HSBC 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

46

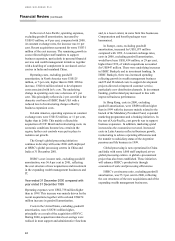

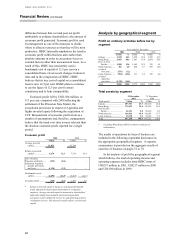

Analysis of overall tax charge

Year ended 31 December

Figures in US$m 2001 2000 1999

Taxation at UK corporate

tax rate of 30.0% (2000:30.0%

1999: 30.25%)...................... 2,400 2,932 2,415

Impact of differently taxed

overseas profits in principal

locations................................... (616) (498) (418)

Unrecognised (previously

unrecognised) tax benefits.... (499) (137) 35

Tax free gains ........................... (102) (15 )

–

Argentine losses........................ 336

–

–

Goodwill amortisatio

n

............... 263 172 11

Other items ............................... (208 ) (216) (5 )

1,574 2,238 2,038

Year ended 31 December 2001 compared with

year ended 31 December 2000

HSBC Holdings and its subsidiary undertakings in

the United Kingdom provided for UK corporation

taxation at 30 per cent, the rate for the calendar year

2001 (2000: 30 per cent). Overseas tax included

Hong Kong profits tax of US$450 million (2000:

US$478 million), provided at a rate of 16 per cent

(2000: 16 per cent) on the profits assessable in Hong

Kong. Other overseas taxation was provided for in

the countries of operation at the appropriate rates of

taxation.

HSBC’s effective tax rate of 19.7 per cent in

2001 was lower than that for 2000 (22.9 per cent)

mainly as a result of profit mix, untaxed disposal

gains and resolution of a number of tax uncertainties

allowing recognition of previously unrecognised

benefits.

As a result of changes in the UK basis of

taxation of overseas income, there was a release of

the remaining balance of a deferred tax provision

previously held in respect of additional UK tax on

profit remittances from overseas. Settlement of a

number of outstanding tax computations allowed

release of related tax contingencies including one

relating to a material capital allowance claim. In

addition, certain capital gains have been covered by

previously unrecognised capital losses, allied to the

fact that tax-free gains in Hong Kong were greater in

2001 than in 2000. North American operations

represented a lower percentage of HSBC’s profits in

2001 than in 2000. No tax relief has been assumed in

2001 for the additional general bad debt provision in

respect of Argentina.

At 31 December 2001, there were potential

future tax benefits of US$220 million (2000: US$350

million) in respect of trading losses, allowable

expenditure charged to the profit and loss account

but not yet allowable for tax and capital losses which

have not yet been recognised because realisation of

the benefits is not considered certain.

Year ended 31 December 2000 compared with

year ended 31 December 1999

HSBC Holdings and its subsidiary undertakings in

the United Kingdom provided for UK corporation

tax at 30 per cent, the rate for the calendar year 2000,

compared with 30.25 per cent in 1999. Overseas tax

included Hong Kong profits tax of US$478 million,

compared with US$367 million in 1999, provided at

a rate of 16.0 per cent for both years on the profits

assessable in Hong Kong. Other overseas taxation

was provided for in the countries of operation at the

appropriate rates of taxation.

At 31 December 2000, there were potential

future tax benefits of approximately US$350 million

compared with US$520 million at 31 December

1999, in respect of trading losses, allowable

expenditure charged to the profit and loss account

but not yet allowed for tax and capital losses which

have not been recognised because realisation of the

benefits is not considered certain.

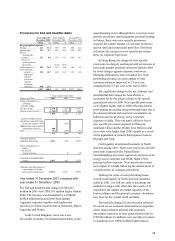

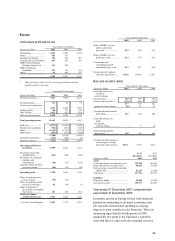

Asset deployment

At 31 December 2001 At 31 December 2000

US$m % US$

m

%

Loans and

advances to

customers......... 308,649 44.9 289,837 43.5

Loans and

advances to

b

anks................ 104,641 15.2 126,032 18.9

Debt securities...... 160,579 23.4 132,818 20.0

Treasury bills an

d

other eligible

b

ills.................. 17,971 2.6 23,131 3.5

Equity shares ........ 8,057 1.2 8,104 1.2

Intangible fixed

assets ................. 14,581 2.1 15,089 2.3

Othe

r

.................... 72,762 10.6 70,610 10.6

687,240 100.0 665,621 100.0

Hong Kong SAR

Government

certificates of

indebtedness .... 8,637 8,193

Total assets ........... 695,877 673,814

Loans and advances to

customers include:

–

reverse repos...... 14,823 12,158

– settlement

accounts ........... 11,761 6,954

Loans and advances to banks

include:

–

reverse repos...... 10,926 12,341

– settlement

accounts ........... 4,433 6,745