HSBC 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

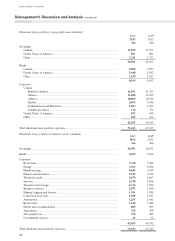

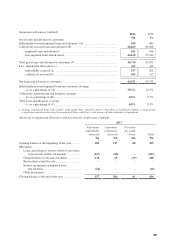

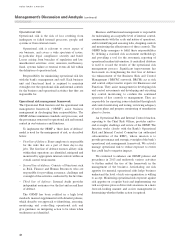

Cash flows within three months (Unaudited)

2013

$m

2012

$m

Interbank and intra-Group loans and deposits ............................................................... 855 (573)

Reverse repo, repo and outright short positions (including intra-Group) ...................... 1,057 (750)

Contingent liquidity risk arising from committed

lending facilities

The bank provides commitments to various counterparts.

In terms of liquidity risk, the most significant risk relates

to committed lending facilities which, whilst undrawn,

give rise to contingent liquidity risk, as these could be

drawn during a period of liquidity stress. Commitments

are given to customers and committed lending facilities

are provided to conduits, established to enable clients to

access a flexible market-based source of finance.

The table below shows the level of undrawn

commitments outstanding to conduits and customers for

the five largest single facilities and the largest market sector.

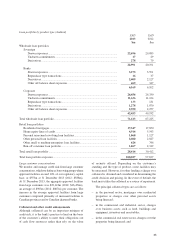

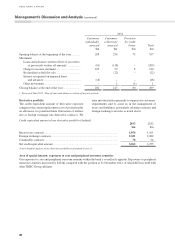

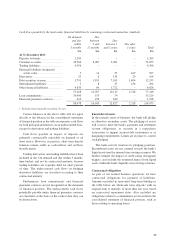

The bank’s contractual undrawn exposures monitored under the contingent liquidity risk structure (Unaudited)

2013

$m

2012

$m

Commitments to conduits

Total lines ................................................................................................................. 1,035 940

Largest individual lines ............................................................................................ 765 765

Commitments to customers

Five largest ............................................................................................................... 1,553 1,733

Largest market sector ............................................................................................... 3,644 4,434

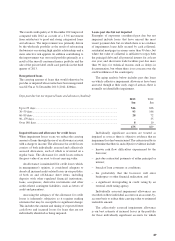

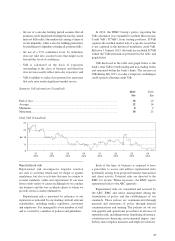

Sources of funding

Current accounts and savings deposits, payable on

demand or on short notice, form a significant part of

our funding. We place considerable importance on

maintaining the stability and growth of these deposits,

which provide a diversified pool of funds.

We also access professional markets in order to

maintain a presence in local money markets and to

optimize the funding of asset maturities not naturally

matched by core deposit funding. As part of our

wholesale funding arrangements, we have a number

of programs for fundraising activities, so that undue

reliance is not placed on any one source of funding.

No reliance is placed on unsecured money market

wholesale funding as a source of core funding. Only

wholesale funding with a residual term to maturity of

one year or greater is counted towards the core funding

base. In addition, our stress testing assumptions require

an equivalent amount of liquid assets to be held against

wholesale funding maturing within the relevant stress

testing horizon.

Management’s Discussion and Analysis (continued)

HSBC BANK CANADA

44