HSBC 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

constant exchange rates, HSBC’s net fees and

commissions in 2000 would have been 27 per cent

higher than in 1999.

Dealing profits at US$1,626 million were

US$327 million higher than in 1999, over half of

which was attributable to the recent acquisitions.

Increased foreign exchange profits reflected higher

volumes in customer-driven business in both the

United Kingdom and Hong Kong. Dealing profits

also benefited from a recovery of 69 per cent of the

provisions made in 1999 against a Korean

corporate’s bonds upon liquidation of the position.

Other income was US$177 million higher at

US$1,716 million mainly due to the recent

acquisitions, together with the impact of the transfer

of Argentina’s pension and life businesses from

associated undertakings to subsidiaries in 1999.

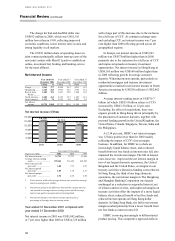

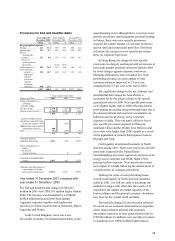

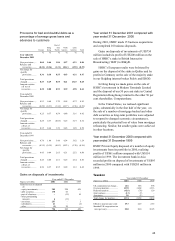

Operating expenses

Year ended 31

December 2001

Year ended 31

December 2000

Year ended 31

December 1999

US$m % US$

m

%US$

m

%

By geographical segment

Europe.................. 7,288 49.1 6,518 47.3 5,445 47.3

Hong Kong........... 2,140 14.4 1,986 14.4 1,896 16.5

Rest of Asia-

Pacific.............. 1,397 9.4 1,292 9.4 1,148 10.0

North America...... 2,488 16.7 2,363 17.1 1,582 13.7

Latin America....... 1,549 10.4 1,635 11.8 1,440 12.5

14,862 100.0 13,794 100.0 11,511 100.0

Goodwill amortisation

Europe.................. 632 348 9

Hong Kong........... –1

–

Rest of Asia-

Pacific.............. 8514

North America...... 142 143 3

Latin America....... 17 13 10

799 510 36

Intra-HSBC

eliminatio

n

....... (257

)

(217) (198)

Total operating

expenses .......... 15,404 14,087 11,349

Year ended 31 December

Figures in US$m 2001 2000 1999

By expense category:

Staff costs............................. 8,553 8,057 6,692

Premises and equipment

(excluding depreciation) .. 1,639 1,480 1,329

Other administrative

expenses .......................... 3,279 2,959 2,329

Administrative expenses*... 13,471 12,496 10,350

Depreciation and

amortisation

–

tangible fixed assets........... 1,134 1,081 963

–

goodwill ............................ 799 510 36

Total operating expenses... 15,404 14,087 11,349

Cost:income ratio (excluding

goodwill amortisation)..... 56.4 55.3 53.9

*Includes US$156 million (2000: US$121 million; 1999 US$164

million) of restructuring costs.

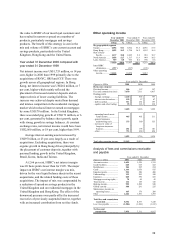

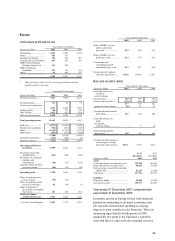

Operating expenses (US$m)

Staff costs Other

Premises and equipment Depreciation and amortisation

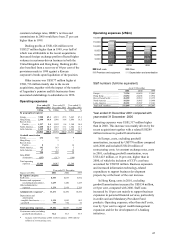

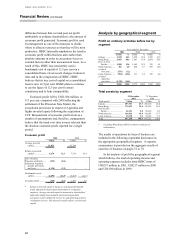

Staff numbers (full-time equivalent)

As at 31 December

2001 2000 1999

Europe................................... 73,326 69,629 53,861

Hong Kong............................ 24,654 24,204 23,932

Rest of Asia-Pacific .............. 26,259 22,919 21,375

North America ...................... 18,518 18,965 19,498

Latin America ....................... 28,292 25,907 27,181

Total staff numbers .............. 171,049 161,624 145,847

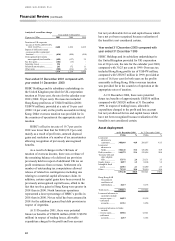

Year ended 31 December 2001 compared with

year ended 31 December 2000

Operating expenses were US$1,317 million higher

than in 2000. This increase was mainly driven by the

recent acquisitions together with a related US$289

million increase in goodwill amortisation.

In Europe, costs, excluding goodwill

amortisation, increased by US$770 million compared

with 2000 and included US$128 million of

restructuring costs. At constant exchange rates, costs

in 2001, excluding goodwill amortisation, were

US$1,023 million, or 16 per cent, higher than in

2000, of which the inclusion of CCF’ s cost base

accounted for US$769 million. Business expansion

and increased information technology-related

expenditure to support business development

projects lay at the heart of the cost increase.

In Hong Kong, costs in 2001, excluding

goodwill amortisation increased by US$154 million,

or 8 per cent, compared with 2000. Staff costs

increased by 10 per cent mainly to support business

expansion in personal financial services, particularly

in credit card and Mandatory Provident Fund

products. Operating expenses, other than staff costs,

rose by 5 per cent to support wealth management

expansion and for the development of e-banking

initiatives.

8,553

1,639

3,279

1,933

8,057

1,480

2,959

1,591

6,692

1,329

2,329

999

0

3,000

6,000

9,000

12,000

15,000

18,000

2001 2000 1999