HSBC 2001 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

HSBCs VAR should be viewed in the context of

the limitations of the methodology used. These

include:

• the model assumes that changes in risk factors

follow a normal distribution. This may not be

the case in reality and may lead to an

underestimation of the probability of extreme

market movements;

• the use of a 10-day holding period assumes that

all positions can be liquidated or hedged in 10

days. This may not fully reflect the market risk

arising from times of severe illiquidity, when a

10-day holding period may be insufficient to

fully liquidate or hedge all positions;

• the use of a 99 per cent confidence level does

not take account of any losses that might occur

beyond this level of confidence;

• the use of historical data as a proxy for

estimating future events may not encompass all

potential events, particularly those which are

extreme in nature;

• the assumption of independence between risk

types may not always hold and therefore result

in VAR not fully capturing market risk where

correlation between variables is exhibited;

• VAR is calculated at the close of business, with

intra-day exposures not being subject to intra-

day VAR calculations on an HSBC basis; and

• VAR does not necessarily capture all of the

higher order market risks and may underestimate

real market risk exposure.

HSBC recognises these limitations by

augmenting the VAR limits with other position and

sensitivity limit structures, as well as with stress

testing, both on individual portfolios and on a

consolidated basis. HSBCs stress testing regime

provides senior management with an assessment of

the impact of extreme events on the market risk

exposures of HSBC.

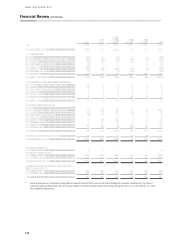

Trading VAR for HSBC for 2001 was:

Minimum Maximum Average

At 31 during the during the for the At 31

December year end year end year end December

2001 2001 2001 2001 2000

US$m US$m US$m US$m US$m

Total trading

activities ............... 122.0 60.8 173.4 102.2 75.0

Foreign exchange

trading positions ... 13.3 1.8 50.6 22.1 19.1

Interest rate trading

positions ............... 111.7 48.1 160.2 86.7 58.9

Equities trading

positions ............... 45.5 27.4 79.6 41.9 39.9

Trading VAR for HSBC for 2000 was:

Combined

HSBC Excluding former Republic operations

At 31 At 31 Minimum Maximum Average

December December during during For the

2000 2000 The year The year year

US$m US$m US$m US$m US$m

Total trading

activities............... 75.0 64.8 44.5 83.7 63.1

Foreign exchange

trading positions ... 19.1 17.2 8.9 26.8 16.6

Interest rate trading

positions............... 58.9 45.0 32.2 66.4 46.9

Equities trading

positions............... 39.9 39.9 23.6 53.4 36.2

Trading VAR for CCF is included in the above

table from the date of acquisition.

Trading VAR for the former Republic operations

at 31 December 2000 was US$23.2 million on a

variance/co-variance basis. On a historical

simulation approach, trading VAR for the former

Republic operations at 31 December 2000 was

US$11.7 million, the maximum during 2000 was

US$37.1 million, the minimum US$9.3 million and

the average US$18.8 million. The scope of

calculation of VAR on the former Republic

operations was refined at 30 June 2000, following a

review of its basis, to be more consistent with that of

the rest of HSBC. The maximum, minimum and

average on a historical simulation approach for each

half year are set out below:

Former Re

p

ublic o

p

erations

Total trading

First hal

f

2000

Second

hal

f

2000

US$m US$m

Maximum in the half-

y

ea

r

........... 37.1 19.1

Minimum in the half-

y

ea

r

............ 12.5 9.3

Avera

g

e for the half-

y

ea

r

............ 22.7 13.6

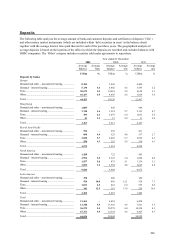

The average daily revenue earned from market

risk-related treasury activities in 2001, including

accrual book net interest income and funding related

to dealing positions, was US$13.9 million, compared

with US$10.0 million for 2000. The standard

deviation of these daily revenues was US$7.7 million

compared with US$4.4 million in 2000. An analysis

of the frequency distribution of daily revenues shows

that there were eleven days with negative revenues

during 2001. The most frequent result was a daily

revenue of between US$18 million and US$19

million with 20 occurrences. The highest daily

revenue was US$41 million.