HSBC 2001 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

234

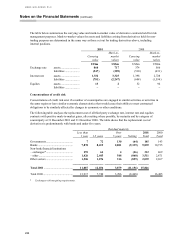

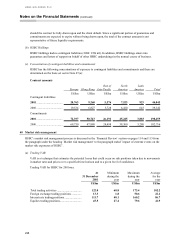

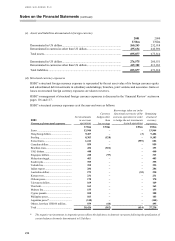

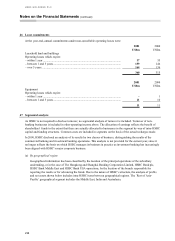

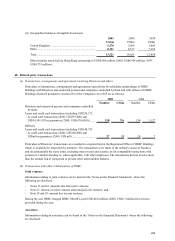

41 Reconciliation of operating profit to net cash flow from operating activities

2001 2000 1999

US$m US$m US$m

Operating profit .......................................................................... 7,153 9,447 7,409

Change in prepayments and accrued income ................................ 452 (772) 359

Change in accruals and deferred income ...................................... (2,207) 1,863 249

Interest on finance leases and similar hire purchase contracts...... 27 26 26

Interest on subordinated loan capital ............................................ 1,074 1,216 826

Depreciation and amortisation ...................................................... 1,933 1,591 999

Amortisation of discounts and premiums ..................................... (640) (727) (112)

Provisions for bad and doubtful debts........................................... 2,037 932 2,073

Loans written off net of recoveries ............................................... (1,893) (1,653) (1,021)

Provisions for liabilities and charges ........................................... 1,229 723 765

Provisions utilised......................................................................... (542) (510) (478)

Amounts written off fixed asset investments ................................ 125 36 28

Net cash inflow from trading activities ..................................... 8,748 12,172 11,123

Change in items in the course of collection from other banks ...... 1,009 656 304

Change in treasury bills and other eligible bills............................ 2,200 (826) (2,007)

Change in loans and advances to banks ........................................ 19,601 838 (5,832)

Change in loans and advances to customers ................................. (16,072) (10,265) 1,126

Change in other securities............................................................. (20,307) (16,006) 11,293

Change in other assets................................................................... (1,856) (1,858) 7,669

Change in deposits by banks......................................................... (8,546) (2,333) (4,700)

Change in customer accounts........................................................ 19,799 42,153 10,269

Change in items in the course of transmission to other banks ...... (827) (1,576) 559

Change in debt securities in issue ................................................. (1,437) (17,019) (2,324)

Change in other liabilities* ........................................................... 9,179 7,004 (4,618)

Elimination of exchange differences†.......................................... 1,424 2,283 (1,318)

Net cash inflow from operating activities 12,915 15,223 21,544

*The change in other liabilities excludes the creditor of US$9,733 million at 31 December 1999 in respect of the acquisitions of the

former Republic and Safra Republic businesses, as this was a non-operating item. The settlement of this creditor was in January

2000 and is recorded under ‘Acquisitions and disposals’ in the Consolidated Cash Flow Statement.

†Adjustment to bring changes between opening and closing balance sheet amounts to average rates. This is not done on a line-by-line

basis, as it cannot be determined without unreasonable expense.