HSBC 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

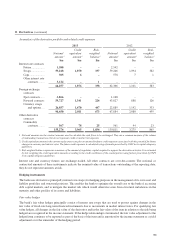

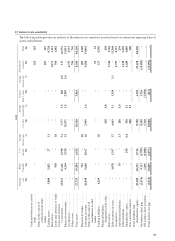

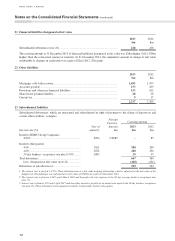

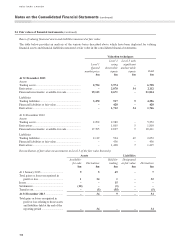

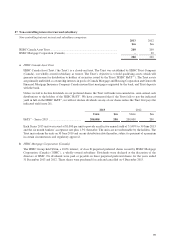

21 Financial liabilities designated at fair value

2013

$m

2012

$m

Subordinated debentures (note 23) ................................................................................ 428 436

The carrying amount at 31 December 2013 of financial liabilities designated at fair value was $28m higher (2012: $36m

higher) than the contractual amount at maturity. At 31 December 2013, the cumulative amount of change in fair value

attributable to changes in credit risk was a gain of $2m (2012: $7m gain).

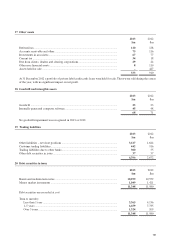

22 Other liabilities

2013

$m

2012

$m

Mortgages sold with recourse ........................................................................................ 1,882 1,995

Accounts payable ........................................................................................................... 273 189

Provisions and other non-financial liabilities ................................................................ 153 162

Share based payment liability ........................................................................................ 20 26

Current tax ..................................................................................................................... 917

2,337 2,389

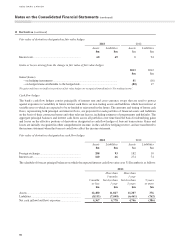

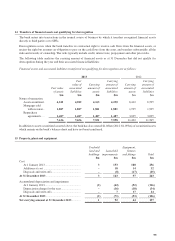

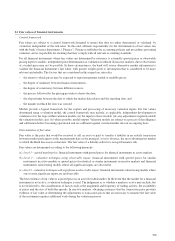

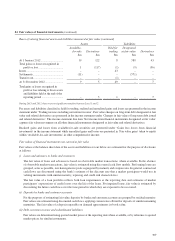

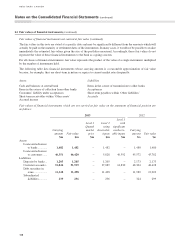

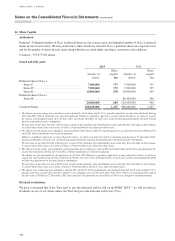

23 Subordinated liabilities

Subordinated debentures, which are unsecured and subordinated in right of payment to the claims of depositors and

certain other creditors, comprise:

Year of

maturity

Foreign

Currency

Amount

$m

Carrying amount

Interest rate (%) 2013

$m

2012

$m

Issued to HSBC Group Companies

4.8221 ..................................................................... 2094 US$85 –85

Issued to third parties

4.942 ....................................................................... 2021 200 200

4.803 ....................................................................... 2022 428 436

30 day bankers’ acceptance rate plus 0.50% ......... 2083 39 39

Total debentures .......................................................... 667 760

Less: designated at fair value (note 21) ................ (428) (436)

Debentures at amortized cost ...................................... 239 324

1 The interest rate is fixed at 2.478%. These debentures are in a fair value hedging relationship which is adjusted for the fair value of the

hedged risk. The debenture was redeemed at its fair value of US$85m for cash on 9 December 2013.

2 The interest rate is fixed at 4.94% until March 2016 and thereafter the rate reprices at the 90 day average bankers’ acceptance rate

plus 1%.

3 Interest rate is fixed at 4.8% until April 2017 and thereafter interest is payable at an annual rate equal to the 90 day bankers’ acceptance

rate plus 1%. These debentures are designated as held for trading under the fair value option.

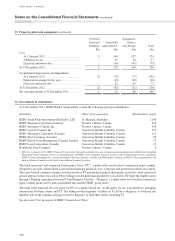

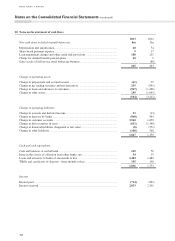

Notes on the Consolidated Financial Statements (continued)

102