HSBC 2001 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

247

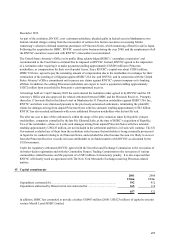

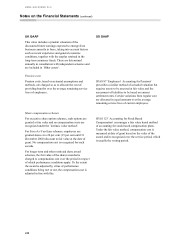

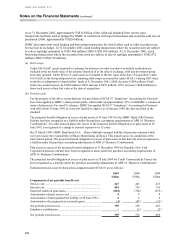

UK GAAP US GAAP

Costs of software for internal use

HSBC generally expenses costs of software developed

for internal use. However, if it can be demonstrated

that conditions for capitalisation are met under FRS 10

‘Goodwill and intangible assets’ or FRS 15 ‘Tangible

fixed assets’ , the software should be capitalised as part

of the cost of related hardware and amortised over its

useful life.

Website design and content development costs should

be capitalised only to the extent that they lead to the

creation of an enduring asset delivering benefits at least

as great as the amount capitalised.

The American Institute of Certified Public

Accountants’ (‘AICPA’ ) Statement of Position (‘SOP’ )

98-1 ‘Accounting for the costs of computer software

developed or obtained for internal use’ was issued in

March 1998, to be effective for fiscal years beginning

after 15 December 1998. It requires that all costs

incurred in the preliminary project and post

implementation stages of internal software

development be expensed. Costs incurred in the

application development stage must be capitalised and

amortised over the estimated useful life.

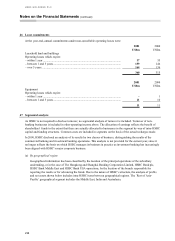

Goodwill

For acquisitions prior to 1998, goodwill arising on the

acquisition of subsidiary undertakings, associates or

joint ventures was charged against reserves in the year

of acquisition.

Goodwill acquired up to 30 June 2001 is capitalised

and amortised over its estimated useful life but not

more than 25 years. Under the transition requirements

of SFAS 142 ‘Goodwill and Other Intangible Assets’

goodwill acquired after 30 June 2001 is capitalised but

not amortised, and is subject to annual impairment

testing as required under APB 17 ‘Intangible Assets’ .

All goodwill will cease to be amortised from 31

December 2001.

In 1998, HSBC adopted FRS 10. For acquisitions made

on or after 1 January 1998, goodwill is included in the

balance sheet and amortised over its estimated useful

life on a straight-line basis. FRS 10 allows goodwill

previously eliminated against reserves to be reinstated,

but does not require it. In common with many other

UK companies, HSBC elected not to reinstate such

goodwill. HSBC considered whether reinstatement

would materially assist the understanding of readers of

its accounts who were already familiar with UK GAAP

and decided that it would not.

US GAAP requires the recoverability of goodwill to be

assessed whenever events or changes in circumstances

indicate that the carrying amount of an asset may not

be recoverable. Impairment of goodwill relating to an

entity is recognised if the sum of the estimated future

cashflows (undiscounted and without interest charges)

expected to be generated by that entity is less than its

carrying amount. If impairment is assessed to exist, the

amount recognised is the amount by which the carrying

amount of the entity exceeds its fair value.

Goodwill included in the balance sheet is tested for

impairment when necessary by comparing the

recoverable amount of an entity with the carrying value

of its net assets, including attributable goodwill. The

recoverable amount of an entity is the higher of its

value in use, generally the present value of the

expected future cash flows from the entity, and its net

realisable value.