HSBC 2001 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

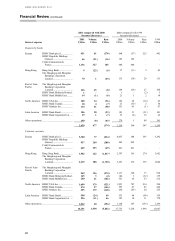

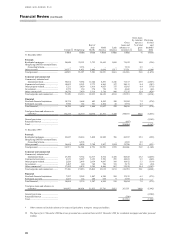

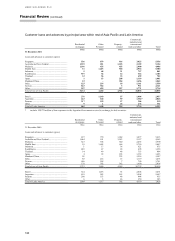

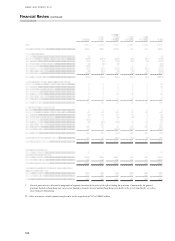

Analysis of loans and advances to banks by geographical region

Europe Hong Kong

Rest o

f

Asia-Pacific

Nort

h

America

Lati

n

America

Gross

loans an

d

advances to

b

anks

Provisions

for bad an

d

doubtful

debts

US$

m

US$

m

US$

m

US$

m

US$

m

US$

m

US$

m

31 December 2001........................................ 40,665 42,516 11,253 7,864 2,367 104,665 (22)

Suspended interes

t

......................................... (2)

Total.............................................................. 104,663

31 December 2000......................................... 45,072 57,154 11,197 9,279 3,362 126,064 (30)

Suspended interes

t

......................................... (2)

Total.............................................................. 126,062

31 December 1999......................................... 29,395 53,778 10,024 4,503 2,402 100,102 (24)

Suspended interes

t

......................................... (1)

Total.............................................................. 100,101

31 December 1998......................................... 22,713 44,938 11,433 4,523 1,740 85,347 (31)

Suspended interes

t

......................................... (1)

Total.............................................................. 85,346

31 December 1997......................................... 22,471 36,725 11,993 10,563 4,827 86,579 (46)

Suspended interes

t

......................................... (11)

Total.............................................................. 86,568

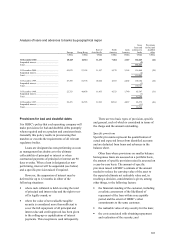

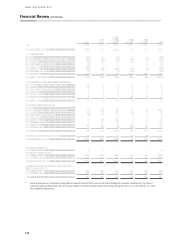

Provisions for bad and doubtful debts

It is HSBC’s policy that each operating company will

make provisions for bad and doubtful debts promptly

where required and on a prudent and consistent basis.

Generally this policy results in provisioning that

matches or exceeds the requirements of all relevant

regulatory bodies.

Loans are designated as non-performing as soon

as management has doubts as to the ultimate

collectability of principal or interest or when

contractual payments of principal or interest are 90

days overdue. When a loan is designated as non-

performing, interest will be suspended (see below)

and a specific provision raised if required.

However, the suspension of interest may be

deferred for up to 12 months in either of the

following situations:

• where cash collateral is held covering the total

of principal and interest due and the right to set-

off is legally sound; or

• where the value of net realisable tangible

security is considered more than sufficient to

cover the full repayment of all principal and

interest due and credit approval has been given

to the rolling-up or capitalisation of interest

payments. This exception is used infrequently.

There are two basic types of provision, specific

and general, each of which is considered in terms of

the charge and the amount outstanding.

Specific provisions

Specific provisions represent the quantification of

actual and expected losses from identified accounts

and are deducted from loans and advances in the

balance sheet.

Other than where provisions on smaller balance

homogenous loans are assessed on a portfolio basis,

the amount of specific provision raised is assessed on

a case-by-case basis. The amount of specific

provision raised is HSBC’s estimate of the amount

needed to reduce the carrying value of the asset to

the expected ultimate net realisable value and, in

reaching a decision, consideration is given, among

other things, to the following factors:

• the financial standing of the customer, including

a realistic assessment of the likelihood of

repayment of the loan within an acceptable

period and the extent of HSBC’ s other

commitments to the same customer;

• the realisable value of any security for the loan;

• the costs associated with obtaining repayment

and realisation of the security; and