HSBC 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

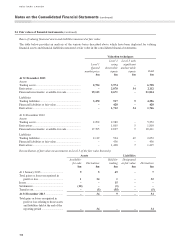

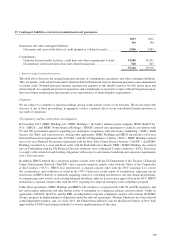

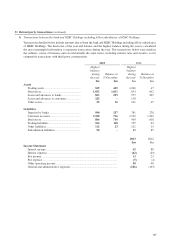

25 Assets charged as security for liabilities and collateral accepted as security for assets

a Assets charged as security for liabilities and contingent obligations

In the ordinary course of business, we pledge assets recorded on our consolidated statement of financial position

in relation to securitization activity, mortgages sold with recourse, securities lending and securities sold under

repurchase agreements. These transactions are conducted under terms that are usual and customary to standard

securitization, mortgages sold with recourse, securities lending and repurchase agreements. In addition, we also

pledge assets to secure our obligations within payment and depository clearing systems.

Financial assets pledged to secure recognized liabilities on the statement of financial position and obligations within

payment and depository clearing systems:

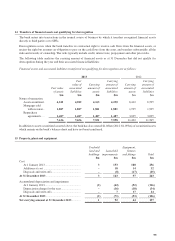

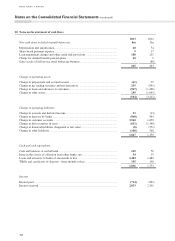

2013

$m

2012

$m

Cash.......................................................................................................................... 263 35

Residential mortgages .............................................................................................. 4,418 5,725

Debt securities .......................................................................................................... 3,246 5,835

7,927 11,595

The bank is required to pledge assets to secure its obligations in the Large Value Transfer System (‘LVTS’), which

processes electronically in real-time large value and time-critical payments in Canada. In the normal course of

business, pledged assets are released upon settlement of the bank’s obligations at the end of each business day. Only

in very rare circumstances are we required to borrow from the Bank of Canada to cover any settlement obligations.

Under those circumstances, the pledged assets would be used to secure the borrowing. No amounts were outstanding

under this arrangement at 31 December 2013 or 2012. Consequently, the assets pledged with respect to the bank’s

LVTS obligations have not been included in the table above.

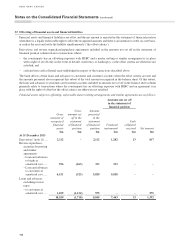

b Collateral accepted as security for assets

The fair value of financial assets accepted as collateral that the bank is permitted to sell or repledge in the absence

of default is $6,727m (2012: $4,328m). The fair value of financial assets accepted as collateral that have been sold

or repledged is $2,651m (2012: $2,651m). The bank is obliged to return equivalent assets.

These transactions are conducted under terms that are usual and customary to standard securities borrowing and

reverse repurchase agreements.