HSBC 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic direction

Retail Banking and Wealth Management provides retail

banking and wealth management services for personal

customers in markets where we have, or can build, the

scale to do so cost effectively.

We focus on three strategic initiatives:

– building a consistent, high standard, customer

needs-driven wealth management service for retail

customers drawing on our financial advisory and

asset management businesses;

– leveraging global expertise to improve customer service

and productivity, to provide a high standard of banking

solutions and service to our customers efficiently; and

– simplifying and re-shaping the Retail Banking

and Wealth Management portfolio of products and

services, to focus our capital and resources where we

have, or can build, the scale to do so cost effectively.

To support these initiatives, we have targeted

growth through deepening customer relationships and

enhancing distribution capabilities.

Implementing Global Standards, enhancing risk

management control models and simplifying processes

also remain top priorities for Retail Banking and

Wealth Management.

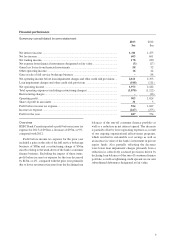

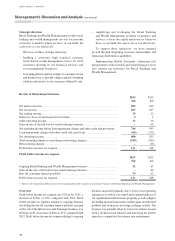

Review of financial performance

2013

$m

2012

$m

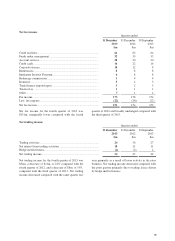

Net interest income ........................................................................................................ 505 629

Net fee income ............................................................................................................... 203 207

Net trading income ......................................................................................................... 19 12

Gains less losses from financial investments ................................................................. 41

Other operating income .................................................................................................. 13 16

Gain on sale of the full service retail brokerage business ............................................... –80

Net operating income before loan impairment charges and other credit risk provisions ... 744 945

Loan impairment charges and other credit risk provisions ............................................ (64) (132)

Net operating income ....................................................................................................... 680 813

Total operating expenses (excluding restructuring charges) .......................................... (549) (589)

Restructuring charges ..................................................................................................... –(36)

Profit before income tax expense ................................................................................... 131 188

Profit before income tax expense

2013

$m

2012

$m

Ongoing Retail Banking and Wealth Management business ......................................... 52 43

Gain on the sale of the full service retail brokerage business ......................................... –80

Run-off consumer finance portfolio1 .............................................................................. 79 65

Profit before income tax expense ................................................................................... 131 188

1 Refer to the beginning of this section for an explanation of the merger of Consumer Finance with Retail Banking and Wealth Management.

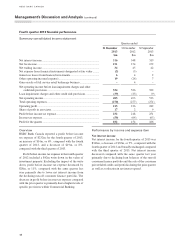

Overview

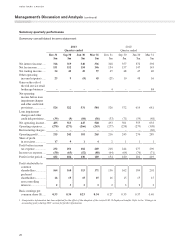

Profit before income tax expense was $131m for 2013, a

decrease of $57m, or 30%, compared with 2012. Profit

before income tax expense relating to ongoing business

(excluding the run-off consumer finance portfolio and gain

on the sale of the full service retail brokerage business) was

$52m for 2013, an increase of $9m, or 21%, compared with

2012. Profit before income tax expense relating to ongoing

business increased primarily due to lower total operating

expenses as a result of cost control and continued delivery of

our organizational effectiveness programs as well as higher

net trading income from mark to market gains on structured

products and an increase in foreign exchange activity. The

increase was partially offset by lower net interest income

from a decline in loan balances and narrowing net interest

spread in a competitive low interest rate environment.

HSBC BANK CANADA

Management’s Discussion and Analysis (continued)

16