HSBC 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

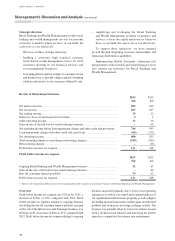

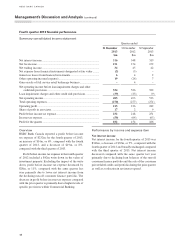

Net fee income Quarter ended

31 December

2013

$m

31 December

2012

$m

30 September

2013

$m

Credit facilities ..................................................................................... 64 63 64

Funds under management .................................................................... 32 33 35

Account services .................................................................................. 20 20 20

Credit cards .......................................................................................... 16 22 16

Corporate finance ................................................................................. 10 12 8

Remittances .......................................................................................... 88 8

Immigrant Investor Program ................................................................ 68 8

Brokerage commissions ....................................................................... 34 4

Insurance .............................................................................................. 34 3

Trade finance import/export ................................................................. 32 3

Trustee fees .......................................................................................... 11 1

Other ....................................................................................................... 71 4

Fee income .............................................................................................. 173 178 174

Less: fee expense ................................................................................. (22) (24)(22)

Net fee income ..................................................................................... 151 154 152

Net fee income for the fourth quarter of 2013 was

$151m, marginally lower compared with the fourth quarter of 2012 and broadly unchanged compared with

the third quarter of 2013.

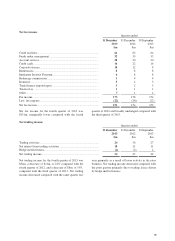

Net trading income Quarter ended

31 December

2013

$m

31 December

2012

$m

30 September

2013

$m

Trading activities .................................................................................. 26 36 27

Net interest from trading activities ...................................................... 10 11 11

Hedge ineffectiveness ............................................................................. (2) (2) 4

Net trading income ............................................................................... 34 45 42

Net trading income for the fourth quarter of 2013 was

$34m, a decrease of $11m, or 24% compared with the

fourth quarter of 2012, and a decrease of $8m, or 19%,

compared with the third quarter of 2013. Net trading

income decreased compared with the same quarter last

year primarily as a result of lower activity in the rates

business. Net trading income decreased compared with

the prior quarter primarily due to trading losses driven

by hedge ineffectiveness.