HSBC 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

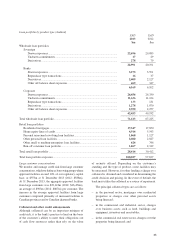

Risk management

(Certain information within this section, except where indicated, forms an integral part of the audited consolidated

financial statements)

How we manage risk

All of our business activities involve the measurement,

evaluation, acceptance and management of some

degree of risk with the primary goal being to achieve

the appropriate balance between the risk assumed and

the reward. Our risk culture plays an important role

in delivering our strategic objectives. It is reinforced

by our HSBC Values and our Global Standards, and

forms the basis on which the Board, the Audit and Risk

Committee (‘ARC’), a sub-committee of the Board, and

the Risk Management Committee (‘RMC’) establish our

risk appetite and the risk management framework. These

are instrumental in aligning the behaviour of individuals

with our attitude to assuming and managing risk.

We manage risk actively, employing five main

elements that underpin our risk culture.

Running risk like a business

Running risk like a business means ensuring that the

Risk function is dynamic and responsive to the needs of

its stakeholders. This is aided by:

– ensuring systems (for example, in Risk and Finance)

are compatible so a complete picture of our risks is

obtained;

– streamlining data production and re-engineering

processes to create time to spend on risk management;

and

– understanding the detail behind our risks and costs.

Organization and structure

Robust risk governance and accountability are embedded

throughout the bank, fostering a continuous monitoring

of the risk environment and an integrated evaluation of

risks and their interactions.

Our risk governance framework ensures

accountability for the effective management of risk by

the bank. The framework is integrated with the HSBC

Group risk governance framework adding additional

layers of oversight.

Risk governance from a corporate perspective

is structured so that it is positioned at the uppermost

level of the bank. The Board, assisted by the ARC, is

responsible for overseeing a strong risk culture that is

conservative yet competitive. On advice of the RMC

and the ARC, the Board provides the risk discipline

and structure necessary to achieve business objectives

that align with risk strategy. Regular and timely

communication between the Board and executive

management ensures that key risks are identified and

key information is shared regularly.

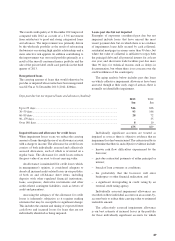

Three lines of defense

The risk governance framework is based on a risk

management and internal control structure referred

to as the ‘three lines of defence’ to ensure we achieve

our commercial aims while meeting regulatory and

legal requirements. It is a key part of our operational

risk management framework. Refer to operational risk

within this section for further information.

People

All staff play a role in the management of risk. They

are required to identify, assess and manage risk within

the scope of their assigned responsibilities, and as such

they form part of the three lines of defence. Our Global

Standards set the tone and are central to our approach

to balancing risk and reward. Personal accountability is

reinforced by our HSBC Values.

A suite of mandatory training on a range of critical

risk and compliance topics helps to embed and strengthen

the risk culture within HSBC. This training, which is

updated regularly, ensures a clear and consistent message

is communicated to staff. It covers technical aspects of the

various risks assumed in the course of business and how

these risks should be managed effectively, and serves to

reinforce our attitude to risk and the behaviours expected

of staff as described in our Global Standards and risk

policies. Staff is supported by a disclosure line which

enables them to raise concerns confidentially.

Our risk culture is reinforced by our approach

to remuneration. Individual awards are based on

compliance with HSBC Values and the achievement of

financial and non-financial objectives which are aligned

to our strategy.

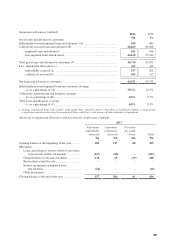

Risk management processes and procedures

Risk management within the bank is driven by the

following four processes:

– risk identification;

– risk appetite;

– mapping our risk profile; and

– stress testing.

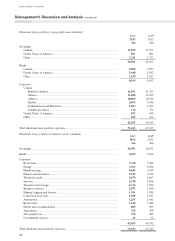

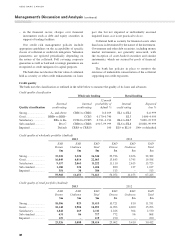

HSBC BANK CANADA

Management’s Discussion and Analysis (continued)

30