HSBC 2001 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

pesification of formerly US dollar denominated

assets and liabilities at differing exchange rates

destroyed capital within the banking system and in

the case of HSBC Argentina created a structured loss

of US$520 million. Discussions are taking place with

the Government of Argentina regarding

compensation for this loss but it is currently unclear

how, to what extent and in what timescale such

compensation might be delivered.

Details of HSBCs structural foreign currency

exposures are given in Note 40 in the Notes on the

Financial Statements.

Interest rate exposure

HSBCs interest rate exposures comprise those

originating in its treasury trading activities and

structural interest rate exposures; both are managed

under limits described on page 114. Interest rate risk

arises on both trading positions and accrual books.

The average daily revenues earned from

treasury-related interest rate activities for 2001 were

US$10.3 million compared with US$6.5 million for

2000. The interest rate risk on interest rate trading

positions is set out in the trading VAR table on page

115.

Structural interest rate risk

Structural interest rate risk arises from the differing

repricing characteristics of commercial banking

assets and liabilities, including non-interest bearing

liabilities such as shareholders funds and some

current accounts. Each operating entity assesses the

structural interest rate risks which arise in its

business and either transfers such risks to its local

treasury unit for management or transfers the risks to

separate books managed by the local asset and

liability management committee (ALCO). Local

ALCOs regularly monitor all such interest rate risk

positions, subject to interest rate risk limits agreed

with HSBC Holdings. In the course of managing

interest rate risk, quantitative techniques and

simulation models are used where appropriate to

identify and assess the potential net interest income

and market value effects of these interest rate

positions in different interest rate scenarios. The

primary objective of such interest rate risk

management is to limit potential adverse effects of

interest rate movements on net interest income.

Assuming no management action in response to

interest rate movements, an immediate hypothetical

100 basis points parallel fall in all yield curves

worldwide on 1 January 2002 would decrease

planned net interest income for the 12 months to 31

December 2002 by US$196 million while a

hypothetical 100 basis points parallel rise in all yield

curves would decrease planned net interest income

by US$200 million.

Rather than assuming that all interest rates move

together, HSBCs interest rate exposures can be

grouped into currency blocs whose interest rates are

considered more likely to move together. The

sensitivity of net interest income for 2002 can then

be described as follows:

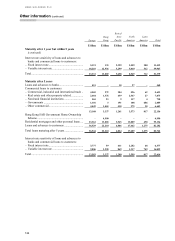

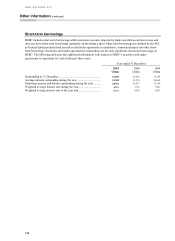

Figures in US$ m

US dollar

bloc

Sterling

bloc

Asian

bloc

Latin

American

bloc

Euro

bloc

Total

2002

Total

2001

Change in 2002 projected net interest income

+100 basis points shift in yield curves 18

(

47)

(

140)

(

1)

(

30)

(

200)(139)

−100 basis points shift in yield curves

(

165)12

(

78)530

(

196)92

The change in HSBCs sensitivity to a fall of

100 basis points is mainly because further interest

rate cuts in the US dollar and Asian blocs at 31

December 2001 would not offer scope to reduce rates

on current and savings accounts by as much as the

full 100 basis points in view of the already low rates

payable on these liabilities, so compressing the

margins on these products.

The projections assume that rates of all

maturities move by the same amount and, therefore,

do not reflect the potential impact on net interest

income of some rates changing while others remain

unchanged. The projections also make other

simplifying assumptions, including an assumption

that all positions run to maturity. In practice, these

exposures are actively managed.

Equities exposure

HSBCs equities exposure comprises trading

equities, forming the basis of VAR, and long-term

equity investments. The latter are reviewed annually

by the Group Executive Committee and regularly