HSBC 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

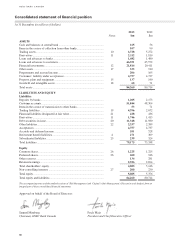

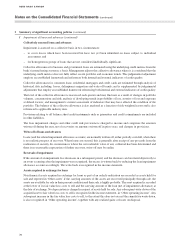

HSBC BANK CANADA

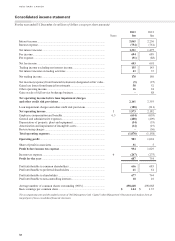

Consolidated statement of financial position

At 31 December (in millions of dollars)

Notes 2013

$m

2012

$m

ASSETS

Cash and balances at central bank .............................................................. 165 56

Items in the course of collection from other banks ..................................... 107 90

Trading assets .............................................................................................. 10 6,728 5,272

Derivatives .................................................................................................. 11 2,112 1,810

Loans and advances to banks ...................................................................... 1,482 1,480

Loans and advances to customers ............................................................... 46,351 45,572

Financial investments .................................................................................. 12 21,814 20,411

Other assets ................................................................................................. 17 333 910

Prepayments and accrued income ............................................................... 206 165

Customers’ liability under acceptances ....................................................... 4,757 4,737

Property, plant and equipment .................................................................... 15 137 140

Goodwill and intangible assets ................................................................... 18 68 71

Total assets .................................................................................................. 84,260 80,714

LIABILITIES AND EQUITY

Liabilities

Deposits by banks ....................................................................................... 1,205 2,173

Customer accounts ...................................................................................... 51,844 48,304

Items in the course of transmission to other banks ..................................... 53 71

Trading liabilities ........................................................................................ 19 4,396 2,672

Financial liabilities designated at fair value ................................................ 21 428 436

Derivatives .................................................................................................. 11 1,746 1,415

Debt securities in issue ................................................................................ 20 11,348 11,980

Other liabilities ............................................................................................ 22 2,337 2,389

Acceptances ................................................................................................ 4,757 4,737

Accruals and deferred income .................................................................... 551 528

Retirement benet liabilities ....................................................................... 4 271 309

Subordinated liabilities ............................................................................... 23 239 324

Total liabilities ............................................................................................ 79,175 75,338

Equity

Common shares ........................................................................................... 26 1,225 1,225

Preferred shares ........................................................................................... 26 600 946

Other reserves ............................................................................................. 134 281

Retained earnings ........................................................................................ 2,926 2,694

Total shareholders’ equity ........................................................................... 4,885 5,146

Non-controlling interests ............................................................................ 27 200 230

Total equity ................................................................................................. 5,085 5,376

Total equity and liabilities ........................................................................... 84,260 80,714

The accompanying notes and the audited sections of ‘Risk Management’ and ‘Capital’ within Management’s Discussion and Analysis form an

integral part of these consolidated financial statements.

Approved on behalf of the Board of Directors:

Samuel Minzberg Paulo Maia

Chairman, HSBC Bank Canada President and Chief Executive Officer