HSBC 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

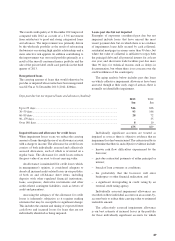

All new and renewed major authorized facilities,

derivative exposures, ‘watch-list’ exposures and

impaired facilities are also reported quarterly to the ARC.

The appetite for credit risk is expressed through portfolio

level limits on specific segments, e.g. commercial real

estate, as well as through Commercial and Personal

Lending Guidelines that conform with HSBC Group

guidelines. These are disseminated throughout our

business along with various credit manuals. The ARC is

advised of any material changes in guidelines through

the quarterly monitoring process noted above.

We have a disciplined approach to managing credit

risk through ongoing monitoring of all credit exposures

at branches, with weaker quality credits being reviewed

at more frequent time intervals. Problem and impaired

loans are identified at an early stage and are actively

managed by a separate dedicated Special Credit

Management unit which possesses the relevant expertise

and experience.

Exposure to banks and financial institutions involves

consultation with a dedicated unit within the HSBC

Group that controls and manages these exposures

on a global basis. Similarly, cross border risk is also

controlled globally by this unit through the imposition

of country limits.

A review of all credit matters undertaken by our

branch and head office credit managers is completed

regularly to ensure all our policies, guidelines, practices,

conditions and terms are followed.

We manage real estate lending within well-defined

parameters, with an emphasis on relationship and project

sponsorship for all new transactions. We are actively

managing the exposure level and composition of this

portfolio given its concentration in our credit portfolio.

Where we are dependent upon third-parties for

establishing asset values, consistent and transparent

valuations are ensured through maintaining a list of

approved professionals that meet our standards.

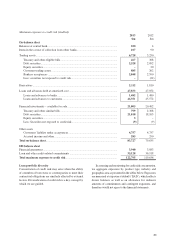

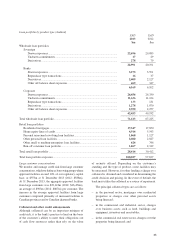

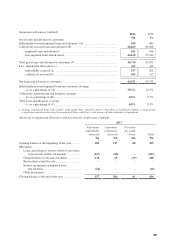

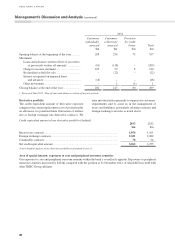

Maximum exposure to credit risk

The following table presents the maximum exposure

to credit risk of balance sheet and off-balance sheet

financial instruments, before taking into account any

collateral held or other credit enhancements. For

on-balance sheet financial assets, the exposure to

credit risk equals their carrying amount. For financial

guarantees, the maximum exposure to credit risk is the

maximum amount that we would have to pay if the

guarantees were called upon. For loan commitments

and other credit-related commitments that are not

unconditionally cancellable, the maximum exposure to

credit risk is the full amount of the committed facilities.

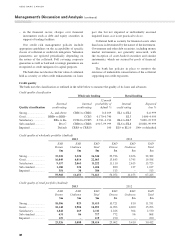

Management’s Discussion and Analysis (continued)

32

HSBC BANK CANADA