HSBC 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

76

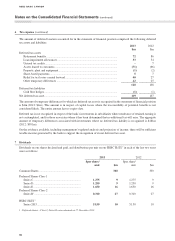

2 Summary of significant accounting policies (continued)

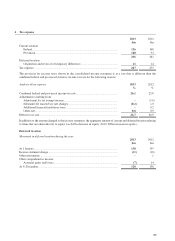

r Income tax

Income tax comprises current tax and deferred tax. Income tax is recognized in the income statement except to the

extent that it relates to items recognized in other comprehensive income or directly in equity, in which case it is

recognized in the same statement in which the related item appears.

Current tax is the tax expected to be payable on the taxable profit for the year, calculated using tax rates enacted or

substantively enacted by the reporting date, and any adjustment to tax payable in respect of previous years. Current

tax assets and liabilities are offset when the bank intends to settle on a net basis and the legal right to offset exists.

Deferred tax is recognized on temporary differences between the carrying amounts of assets and liabilities in the statement

of financial position and the amounts attributed to such assets and liabilities for tax purposes. Deferred tax liabilities

are generally recognized for all taxable temporary differences and deferred tax assets are recognized to the extent that it

is probable that future taxable profits will be available against which deductible temporary differences can be utilized.

Deferred tax is calculated using the tax rates expected to apply in the periods in which the assets will be realized or

the liabilities settled based on tax rates and laws enacted, or substantively enacted, by the reporting date.

Deferred tax relating to actuarial gains and losses on post-employment benefits is recognized in other comprehensive

income. Deferred tax relating to fair value re-measurements of available-for-sale investments and cash flow hedging

instruments which are charged or credited directly to other comprehensive income, is also charged or credited to

other comprehensive income and is subsequently recognized in the income statement when the deferred fair value

gain or loss is recognized in the income statement.

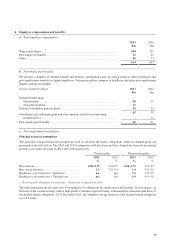

s Pension and other post-employment benefits

The bank operates a number of pension and other post-employment benefit plans. These plans include both defined

benefit and defined contribution plans and various other post-employment benefits such as post employment

healthcare. The post-retirement plans include supplemental pension arrangements that provide pension benefits in

excess of the benefits provided by the pension plans, and post-retirement, non-pension arrangements that provide

certain benefits in retirement. The pension plans are funded by contributions from the bank or its employees, while

the supplemental pension arrangements are not funded.

Payments to defined contribution plans are charged as an expense as they fall due.

The defined benefit pension costs and the present value of defined benefit obligations are calculated at the reporting

date by the schemes’ actuaries using the Projected Unit Credit Method. The net charge to the income statement

mainly comprises the service cost and the net interest on the net defined benefit liability and is presented in operating

expenses. Service cost comprises current service cost, past service cost, and gain or loss on settlement.

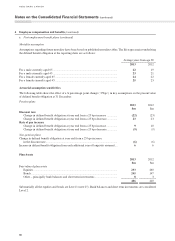

The past service cost which is charged immediately to the income statement, is the change in the present value of the

defined benefit obligation for employee service in prior periods, resulting from a plan amendment (the introduction

or withdrawal of, or changes to, a defined benefit plan) or curtailment (a significant reduction by the entity in the

number of employees covered by a plan). A settlement is a transaction that eliminates all further legal and constructive

obligations for part or all of the benefits provided under a defined benefit plan, other than a payment of benefits to, or

on behalf of, employees that is set out in the terms of the plan and included in the actuarial assumptions.

Re-measurements of the net defined benefit liability, which comprise actuarial gains and losses, return on plan assets

(excluding interest) and the effect of the asset ceiling (if any, excluding interest), are recognized immediately in

other comprehensive income.

Actuarial gains and losses comprise experience adjustments (the effects of differences between the previous actuarial

assumptions and what has actually occurred), as well as the effects of changes in actuarial assumptions. Actuarial

gains and losses are recognized in other comprehensive income in the period in which they arise.

The defined benefit liability recognized in the statement of financial position represents the present value of defined

benefit obligations reduced by the fair value of plan assets. Any net defined benefit surplus is limited to the present

value of available refunds and reductions in future contributions to the plan.

The cost of obligations arising from other post-employment defined benefit plans, such as defined benefit healthcare

plans, are accounted for on the same basis as defined benefit pension plans.

Notes on the Consolidated Financial Statements (continued)

HSBC BANK CANADA