HSBC 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

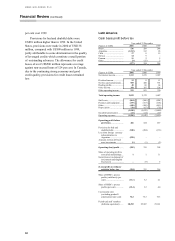

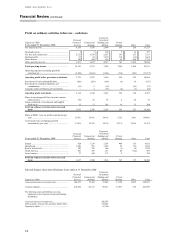

Year ended 31 December 2001 compared with

year ended 31 December 2000

All commentary is made on a cash basis, that is

excluding the impact of goodwill amortisation.

Personal Financial Services

Personal Financial Services contributed US$3,504

million to pre-tax profits in 2001 and represented

39.8 per cent of such profits. Growth in pre-tax

profits over 2000 amounted to US$467million, an

increase of 15 per cent. This was driven by good

growth in operating profits before provisions with

revenues rising 6 per cent against cost growth of 3

per cent. Reflecting significant growth in personal

lending, provisions for bad and doubtful debts rose

US$170 million an increase of 28 per cent. Disposal

gains were exceptionally high as a result of the

disposal of the Group’ s interest in British Interactive

Broadcasting.

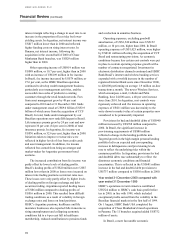

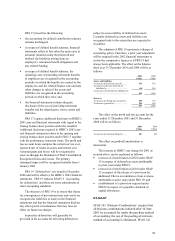

Net interest income increased by US$346

million or 5 per cent. Within this, net interest income

in Europe rose by US$217 million, mainly reflecting

the inclusion of a full year’ s income for CCF in

2001. Excluding the impact of CCF, net interest

income in Europe was effectively flat. In the UK, the

benefit of customer deposit growth was offset by the

impact on margins of competitive pricing initiatives

in mortgages and savings accounts.

In Hong Kong net interest income rose by

US$41 million as the benefits of increased credit

card lending and wider spreads on non-Hong Kong

dollar lending were largely offset by lower spreads

on Hong Kong Dollar savings and deposit accounts

and on residential mortgages.

Net interest income for the Rest of Asia-Pacific

rose by US$53 million with encouraging growth in

most entities in the region. In North America

increased net interest income of US$96m reflected

wider margins as funding costs fell more quickly

than lending, particularly mortgage lending, repriced.

The decline in funding costs was further helped by a

switch by depositors away from fixed rate CDs to

lower-paying savings and current accounts.

Net fees and commissions rose by US$209

million or 8 per cent on the year. US$128 million of

this rise was in Europe, again mainly reflecting the

inclusion of a full year of results for CCF. Fees in the

UK fell slightly as lower overdraft fees and the effect

of removing ATM fees on the LINK network and

mortgage valuation fees were only partially offset by

growth in wealth management income and fees on

investment products. Net fees in Hong Kong were up

by US$76 million, with outstanding success in fees

earned from sales of capital-guaranteed funds.

In North America fee income was effectively

unchanged; strongly rising wealth management

income and fees from high levels of mortgage

augmentation were offset by increased write-offs of

mortgage servicing rights as mortgage prepayments

rose in response to falling interest rates. The

mortgage business also suffered losses on

instruments held as hedges against the value of

mortgage servicing rights; such losses are reflected

in dealing profits. Overall the mortgage business

generated positive net interest and non-interest

income.

Other income rose by US$96 million, primarily

in Hong Kong due to strong growth in life insurance

income fees and the growth in embedded value in

this business.

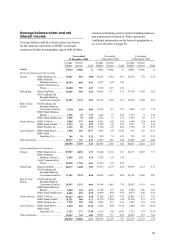

Operating expenses increased by US$218

million or 3 per cent, mainly reflecting a US$139

million rise in staff costs and US$43 million of

increased premises and equipment expenses. In

Europe, expenses rose by US$229 million, mainly

due to the inclusion of a full year’ s costs for CCF.

Excluding this increase, costs in Europe were down.

In constant currency terms, the UK bank’s staff costs

rose 4 per cent due to annual pay rises and increased

headcount in wealth management and customer

telephone services.

Costs in Hong Kong increased by US$147

million, reflecting increased marketing and IT costs,

together with the impact of annual salary increments

and expansion of the cards business and Mandatory

Provident Fund services. In the rest of Asia-Pacific, a

US$96 million rise in costs included increased costs

following acquisitions and branch openings, higher

costs associated with the expansion of wealth

management services, costs of mortgage incentives

in Malaysia and branch expansion in a number of

countries.

Operating costs declined by US$72 million in

North America mainly due to the non-recurrence of

restructuring costs associated with the RNYC

acquisition in 2000, partly offset by increased wealth

management expenses together with lower

performance-based salaries in Canada. Costs in Latin