HSBC 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

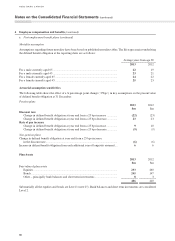

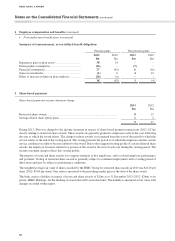

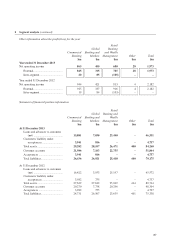

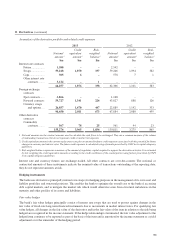

6 Tax expense

2013

$m

2012

$m

Current taxation

Federal ...................................................................................................................... 136 168

Provincial ................................................................................................................. 100 93

236 261

Deferred taxation

Origination and reversal of temporary differences .................................................. 11 14

Tax expense .................................................................................................................... 247 275

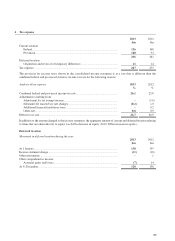

The provision for income taxes shown in the consolidated income statement is at a rate that is different than the

combined federal and provincial statutory income tax rate for the following reasons:

Analysis of tax expense 2013

%

2012

%

Combined federal and provincial income tax rate ......................................................... 26.1 25.8

Adjustments resulting from:

Adjustment for tax exempt income .......................................................................... –(1.0)

Substantively enacted tax rate changes .................................................................... (0.2) 1.0

Additional financial institution taxes ....................................................................... –0.2

Other, net .................................................................................................................. 0.8 0.9

Effective tax rate ............................................................................................................ 26.7 26.9

In addition to the amount charged to the income statement, the aggregate amount of current and deferred taxation relating

to items that are taken directly to equity was $47m decrease in equity (2012: $86m increase in equity).

Deferred taxation

Movement in deferred taxation during the year:

2013

$m

2012

$m

At 1 January ................................................................................................................... 138 139

Income statement charge ................................................................................................ (11)(16)

Other movements ........................................................................................................... –1

Other comprehensive income:

Actuarial gains and losses ........................................................................................ (7) 14

At 31 December ............................................................................................................. 120 138