HSBC 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

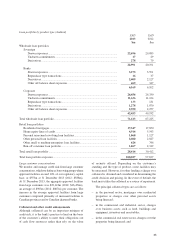

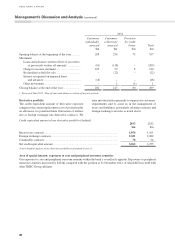

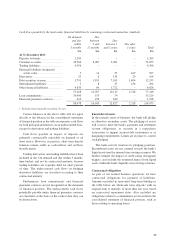

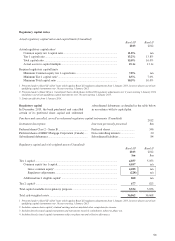

Cash flows payable by the bank under financial liabilities by remaining contractual maturities (Audited)

On demand

and due

within

3 months

$m

Due

between

3 and

12 months

$m

Due

between 1

and 5 years

$m

Due after

5 years

$m Total

$m

At 31 December 2013

Deposits by banks .............................. 1,209 – – – 1,209

Customer accounts ............................. 40,906 8,087 3,062 – 52,055

Trading liabilities ............................... 4,396 – – – 4,396

Financial liabilities designated

at fair value .................................. 5 14 59 429 507

Derivatives ......................................... 23 8 134 29 194

Debt securities in issue ....................... 1,791 1,831 7,109 1,404 12,135

Subordinated liabilities1 ..................... 3 8 27 256 294

Other financial liabilities .................... 4,835 69 1,722 – 6,626

53,168 10,017 12,113 2,118 77,416

Loan commitments ............................. 34,900 155 74 – 35,129

Financial guarantee contracts ............. 410 478 640 – 1,528

88,478 10,650 12,827 2,118 114,073

1 Excludes interest payable exceeding 15 years.

Certain balances in the above table will not agree

directly to the balances in the consolidated statements

of financial position as the table incorporates cash flows

for both principal and interest, on an undiscounted basis,

except for derivatives and trading liabilities.

Cash flows payable in respect of deposits are

primarily contractually repayable on demand or on

short notice. However, in practice, short-term deposit

balances remain stable as cash inflows and outflows

broadly match.

Trading derivatives and trading liabilities have been

included in the ‘On demand and due within 3 months’

time bucket, and not by contractual maturity, because

trading liabilities are typically held for short periods

of time. The undiscounted cash flows on hedging

derivative liabilities are classified according to their

contractual maturity.

Furthermore, loan commitments and financial

guarantee contracts are not recognized on the statement

of financial position. The undiscounted cash flows

potentially payable under financial guarantee contracts

are classified on the basis of the earliest date they can

be drawn down.

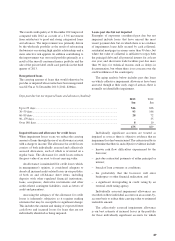

Encumbered assets

In the normal course of business, the bank will pledge

or otherwise encumber assets. The pledging of assets

will occur to meet the bank’s payments and settlement

system obligations, as security in a repurchase

transaction, to support secured debt instruments or as

margining requirements. Limits are in place to control

such pledging.

The bank actively monitors its pledging positions.

Encumbered assets are not counted towards the bank’s

liquid assets used for internal stress testing scenarios. We

further estimate the impact of credit rating downgrade

triggers, and exclude the estimated impact from liquid

assets within the bank’s liquidity stress testing scenarios.

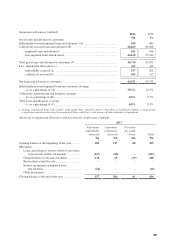

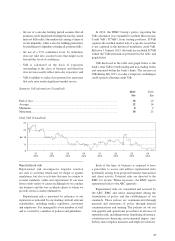

Contractual obligations

As part of our normal business operations we have

contractual obligations for payment of liabilities.

Amounts included in unsecured long-term funding in

the table below are wholesale term deposits with an

original term to maturity of more than one year, based

on contractual repayment dates. Also included are

obligations related to commitments not recorded in the

consolidated statement of financial position, such as

those relating to operating leases.

45