HSBC 2001 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

96

Such audits include consideration of the

completeness and adequacy of credit manuals and

lending guidelines, together with an in-depth analysis

of a representative sample of accounts in the

portfolio to assess the quality of the loan book and

other exposures. Individual accounts are reviewed to

ensure that the facility grade is appropriate, that

credit procedures have been properly followed and

that where an account is non-performing, provisions

raised are adequate. Internal Audit will discuss any

facility grading they consider should be revised at

the end of the audit and their subsequent

recommendations for revised grades must then be

assigned to the facility.

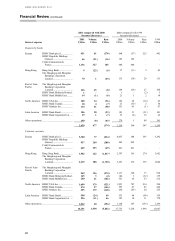

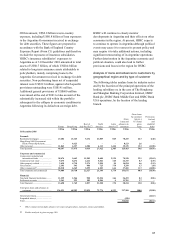

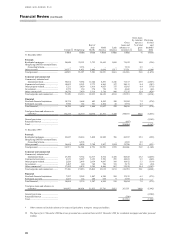

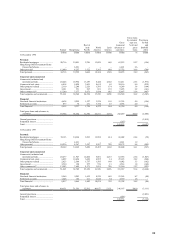

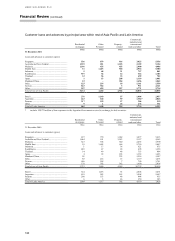

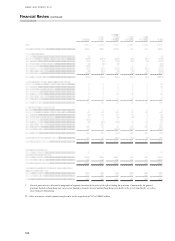

Loan portfolio

Loans and advances to customers are spread across

the various industrial sectors, as well as

geographically.

At constant exchange rates, loans and advances

to customers (excluding the finance sector and

settlement accounts) grew by 6.2 per cent during

2001. Within this growth, personal lending grew by

10.0 per cent and loans and advances to the

commercial and corporate customer base grew by 3.3

per cent.

Residential mortgages increased by US$6.5

billion to US$78.2 billion and comprised 25 per cent

of total gross customer loans at 31 December 2001.

Residential mortgages in Europe increased by

US$3.2 billion, of which US$2.9 billion arose in UK

Banking on the back of increased market share.

Residential mortgage lending in Hong Kong reversed

the decline seen in the last 3 years and was in line

with 2000 as HSBC captured a greater share of the

remortgaging market. Residential mortgage loans

made under the Hong Kong SAR Government Home

Ownership Scheme (‘GHOS’ ) increased by US$0.8

billion substantially in the first half of 2001. The

level of new GHOS mortgage lending will be lower

in future years as the Government of Hong Kong has

temporarily suspended the construction of new

homes under this scheme. In the Rest of Asia-Pacific,

residential mortgages grew by US$1.4 billion with

strong growth in Malaysia, Taiwan, Singapore, Korea

and India supplemented by acquisition related

growth in Australia following the purchase of the

NRMA Building Society Limited. In North America,

residential mortgage lending grew strongly by

US$2.2 billion as mortgage volumes soared as

interest rates fell.

Other personal lending increased to

approximately 12.3 per cent of the overall loan

portfolio. Personal lending grew by US$1.3 billion in

Hong Kong. Strong growth was also achieved in

consumer lending in the United Kingdom, in France

by both organic growth and from acquisitions, and in

personal lending in Singapore and several other

countries in Asia-Pacific. These increases reflected

the greater focus on this sector of the market.

Commercial lending grew in Europe mainly due

to the acquisition of Banque Hervet. In Hong Kong,

the Rest of Asia-Pacific and North America corporate

loan demand was muted

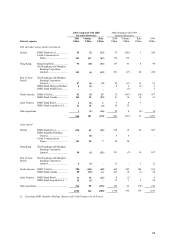

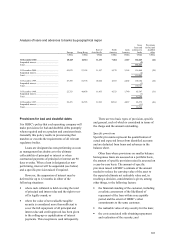

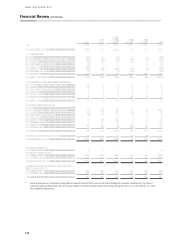

Areas of special interest

Telecoms industry exposure

The table below sets out HSBC’s exposure to the

telecoms industry in terms of outstanding advances.

Telecoms industry exposure is a designated special

category of exposure and is controlled under agreed

caps. The exposure analysed below is well spread

across geographical markets reflecting HSBC’s

international footprint.

Telecoms exposure as a percentage of total loans

and advances was 2.1 per cent as at 31 December

2001 as compared with 2.2 per cent as at 31

December 2000. This exposure had the following

characteristics:

Percentage of telecoms industry

exposure

At 31 December

2001

At 31 December

2000

Investment grade under

HSBC gradings............ 85 95

Under one year

remaining maturity ...... 47 73

Telecom operators........... 70 81

Telecom manufacturers... 30 19

Non-performing

accounts....................... 21

of which provided ....... 55 66

The slight deterioration in the credit quality of

the telecoms industry portfolio is mainly due to the

downgrading of two accounts.

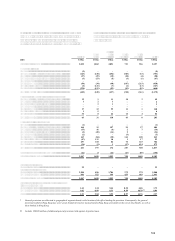

Argentina

HSBC’s banking operations’ exposure to Argentina

as at 31 December 2001 amounted to US$3.3 billion.