervisory

tool. According to the draft guideline, LCR and NCCF

will be in force as of 1 January 2015. NSFR is expected

to follow the BCBS implementation timelines in 2018.

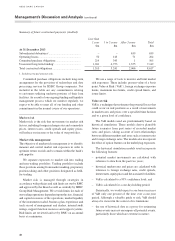

Advances to core funding ratio

The bank emphasizes the importance of core current

accounts and savings accounts as a source of funds to

finance lending to customers, and discourages reliance

on short-term professional funding. This is achieved by

placing limits to restrict the bank’s ability to increase

loans and advances to customers without corresponding

growth in current accounts and savings accounts or

long-term debt funding with a residual maturity beyond

one year. This measure is referred to as the ‘advances to

core funding’ ratio.

The ratio describes loans and advances to customers

as a percentage of the total of core customer current and

savings accounts and term funding with a remaining term

to maturity in excess of one year. Loans and advances

to customers which are part of reverse repurchase

arrangements, and where the bank receives securities

which are deemed to be liquid, are excluded from the

advances to core funding ratio, as are current accounts

and savings accounts from customers deemed to be

‘non-core’. The categorization of customer deposits into

core and non-core takes into account the nature of the

customer and the size and pricing of the deposit.

The distinction between core and non-core deposits

generally means that the bank’s measure of advances to

core funding is more restrictive than that which could be

inferred from the published financial statements.

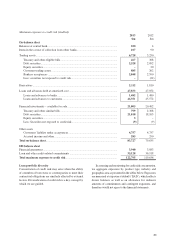

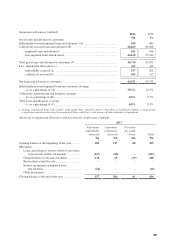

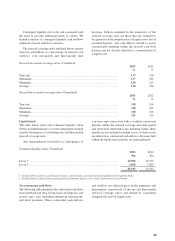

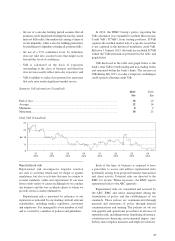

Advances to core funding ratio (Unaudited)

2013

%

2012

%

Year-end ......................................................................................................................... 93 96

Maximum ....................................................................................................................... 100 96

Minimum........................................................................................................................ 93 90

Average .......................................................................................................................... 96 94

Stress testing

The bank runs a range of stressed cash flow scenarios

as its primary liquidity risk measures, spanning various

idiosyncratic and market-wide stress scenarios. Stressed

cash flow scenarios are further supplemented by regular

enterprise-wide stress testing and reverse stress testing.

The results of all liquidity stress tests are reviewed and

monitored by ALCO.

We would meet any unexpected cash outflows

primarily from our cash, by selling or entering into

repurchase agreements (‘repos’) with the securities

assessed as liquid assets, and by maturing interbank

loans and reverse repos. In general, customer advances

are assumed to be renewed and as a result are not

assumed to generate a stressed cash inflow or represent

a liquidity resource.

Management’s Discussion and Analysis (continued)

HSBC BANK CANADA

42