HSBC 2001 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

255

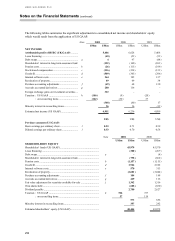

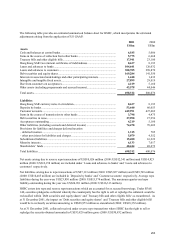

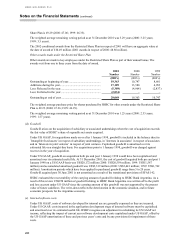

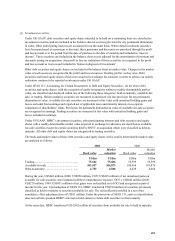

The US GAAP pension cost of US$395 million (2000: US$376 million; 1999 US$489 million) compares with

US$369 million for these plans under UK GAAP (2000: US$263 million; 1999: US$290 million) for the

schemes included in the SFAS 87 calculation.

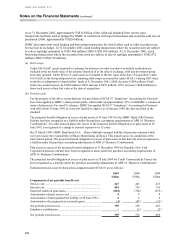

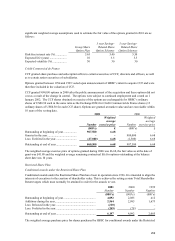

2001 2000

US$m US$m

Change in projected benefit obligation

Projected benefit obligation as at 1 January........................................................ 14,481 13,238

Service cost......................................................................................................... 447 445

Interest cost......................................................................................................... 801 736

Employee contributions ...................................................................................... 12

Net actuarial (gain)/loss ...................................................................................... (869) 278

Acquisition.......................................................................................................... 21 227

Transfers in1........................................................................................................

–

1,009

Plan amendment.................................................................................................. 2

–

Benefits paid ....................................................................................................... (443) (488)

Exchange movements ......................................................................................... (387) (966)

Projected benefit obligation as at 31 December.................................................. 14,054 14,481

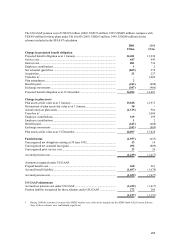

Change in plan assets

Plan assets at fair value as at 1 January............................................................... 13,828 12,971

Restatement of plan assets fair value as at 1 January.......................................... 30

–

Actual return on plan assets ................................................................................ (1,315) 904

Transfers in1........................................................................................................

–

1,009

Employer contributions....................................................................................... 339 299

Employee contributions ...................................................................................... 12

Benefits paid ....................................................................................................... (443) (488)

Exchange movements ......................................................................................... (343) (869)

Plan assets at fair value as at 31 December......................................................... 12,097 13,828

Funded status (1,957) (653)

Unrecognised net obligation existing at 30 June 1992........................................ 13 19

Unrecognised net actuarial loss/(gain)................................................................ 492 (809)

Unrecognised prior service cost.......................................................................... 23 26

Accrued pension cost.......................................................................................... (1,429) (1,417)

Amounts recognised under US GAAP:

Prepaid benefit cost............................................................................................. 268 261

Accrued benefit liability ..................................................................................... (1,697) (1,678)

Accrued pension cost.......................................................................................... (1,429) (1,417)

US GAAP adjustment:

Accrued net pension cost under US GAAP ........................................................ (1,429) (1,417)

Pension liability recognised for these schemes under UK GAAP....................... 272 266

(1,157) (1,151)

1 During 2000 the schemes of certain other HSBC entities were collectively merged into the HSBC Bank (UK) Pension Scheme.

None of these schemes were individually significant.