HSBC 2001 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

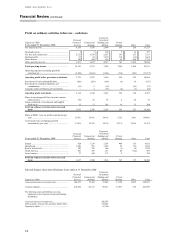

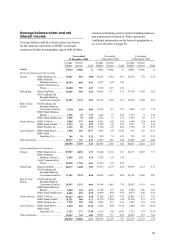

Financial Review (continued)

76

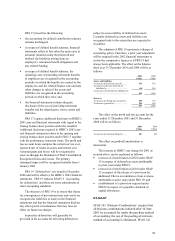

America were lower by US$182 million, mainly due

to the effect of exchange rate changes in Brazil.

Local currency costs were up slightly in Brazil,

reflecting higher transactional taxes.

Provisions for bad and doubtful debts rose from

US$602 million to US$772 million. In Europe lower

provisions (down by US$58 million), partly reflected

improved recovery procedures in First Direct and the

cards portfolio.

Provisions in Hong Kong rose by US$94 million

as the weakening economic environment led to an

increase in personal bankruptcies and this, together

with a rise in card lending, resulted in increased

provisions on credit cards. Provisions in the Rest of

Asia-Pacific rose by US$84 million, with higher

charges in Taiwan and the non-recurrence of the

benefit seen in 2000 from the release of part of the

Asia special general provision. Latin American loan

losses rose by US$37 million, including US$11

million in Argentina due to the economic situation in

the country. Latin American provisioning excludes

the exceptional provision taken against 2001 results

following the formal default of sovereign debt and

the pesification of the banking system. Brazil’s

growing provisioning requirements reflected planned

expansion of the personal lending portfolio in 2000.

Provisions for contingent liabilities and

commitments saw a US$17 million charge in the

year, compared with US$31 million in 2000, all of

which arose in Europe. The 2001 charge included

US$13 million relating to CCF.

Losses from associated undertakings reduced by

US$40 million, mainly reflecting the sale of British

Interactive Broadcasting which also contributed

US$202 million to profit on disposal of fixed asset

investments. In other associates and joint ventures,

an improved performance in Cyprus partly offset

higher losses in Merrill Lynch HSBC and lower

profits in the personal banking business of Saudi

British Bank.

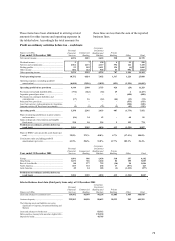

Commercial

The commercial line of business contributed

US$2,385 million to pre-tax profits in 2001 and

represented 27.1 per cent of such profits. Pre-tax

profits were US$395 million lower, a decline of 14

per cent reflecting higher net provisions for bad and

doubtful debts as recoveries fell and the impact of

the release of the Asian special general provision in

2000 was not repeated. Operating profits before

provisions were up slightly, by US$51 million or 2

per cent.

Net interest income increased by US$280

million or 8 per cent. Net interest income in Europe

rose by US$254 million, mainly reflecting the

inclusion of a full year’ s income for CCF in 2001.

Excluding the impact of CCF, net interest income in

Europe was down slightly, mainly due to foreign

exchange movements. Underlying net interest

income in the UK was broadly unchanged, as

significant growth in UK commercial loans and

deposits was offset by falling margins due to lower

base rates and increased competitive pressures. Net

interest income in Hong Kong fell slightly, by US$44

million, due to lower margins on current account

deposits. The Rest of Asia-Pacific saw a small rise in

net interest income as the benefit of lower funding

costs in the Middle East offset lower margins in

Singapore.

North America saw strong growth in net interest

income, which rose by US$82 million reflecting

organic growth, increased commercial deposit levels

and improved margins in commercial real estate

lending.

Net fees and commissions rose by US$92

million or 6 per cent against 2000. The main part of

this rise was in Europe, again mainly reflecting the

impact of including a full year of results for CCF.

Fees in the UK were broadly flat in constant

currency terms.

Operating expenses increased by US$400

million or 15 per cent, within which US$227 million

reflected a rise in staff costs and US$64 million

increased premises and equipment. Again, the

inclusion of a full impact for CCF was the main

contributor.

Provisions for bad and doubtful debts rose

sharply from US$202 million to US$662 million. Of

the increase in Europe (up by US$171 million),

US$60 million related to CCF, with the remainder

mainly reflecting higher provisions in the UK due to

the less favourable economic environment and

pressures on UK manufacturing industry. Provisions

in the Rest of Asia-Pacific rose by US$123 million,

notably due to further charges in Indonesia and the

non-recurrence of the benefit seen in 2000 from the

release of the special general provision.

In North America provisions rose by US$98

million, reflecting losses in receivables lending and