HSBC 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

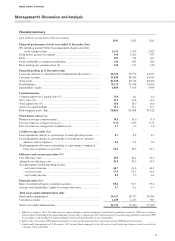

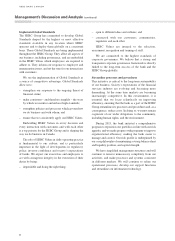

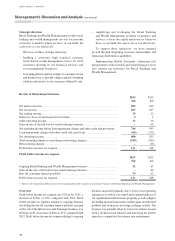

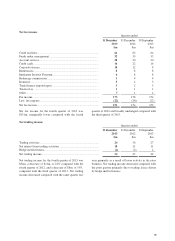

Net trading income

2013

$m

2012

$m

Trading activities ............................................................................................................ 129 138

Net interest from trading activities ................................................................................ 43 37

Hedge ineffectiveness .................................................................................................... 65

Net trading income ......................................................................................................... 178 180

Net trading income for 2013 was $178m, marginally lower compared with 2012.

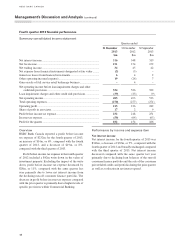

Other items of income

2013

$m

2012

$m

Net expense from financial instruments designated at fair value .................................. (5) (27)

Gains less losses from financial investments ................................................................. 58 52

Other operating income .................................................................................................. 16 24

Gain on the sale of the full service retail brokerage business ........................................ –88

Other items of income .................................................................................................... 69 137

Net expense from financial instruments designated at

fair value for 2013 was a loss of $5m compared with a

loss of $27m in 2012. The bank’s financial instruments

designated at fair value are fixed-rate long-term

subordinated debt issued, the rate profile of which has

been changed to floating through interest rate swaps as

part of a documented interest rate management strategy.

The movement in fair value of these long-term debt

issues and the related hedges includes the effect of our

credit spread changes and any ineffectiveness in the

economic relationship between the related swaps and

own debt. As credit spreads widen or narrow, accounting

profits or losses, respectively, are booked. We reported

net expense from financial instruments in both the current

and last year primarily as a result of adverse fair value

movements driven by the tightening of credit spreads.

Gains less losses from financial investments for 2013

were $58m, an increase of $6m, or 12%, compared with

2012 as Balance Sheet Management recognized higher

gains on sales of available-for-sale debt securities as a

result of the continued re-balancing of the portfolio for

risk management purposes based on the low interest rate

environment.

Other operating income for 2013 was $16m, a

decrease of $8m, or 33% compared with 2012. The

decrease is primarily due to a reduction in fair value of

an investment property sold during 2013.

Gain on the sale of the full service retail brokerage

business. The sale of the full service retail brokerage

business resulted in a gain of $88m, net of assets written

off and directly related costs, and was reported in the

results of 2012.

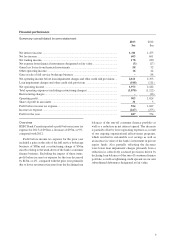

Loan impairment charges and other credit risk provisions

2013

$m

2012

$m

Individually assessed allowances ................................................................................... 138 103

Collectively assessed allowances ................................................................................... 69 99

Loan impairment charges ............................................................................................... 207 202

Impairment of available-for-sale debt securities ............................................................ –1

Other credit risk provisions (reversal of provisions) ..................................................... (19) 8

Loan impairment charges and other credit risk provisions ............................................ 188 211

Loan impairment charges and other credit risk provisions

for 2013 were $188m, a decrease of $23m, or 11%,

compared with 2012. The decrease in loan impairment

charges and other credit risk provisions is primarily as a

result of a reduction in collectively assessed allowances

driven by declining loan balances of the run-off

consumer finance portfolio and lower provisions carried

relating to off-balance sheet exposures due to an overall

improved credit quality. The decrease in loan impairment

charges and other credit provisions was partially offset

by higher specific allowances for commercial customers

in the energy, real estate and agriculture sectors.