HSBC 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

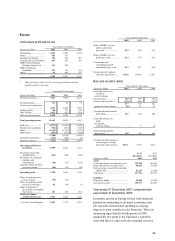

47

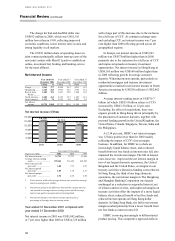

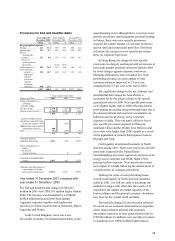

Assets 2001 (excluding Hong Kong Government

certificates of indebtedness)

%US$bn

Treasury and other

eligible bills 2.6 18.0

Debt securities 23.4 160.6

Loans and advances

to banks 15.2 104.6

Loans and advances

to customers 44.9 308.6

Other 13.9 95.4

Total 100.0 687.2

Assets 2000 (excluding Hong Kong Government

certificates of indebtedness)

%US$bn

Treasury and other

eligible bills 3.5 23.1

Debt securities 20.0 132.8

Loans and advances

to banks 18.9 126

Loans and advances

to customers 43.5 289.8

Other 14.1 93.9

Total 100.0 665.6

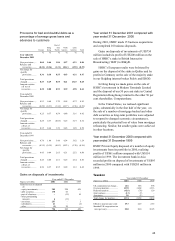

31 December 2001 compared with 31

December 2000

HSBC’s total assets at 31 December 2001 were

US$696 billion, an increase of US$22 billion, or 3

per cent, since 31 December 2000; at constant

exchange rates, the increase was US$39 billion, or 6

per cent. The growth attributable to acquisitions was

US$7 billion.

HSBC’s balance sheet remained highly liquid,

reflecting further strong growth in customer deposits

and limited credit demand in some countries.

Approximately 45 per cent of the balance sheet was

deployed in customer loans and advances which was

one per cent higher than at 31 December 2000.

At constant exchange rates, gross loans and

advances to customers (excluding loans to the

financial sector) at 31 December 2001 were US$16

billion, or 6 per cent, higher than at 31 December

2000. Personal lending grew by 10 per cent and

constituted 39 per cent of gross customer lending at

31 December 2001, compared with 39 per cent at 31

December 2000. This reflected the acquisitions of

Banque Hervet and NRMA Building Society as well

as strong organic growth in the UK, United States,

Malaysia, Taiwan, Korea and India. Loans and

advances to the commercial and corporate customer

base (excluding Governments) grew by 2 per cent

reflecting muted loan demand from this sector.

At 31 December 2001, assets held by the Group

as custodian amounted to US$1,300 billion. Custody

is the safe-keeping and administration of securities

and financial instruments on behalf of others. Funds

under management amounted to US$284 billion at

31 December 2001.

Debt securities and equity shares

Debt securities held in the accruals book at 31

December 2001 showed an unrecognised gain, net of

off-balance-sheet hedges, of US$885 million

compared with an unrecognised gain of US$711

million at 31 December 2000. Equity shares included

US$4,755 million held on investment account,

compared with US$4,638 million at 31 December

2000, on which there was an unrecognised gain of

US$539 million compared with US$1,135 million at

31 December 2000.

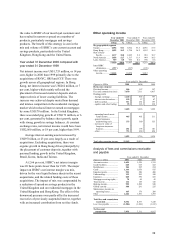

Funds under management

Funds under management of US$284 billion were

US$11 billion, or 4 per cent, lower than at 31

December 2000.

During the year, both our asset management and

private banking businesses attracted net funds

inflows. However, the sale of specialised CCF fund

managing businesses, the fall in global equity

markets and the impact of the continued

strengthening of the US dollar on our sterling and

euro denominated funds, have resulted in a fall in the

value of funds under management.

Funds under management US$bn

At 1 January 2001 ................................................................ 295

Additions ............................................................................. 79

Withdrawals......................................................................... (51 )

Value change........................................................................ (25)

Exchange and othe

r

.............................................................. (14 )

At 31 December 2001 .......................................................... 284

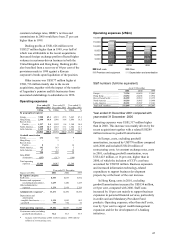

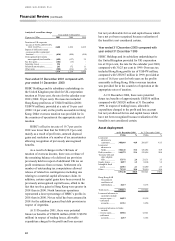

Economic profit

HSBC’s internal performance measures include

economic profit, a measure which compares the

return on the amount of capital invested in HSBC by

its shareholders with the cost of that capital. HSBC

prices that cost of capital internally and the