HSBC 2001 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

236

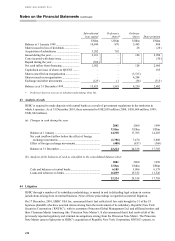

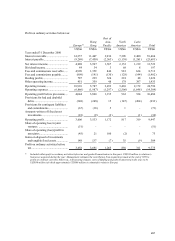

Subordinate

d

loan capita

l

Preference

shares*

Ordinary

shares Share premium

US$m US$m US$m US$m

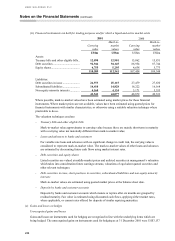

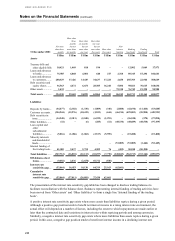

Balance at 1 January 1999 ................................ 10,844 870 3,443 480

Shares issued in lieu of dividends.....................

–

–28(28)

Acquisition of subsidiaries ............................... 3,202 702 –

–

Issued during the year ....................................... 2,101

–

128 2,990

Costs incurred with share issue.........................

–

–

–

(30)

Repaid during the year...................................... (599)

–

–

–

Net cash inflow from financing ........................ 1,502 – 128 2,960

Capitalised on issue of shares to QUEST .........

–

– – 185

Shares cancelled on reorganisation ...................

–

– (3,515)

–

Shares issued on reorganisation ........................

–

–4,204

–

Exchange and other movements ....................... (125) 11 (58) (715)

Balance as at 31 December 1999 ...................... 15,423 1,583 4,230 2,882

* Preference shares in issue are in subsidiary undertakings (Note 34).

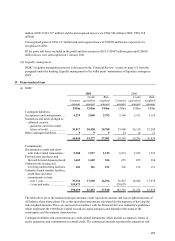

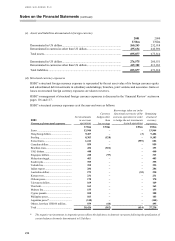

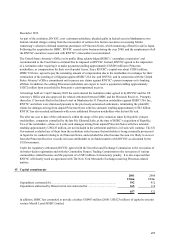

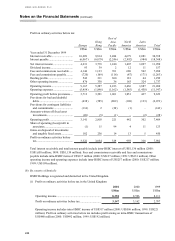

43 Analysis of cash

HSBC is required to make deposits with central banks as a result of government regulations in the territories in

which it operates. As at 31 December 2001, these amounted to US$2,030 million (2000: US$1,604 million; 1999:

US$1,842 million).

(a) Changes in cash during the year

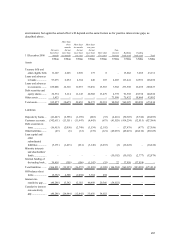

2001 2000 1999

US$m US$m US$m

Balance at 1 January .............................................................. 24,338 17,705 14,203

Net cash (outflow)/inflow before the effect of foreign

exchange movements ......................................................... (1,706) 7,470 3,808

Effect of foreign exchange movements.................................. (408) (837) (306)

Balance at 31 December ........................................................ 22,224 24,338 17,705

(b) Analysis of the balances of cash as classified in the consolidated balance sheet

2001 2000 1999

US$m US$m US$m

Cash and balances at central banks........................................ 6,185 5,006 6,179

Loans and advances to banks................................................. 16,039 19,332 11,526

22,224 24,338 17,705

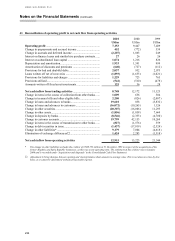

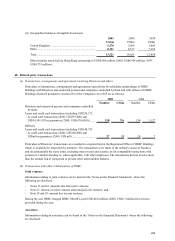

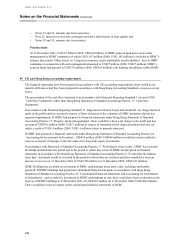

44 Litigation

HSBC through a number of its subsidiary undertakings, is named in and is defending legal actions in various

jurisdictions arising from its normal business. None of these proceedings is regarded as material litigation.

On 17 December, 2001, HSBC USA Inc. announced that it had settled civil law suits brought by 51 of the 53

Japanese plaintiffs who have asserted claims arising from the involvement of its subsidiary, Republic New York

Securities Corporation (‘RNYSC’ ), with its customers Princeton Global Management Ltd. and affiliated entities and

their Chairman Martin Armstrong (the ‘Princeton Note Matter’ ). It also announced that it had resolved all of the

previously reported regulatory and criminal investigations arising from the Princeton Note Matter. The Princeton

Note Matter came to light prior to HSBC’ s acquisition of Republic New York Corporation, RNYSC’ s parent, in