HSBC 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

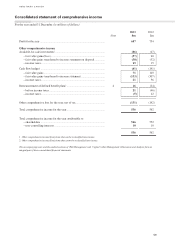

59

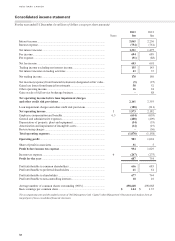

Note 2013

$m

2012

$m

Prot for the year .......................................................................................... 687 754

Other comprehensive income

Available-for-sale investments1 ..................................................................... (86) (17)

– fair value gains/(loss) ........................................................................... (57) 20

– fair value gains transferred to income statement on disposal .............. (58) (52)

– income taxes ......................................................................................... 29 15

Cash ow hedges1 ......................................................................................... (61) (141)

– fair value gains ..................................................................................... 71 110

– fair value gains transferred to income statement ................................. (153) (307)

– income taxes ......................................................................................... 21 56

Remeasurement of dened benet plans2 ..................................................... 4 16 (34)

– before income taxes ............................................................................. 21 (46)

– income taxes ......................................................................................... (5) 12

Other comprehensive loss for the year, net of tax ......................................... (131) (192)

Total comprehensive income for the year ..................................................... 556 562

Total comprehensive income for the year attributable to:

– shareholders ......................................................................................... 546 552

– non-controlling interests ...................................................................... 10 10

556 562

1 Other comprehensive income/(loss) items that can be reclassified into income.

2 Other comprehensive income/(loss) items that cannot be reclassified into income.

The accompanying notes and the audited sections of ‘Risk Management’ and ‘Capital’ within Management’s Discussion and Analysis form an

integral part of these consolidated financial statements.

HSBC BANK CANADA

Consolidated statement of comprehensive income

For the year ended 31 December (in millions of dollars)