HSBC 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

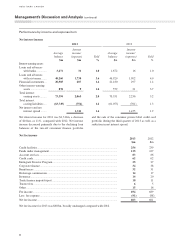

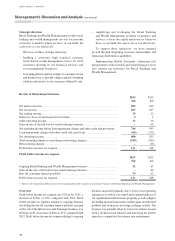

Fourth quarter 2013 financial performance

Summary consolidated income statement

Quarter ended

31 December

2013

$m

31 December

2012

$m

30 September

2013

$m

Net interest income ............................................................................... 316 348 319

Net fee income ...................................................................................... 151 154 152

Net trading income ................................................................................ 34 45 42

Net expense from financial instruments designated at fair value ......... (2) (3) –

Gains less losses from financial investments ........................................ 64 2

Other operating income/(expense) ........................................................ 19 (26) 7

Gain on sale of full service retail brokerage business ........................... –4 –

Net operating income before loan impairment charges and other

credit risk provisions ........................................................................ 524 526 522

Loan impairment charges and other credit risk provisions ................... (39) (33) (9)

Net operating income ............................................................................. 485 493 513

Total operating expenses ........................................................................ (270) (277) (271)

Operating profit ...................................................................................... 215 216 242

Share of profit in associates .................................................................. 17 2 9

Profit before income tax expense ............................................................ 232 218 251

Income tax expense ............................................................................... (50) (64) (65)

Profit for the quarter ............................................................................... 182 154 186

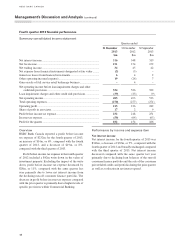

Overview

HSBC Bank Canada reported a profit before income

tax expense of $232m for the fourth quarter of 2013,

an increase of $14m, or 6%, compared with the fourth

quarter of 2012, and a decrease of $19m, or 8%,

compared with the third quarter of 2013.

Profit before income tax expense in the fourth quarter

of 2012 included a $42m write down in the value of

investment property. Excluding the impact of the write

down, profit before income tax expense decreased by

$28m, or 11%, compared with the same quarter last

year primarily due to lower net interest income from

the declining run-off consumer finance portfolio. The

decrease in profit before income tax expense compared

with the prior quarter is primarily due to higher levels of

specific provisions within Commercial Banking.

Performance by income and expense item

Net interest income

Net interest income for the fourth quarter of 2013 was

$316m, a decrease of $32m, or 9%, compared with the

fourth quarter of 2012 and broadly unchanged compared

with the third quarter of 2013. Net interest income

decreased compared with the same quarter last year

primarily due to declining loan balances of the run-off

consumer finance portfolio and the sale of the consumer

private label credit card portfolio during the prior quarter

as well as a reduction in net interest spread.

HSBC BANK CANADA

Management’s Discussion and Analysis (continued)

18