HSBC 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

48

difference between that cost and post-tax profit

attributable to ordinary shareholders is the amount of

economic profit generated. Economic profit is used

by management as one of the measures to decide

where to allocate resources so that they will be most

productive. HSBC internally emphasises the trend in

economic profit within business units rather than

absolute amounts in order to concentrate focus on

external factors rather than measurement bases. As a

result of this, HSBC has consistently used a

benchmark cost of capital of 12.5 per cent on a

consolidated basis. Given recent changes in interest

rates and in the composition of HSBC, HSBC

believes that its true cost of capital on a consolidated

basis is now 10.5 per cent. HSBC plans to continue

to use the figure of 12.5 per cent to ensure

consistency and to help comparability.

Economic profit fell by US$1,924 million, or

113 per cent, compared with 2000 reflecting the

settlement of the Princeton Note Matter, the

exceptional provisions in respect of Argentina and

higher invested equity following the acquisition of

CCF. Measurement of economic profit involves a

number of assumptions and, therefore, management

believe that the trend over time is more relevant than

the absolute economic profit reported for a single

period.

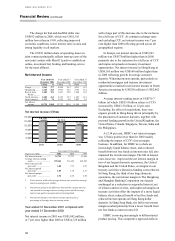

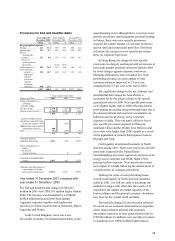

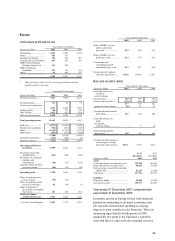

Economic profit

2001 2000

US$m % US$

m

%

Average invested

capital....................... 51,933 43,744

Return on invested

capital*..................... 6,274 12.1 7,174 16.4

After charging:

Princeton settlemen

t

...... (323) (0.6 )

–

–

Additional Argentine

general provisions

and losses ................. (1,120 ) (2.2) – –

Benchmark cost of

capital....................... (6,492 ) (12.5 ) (5,468) (12.5)

Economic profi

t

............ (218) (0.4 ) 1,706 3.9

* Return on invested capital is based on cash-based attributable

profit adjusted for depreciation attributable to revaluation

surpluses. Average invested capital is measured as shareholders’

funds after adding back goodwill amortised and goodwill

previously written-off directly to reserves and deducting property

revaluation reserves. This measure broadly reflects cash invested

capital.

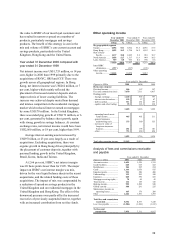

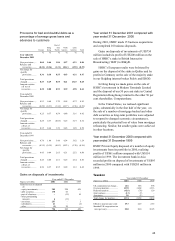

Analysis by geographical segment

Profit on ordinary activities before tax by

segment

Year ended 31 December

2001 2000 1999

US$m % US$

m

%US$

m

%

Europe .................. 3,542 44.3 3,658 37.4 3,322 41.6

Hong Kong........... 3,883 48.5 3,691 37.8 3,054 38.3

Rest of Asia-

Pacific.............. 1,088 13.6 1,265 12.9 329 4.1

North America...... 481 6.0 850 8.7 959 12.0

of which

Princeton ......... (575

)

(7.2

)

–

–

–

–

Latin America....... (994

)

(12.4

)

311 3.2 318 4.0

of which

Argentina

p

rovisions ........ (1,120

)

(14.0

)

–

–

–

–

Total 8,000 100.0 9,775 100.0 7,982 100.0

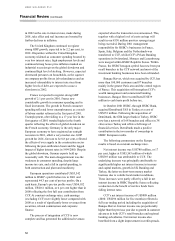

Total assets by segment

31 December

2001

31 December

2000

Total assets* US$m % US$

m

%

Europe .................................. 297,701 43.3 295,274 44.4

Hong Kong........................... 175,652 25.6 176,545 26.5

Rest of Asia-

Pacific............................... 62,151 9.0 56,676 8.5

North America...................... 136,526 19.9 118,053 17.7

Latin America....................... 15,210 2.2 19,073 2.9

Total 687,240 100.0 665,621 100.0

*Excluding Hong Kong SAR Government certificates of

indebtedness.

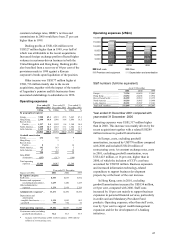

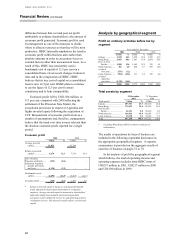

The results of operations by lines of business are

included in the following segmental disclosures in

the appropriate geographical segment. A separate

commentary is provided on the aggregate results of

each line of business on pages 72 to 78.

In the analysis of profit by geographical segment

which follows, the total of operating income and

operating expenses includes intra-HSBC items of

US$257 million in 2001, US$217 million in 2000

and US$198 million in 1999.