HSBC 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

78

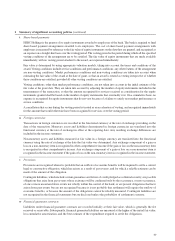

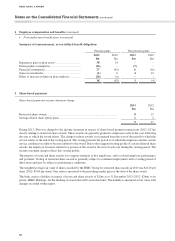

2 Summary of significant accounting policies (continued)

x Debt securities in issue and deposits by customers and banks

Financial liabilities are recognized when the bank enters into the contractual provisions of the arrangements

with counterparties, which is generally on trade date, and initially measured at fair value, which is normally the

consideration received, net of directly attributable transaction costs incurred. Subsequent measurement of financial

liabilities, other than those measured at fair value through profit or loss and financial guarantees, is at amortized cost,

using the effective interest method to amortize the difference between proceeds received, net of directly attributable

transaction costs incurred, and the redemption amount over the expected life of the instrument.

y Share capital

Shares are classified as equity when there is no contractual obligation to transfer cash or other financial assets.

Incremental costs directly attributable to the issue of equity instruments are shown in equity as a deduction from

the proceeds, net of tax.

z Cash and cash equivalents

For the purpose of the statement of cash flows, cash and cash equivalents include highly liquid investments that are

readily convertible to known amounts of cash and which are subject to an insignificant risk of change in value. Such

investments are normally those with less than three months’ maturity from the date of acquisition, and include cash

and balances at the central bank, debt securities, loans and advances to banks, items in the course of collection from

or in transmission to other banks and certificates of deposit.

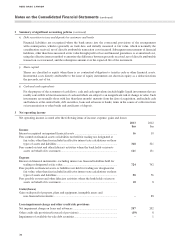

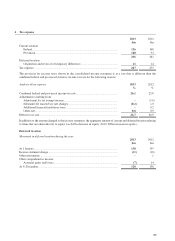

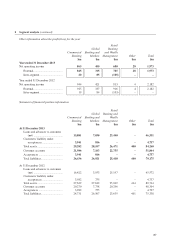

3 Net operating income

Net operating income is stated after the following items of income, expense, gains and losses:

2013

$m

2012

$m

Income

Interest recognized on impaired financial assets ........................................................... 16 18

Fees earned on financial assets or liabilities not held for trading nor designated at

fair value, other than fees included in effective interest rate calculations on these

types of assets and liabilities .................................................................................... 340 321

Fees earned on trust and other fiduciary activities where the bank holds or invests

assets on behalf of its customers .............................................................................. 141 131

Expense

Interest on financial instruments, excluding interest on financial liabilities held for

trading or designated at fair value ............................................................................ 724 742

Fees payable on financial assets or liabilities not held for trading nor designated at

fair value, other than fees included in effective interest rate calculations on these

types of assets and liabilities .................................................................................... 58 56

Fees payable on trust and other fiduciary activities where the bank holds or invests

assets on behalf of its customers .............................................................................. 10 8

Gains/(losses)

Gain on disposal of property, plant and equipment, intangible assets and

non-financial investments ........................................................................................ –88

Loan impairment charge and other credit risk provisions

Net impairment charge on loans and advances .............................................................. 207 202

Other credit risk provisions/(reversal of provisions) ..................................................... (19) 8

Impairment of available-for-sale debt securities ............................................................ –1

Notes on the Consolidated Financial Statements (continued)

HSBC BANK CANADA