HSBC 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

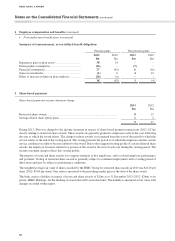

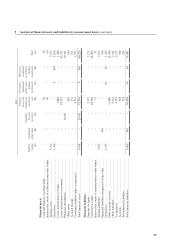

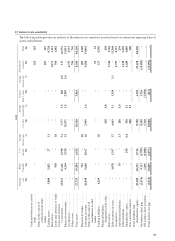

11 Derivatives (continued)

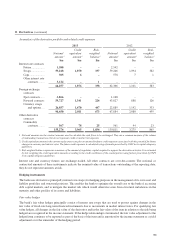

The following tables summarize the notional amounts by remaining term to maturity of the derivative portfolio.

2013

Trading Hedging Total

Less than

1 year

$m

1 to 5 years

$m

More than

5 years

$m

Total

trading

$m

Less than

1 year

$m

Between

1–5 years

$m

Over

5 years

$m

Total

hedging

$m $m

Interest rate contracts

Futures ........................................... 1,580 – – 1,580 – – – – 1,580

Swaps ............................................ 7,844 20,864 4,028 32,736 3,342 19,469 3,701 26,512 59,248

Caps ............................................... 2 303 – 305 – – – – 305

Other interest rate contracts .......... 3,124 – – 3,124 – – – – 3,124

12,550 21,167 4,028 37,745 3,342 19,469 3,701 26,512 64,257

Foreign exchange contracts

Spot contracts ................................ 3,866 – – 3,866 – – – – 3,866

Forward contracts .......................... 56,352 2,904 471 59,727 – – – – 59,727

Currency swaps and options ......... 12,765 7,386 3,590 23,741 870 2,033 213 3,116 26,857

72,983 10,290 4,061 87,334 870 2,033 213 3,116 90,450

Other derivative contracts

Commodity contracts .................... 437 130 – 567 – – – – 567

85,970 31,587 8,089 125,646 4,212 21,502 3,914 29,628 155,274

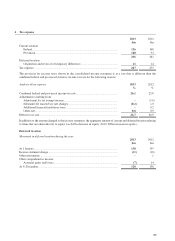

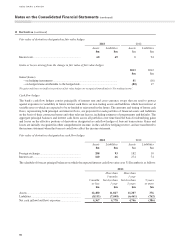

2012

Trading Hedging Total

Less than

1 year

$m 1 to 5 years

$m

More than

5 years

$m

Total

trading

$m

Less than

1 year

$m

Between

1–5 years

$m

Over

5 years

$m

Total

hedging

$m $m

Interest rate contracts

Futures ........................................... 2,542 – – 2,542 – – – – 2,542

Swaps ............................................ 8,862 17,426 6,102 32,390 8,618 16,626 1,612 26,856 59,246

Caps ............................................... – 578 – 578 – – – – 578

11,404 18,004 6,102 35,510 8,618 16,626 1,612 26,856 62,366

Foreign exchange contracts

Spot contracts ................................ 1,168 – – 1,168 – – – – 1,168

Forward contracts .......................... 41,209 2,618 – 43,827 – – – – 43,827

Currency swaps and options ......... 10,717 7,586 2,285 20,588 238 2,063 – 2,301 22,889

53,094 10,204 2,285 65,583 238 2,063 – 2,301 67,884

Other derivative contracts

Commodity contracts .................... 368 193 – 561 – – – – 561

64,866 28,401 8,387 101,654 8,856 18,689 1,612 29,157 130,811