HSBC 2001 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

263

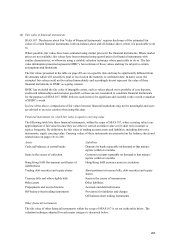

(j) Investment securities

Under UK GAAP, debt securities and equity shares intended to be held on a continuing basis are classified as

investment securities and are included in the balance sheet at cost less provision for any permanent diminution

in value. Other participating interests are accounted for on the same basis. Where dated investment securities

have been purchased at a premium or discount, these premiums and discounts are amortised through the profit

and loss account over the period from the date of purchase to the date of maturity and included in ‘interest

income’ . These securities are included in the balance sheet at cost adjusted for the amortisation of premium and

discounts arising on acquisition. Any profit or loss on realisation of these securities is recognised in the profit

and loss account as it arises and included in ‘Gains on disposal of investments’ .

Other debt securities and equity shares are included in the balance sheet at market value. Changes in the market

value of such assets are recognised in the profit and loss account as ‘Dealing profits’ as they arise. Debt

securities and listed equity shares which were acquired in exchange for advances in order to achieve an orderly

realisation continue to be reported as advances under UK GAAP.

Under SFAS 115 ‘Accounting for Certain Investments in Debt and Equity Securities’ , all the above debt

securities and equity shares, with the exception of equity investments without a readily determinable market

value, are classified and disclosed within one of the following three categories: held-to-maturity; available-for-

sale; or trading. Held-to-maturity securities are measured at amortised cost less provision for any permanent

diminution in value. Available-for-sale securities are measured at fair value with unrealised holding gains and

losses excluded from earnings and reported net of applicable taxes and minority interests in a separate

component of shareholders’ funds. Provisions for permanent diminution in value of available-for-sale securities

are recognised in earnings. Trading securities are measured at fair value with unrealised holding gains and

losses included in earnings.

Under US GAAP, HSBC’ s investment securities, other participating interests and debt securities and equity

shares with a readily determinable market value acquired in exchange for advances are classified as available-

for-sale securities except for certain securities held by RNYC at acquisition which were classified as held-to-

maturity. All other debt and equity shares are categorised as trading securities.

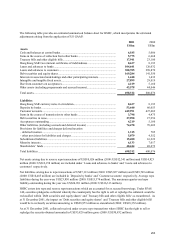

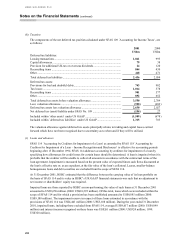

The book and market values of these debt securities and equity shares with a readily determinable market value

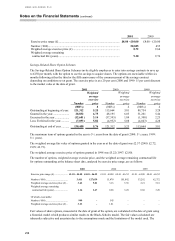

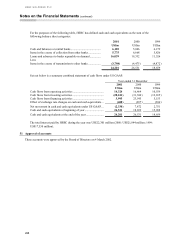

are analysed as follows:

2001 2000

Book value Marke

t

valuation Book value Market

valuation

US$m US$m US$m US$m

Trading............................................................ 75,684 75,684 56,599 56,599

Available-for-sale ........................................... 103,557 104,873 100,560 101,876

Held-to-maturity ............................................. 4,703 4,866 4,438 4,604

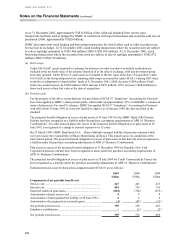

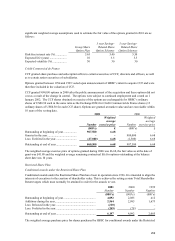

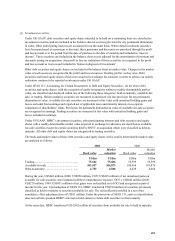

During the year, US$442 million (2000: US$850 million, 1999: US$425 million) of net unrealised gains on

available for sale securities were included in Other Comprehensive Income (‘OCI’ ). US$442 million (2000:

US$270 million, 1999: US$431 million) of net gains were reclassified out of OCI and recognised as part of

income for the year. Upon adoption of SFAS 133, HSBC transferred US$190 million of securities previously

classified as held to maturity to securities available for sale. The reclassification resulted in a net of tax

cumulative effect adjustment loss of US$11 million. Under the provisions of SFAS 133, such a reclassification

does not call into question HSBC’ s interest to hold current or future debt securities to their maturity.

At the same date, HSBC transferred US$1,042 million of securities from available for sale to held to maturity.