HSBC 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

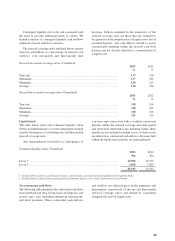

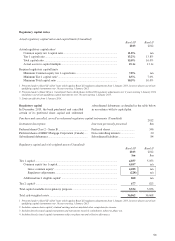

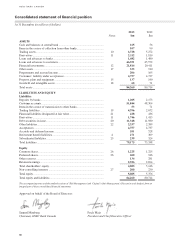

Regulatory capital ratios

Actual regulatory capital ratios and capital limits (Unaudited) Basel III

2013

1 Basel II

2012

Actual regulatory capital ratios2

Common equity tier 1 capital ratio .......................................................................... 11.0% n/a

Tier 1 capital ratio .................................................................................................... 13.2% 13.8%

Total capital ratio ..................................................................................................... 15.0% 16.0%

Actual assets-to-capital multiple .............................................................................. 15.1x 13.1x

Required regulatory capital limits

Minimum Common equity tier 1 capital ratio ......................................................... 7.0% n/a

Minimum Tier 1 capital ratio3 .................................................................................. 8.5% 7.0%

Minimum Total capital ratio .................................................................................... 10.5% 10.0%

1 Presented under a Basel III ‘all-in’ basis which applies Basel III regulatory adjustments from 1 January 2013, however phases out of non-

qualifying capital instruments over 10 years starting 1 January 2013.

2 Presented under a Basel III on a ‘transitional’ basis which phases in Basel III regulatory adjustments over 4 years starting 1 January 2014

and phases out of non-qualifying capital instruments over 10 years starting 1 January 2013.

3 Limits are effective from 1 January 2014.

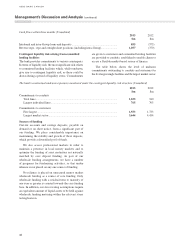

Regulatory capital

In December 2013, the bank purchased and cancelled

certain of its preferred share capital and redeemed

subordinated debentures as detailed in the table below

in accordance with its capital plan.

Purchase and cancelled, as well as redeemed regulatory capital instruments (Unaudited)

Instrument description Line item previously presented 2012

$m

Preferred shares Class 2 – Series B ......................................... Preferred shares .................................. 346

Preferred shares of HSBC Mortgage Corporation (Canada) ..... Non-controlling interests ................... 30

Subordinated debentures ....................................................... Subordinated liabilities ...................... 84

Regulatory capital and risk weighted assets (Unaudited) Basel III

2013

$m

1

Basel II

2012

$m

Tier 1 capital .................................................................................................................. 4,857 5,053

Common equity tier 1 capital ................................................................................... 4,057 n/a

Gross common equity2 ....................................................................................... 4,285 n/a

Regulatory adjustments ...................................................................................... (228) n/a

Additional tier 1 eligible capital3 ............................................................................. 800 n/a

Tier 2 capital4 ................................................................................................................. 677 823

Total capital available for regulatory purposes .............................................................. 5,534 5,876

Total risk-weighted assets .............................................................................................. 36,862 36,668

1 Presented under a Basel III ‘all-in’ basis which applies Basel III regulatory adjustments from 1 January 2013, however phases out of non-

qualifying capital instruments over 10 years starting 1 January 2013.

2 Includes common share capital, retained earnings and accumulated other comprehensive income.

3 Includes directly issued capital instruments and instruments issued by subsidiaries subject to phase out.

4 Includes directly issued capital instruments subject to phase out and collective allowances.