HSBC 2001 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.167

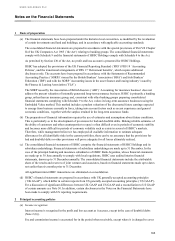

Loans on which interest is being suspended

Provided that there is a realistic prospect of interest being paid at some future date, interest on non-performing

loans is charged to the customer’ s account. However, the interest is not credited to the profit and loss account

but to an interest suspense account in the balance sheet which is netted against the relevant loan. On receipt of

cash (other than from the realisation of security), suspended interest is recovered and taken to the profit and loss

account. A specific provision of the same amount as the interest receipt is then raised against the principal

balance. Amounts received from the realisation of security are applied to the repayment of outstanding

indebtedness, with any surplus used to recover any specific provisions and then suspended interest.

Non-accrual loans

Where the probability of receiving interest payments is remote, interest is no longer accrued and any suspended

interest balance is written off.

Loans are not reclassified as accruing until interest and principal payments are up-to-date and future payments

are reasonably assured.

Assets acquired in exchange for advances in order to achieve an orderly realisation continue to be reported as

advances. The asset acquired is recorded at the carrying value of the advance disposed of at the date of the

exchange and provisions are based on any subsequent deterioration in its value.

(c) Treasury bills, debt securities and equity shares

Treasury bills, debt securities and equity shares intended to be held on a continuing basis are disclosed as

investment securities and are included in the balance sheet at cost less provision for any permanent diminution

in value.

Where dated investment securities have been purchased at a premium or discount, these premiums and

discounts are amortised through the profit and loss account over the period from the date of purchase to the date

of maturity so as to give a constant rate of return. If the maturity is at the borrowers’ option within a specified

range of years, the maturity date which gives the more conservative result is adopted. These securities are

included in the balance sheet at cost adjusted for the amortisation of premiums and discounts arising on

acquisition. The amortisation of premiums and discounts is included in ‘Interest receivable’ . Any profit or loss

on realisation of these securities is recognised in the profit and loss account as it arises and included in ‘Gains

on disposal of investments’ .

Debt securities held for the purpose of hedging are valued on the same basis as the liabilities which are being

hedged.

Other treasury bills, debt securities, equity shares and short positions in securities are included in the balance

sheet at market value. Changes in the market value of such assets and liabilities are recognised in the profit and

loss account as ‘Dealing profits’ as they arise. For liquid portfolios market values are determined by reference to

independently sourced mid-market prices. In certain less liquid portfolios securities are valued by reference to

bid or offer prices as appropriate. Where independent prices are not available, market values may be determined

by discounting the expected future cash flows using an appropriate interest rate adjusted for the credit risk of the

counterparty. In addition, adjustments are made for illiquid positions where appropriate.

Where securities are sold subject to a commitment to repurchase them at a predetermined price, they remain on

the balance sheet and a liability is recorded in respect of the consideration received. Conversely, securities

purchased under analogous commitments to resell are not recognised on the balance sheet and the consideration

paid is recorded in ‘Loans and advances to banks’ or ‘Loans and advances to customers’ .