HSBC 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

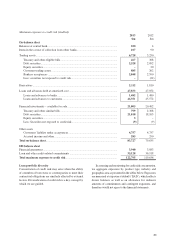

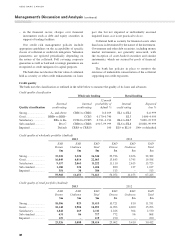

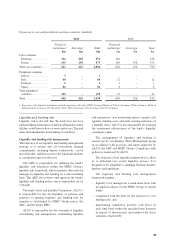

Loan portfolio by product type (Audited) EAD

2013

$m

EAD

2012

$m

Wholesale loan portfolios

Sovereign

Drawn exposures ................................................................................................ 22,696 20,083

Undrawn commitments ...................................................................................... 17 29

Derivatives ......................................................................................................... 278 79

22,991 20,191

Banks

Drawn exposures ................................................................................................ 3,275 3,591

Repurchase type transactions ............................................................................. 16 37

Derivatives ......................................................................................................... 2,409 2,127

Other off-balance sheet exposures ..................................................................... 469 347

6,169 6,102

Corporate

Drawn exposures ................................................................................................ 26,456 26,330

Undrawn commitments ...................................................................................... 11,636 11,124

Repurchase type transactions ............................................................................. 133 131

Derivatives ......................................................................................................... 1,278 1,070

Other off-balance sheet exposures ..................................................................... 2,950 2,277

42,453 40,932

Total wholesale loan portfolio........................................................................................ 71,613 67,225

Retail loan portfolios

Residential mortgages .............................................................................................. 17,347 17,850

Home equity lines of credit ...................................................................................... 4,916 5,543

Personal unsecured revolving loan facilities ............................................................ 1,060 1,127

Other personal loan facilities ................................................................................... 2,600 2,827

Other small to medium enterprises loan facilities .................................................... 624 746

Run-off consumer loan portfolio .............................................................................. 1,867 2,319

Total retail loan portfolio ............................................................................................... 28,414 30,412

Total loan portfolio exposure ......................................................................................... 100,027 97,637

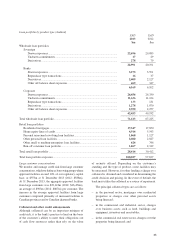

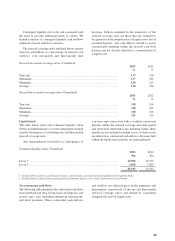

Large customer concentrations

We monitor and manage credit risk from large customer

concentrations, which we define as borrowing groups where

approved facilities exceed 10% of our regulatory capital

base, or $553m at 31 December 2013 (2012: $588m).

At 31 December 2013, the aggregate approved facilities

from large customers was $22,143m (2012: $16,474m),

an average of $963m (2012: $867m) per customer. The

increase in the average approved facilities from large

customers comprised primarily of increased facilities to

Canadian provinces and to Canadian chartered banks.

Collateral and other credit enhancements

Although collateral can be an important mitigant of

credit risk, it is the bank’s practice to lend on the basis

of the customer’s ability to meet their obligations out

of cash flow resources rather than rely on the value

of security offered. Depending on the customer’s

standing and the type of product, some facilities may

be unsecured. However, for other lending a charge over

collateral is obtained and considered in determining the

credit decision and pricing. In the event of default, the

bank may utilize the collateral as a source of repayment.

The principal collateral types are as follows:

– in the personal sector, mortgages over residential

properties or charges over other personal assets

being financed;

– in the commercial and industrial sector, charges

over business assets such as land, buildings and

equipment, inventory and receivables;

– in the commercial real estate sector, charges over the

properties being financed; and