HSBC 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

114

Notes on the Consolidated Financial Statements (continued)

29 Contingent liabilities, contractual commitments and guarantees (continued)

US regulatory and law enforcement investigations (continued)

If HSBC Holdings and HSBC Bank USA fulfil all of the requirements imposed by the US DPA, the DOJ’s charges

against those entities will be dismissed at the end of the five-year period of that agreement. Similarly, if HSBC Holdings

fulfils all of the requirements imposed by the DANY DPA, DANY’s charges against it will be dismissed at the end of

the two-year period of that agreement. The DoJ may prosecute HSBC Holdings or HSBC Bank USA in relation to the

matters which are the subject of the US DPA if HSBC Holdings or HSBC Bank USA breaches the terms of the US DPA,

and DANY may prosecute HSBC Holdings in relation to the matters which are subject of the DANY DPA if HSBC

Holdings violates the terms of the DANY DPA.

Under these agreements, HSBC Holdings has certain obligations to ensure that entities in the HSBC Group, including

the bank and its subsidiaries, comply with certain requirements. Steps continue to be taken to implement ongoing

obligations under the US DPA, FCA direction, and other settlement agreements.

The settlement with U.S. and U.K. authorities does not preclude private litigation relating to, among other things, the

HSBC Group’s compliance with applicable AML/BSA and sanctions laws or other regulatory or law enforcement

actions for AML/BSA or sanctions matters not covered by the various agreements.

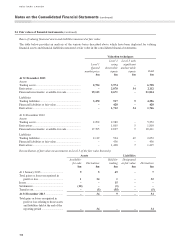

Guarantees

The bank provides guarantees and similar undertakings on behalf of both third party customers and other entities within

the bank. These guarantees are generally provided in the normal course of the bank’s banking business. The principal

types of guarantees provided, and the maximum potential amount of future payments which the bank could be required

to make at 31 December, were as follows:

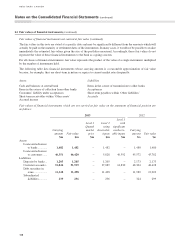

Guarantees in favour of third parties

2013

$m

2012

$m

Guarantee type

Financial guarantee contracts1 .................................................................................. 1,663 1,305

Performance bonds2 .................................................................................................. 2,277 1,778

Total ............................................................................................................................... 3,940 3,083

1 Financial guarantees contracts require the issuer to make specified payments to reimburse the holder for a loss incurred because a specified

debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument. The amounts in the above

table are nominal principal amounts.

2 Performance bonds, bid bonds, standby letters of credit and other transaction-related guarantees are undertakings by which the obligation

on the bank and/or the bank to make payment depends on the outcome of a future event.

The amounts disclosed in the above table reflect the bank’s maximum exposure under a large number of individual

guarantee undertakings. The risks and exposures arising from guarantees are captured and managed in accordance with

the bank’s overall credit risk management policies and procedures. Guarantees with terms of more than one year are

subject to the bank’s annual credit review process.

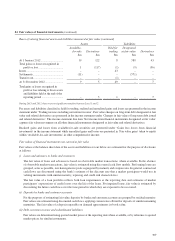

Credit enhancements

The bank provides partial program-wide credit enhancements to the multi-seller conduit program administered by

it to protect commercial paper investors in the event that the collections on the underlying assets and any draws on

the transaction specific credit enhancement and liquidity backstop facilities are insufficient to repay the maturing

asset-backed commercial paper issued by such multi-seller conduit program. Each of the assets pools funded by this

multi-seller conduit program is structured to achieve a high investment grade credit profile through the provision of

transaction specific credit enhancement provided by the seller of each asset pool to this multi-seller conduit program.

The term of this program-wide credit enhancement is 12 months.