HSBC 2001 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

222

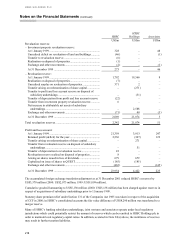

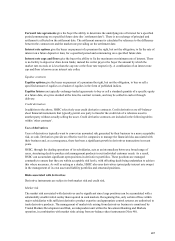

Credit risk

Unlike assets recorded on the balance sheet, where the credit risk is typically the full amount of the principal

value, together with any unrealised interest accrued or mark-to-market gain (Note 14), the credit risk relative to

a derivative is principally the replacement cost of any contract with a positive mark-to-market gain and an

estimate for the potential future change in value, reflecting the volatilities affecting the contract. Credit risk on

contracts having a negative mark-to-market value is restricted to the potential future change in value. Credit risk

on derivatives is, therefore, small in relation to a comparable balance sheet risk. In addition, credit exposure

with individual counterparties can be reduced by the receipt of collateral and close-out netting agreements

which allow for positive and negative mark-to-market values on different transactions to be offset and settled by

a single payment in the event of default by either party. Such agreements are enforceable in the jurisdictions of

the major market makers and HSBC has executed close-out netting agreements with the majority of its

counterparties, notwithstanding the fact that HSBC deals only with the most creditworthy counterparties.

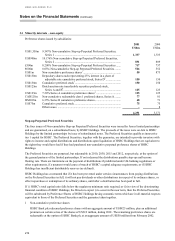

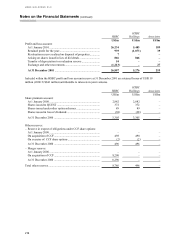

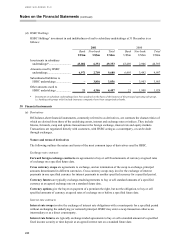

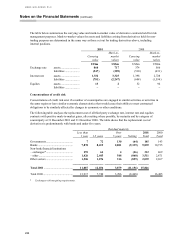

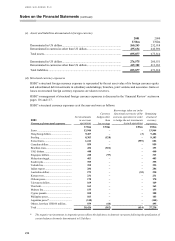

Derivatives used for trading purposes

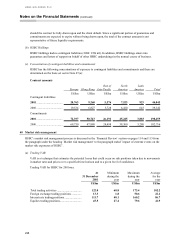

The following tables summarise the contract amount, replacement cost, mark-to-market values and average

mark-to-market values of third party and internal trading derivatives by product type. The replacement cost

shown is the positive mark-to-market value and represents the accounting loss HSBC would incur if the

counterparty to a derivative contract failed to perform according to the terms of the contract and the collateral, if

any, for the amount due proved to be of no value.

The notional or contractual amounts of these instruments indicate the volume of transactions outstanding at the

balance sheet date; they do not represent amounts at risk.

Because all derivative instruments used for trading purposes are marked to market, carrying values are equal to

mark-to-market values. Mark-to-market values are determined by reference to market rates prevailing on the

date of valuation or by discounting future cash flows and include netted internal positions, except where

otherwise indicated.

2001 2000

Contrac

t

amoun

t

R

eplacemen

t

cos

t

*

Contrac

t

amoun

t

R

eplacemen

t

cos

t

*

US$m US$m US$m US$m

Spot and forward foreign exchange ........... 685,674 7,770 644,169 10,149

Currency swaps, futures and options

purchased ............................................... 127,120 3,045 90,278 2,342

Currency options written ........................... 36,087

–

21,165

–

Other contracts........................................... 7,530 104 3,935 108

Total exchange rate contracts..................... 856,411 10,919 759,547 12,599

Interest rate swaps...................................... 1,013,807 12,703 839,671 8,748

Interest rate futures, forward rate

agreements, collars and options

purchased ............................................... 408,758 1,261 363,737 863

Interest rate options written ....................... 87,245

–

63,037

–

Total interest rate contracts........................ 1,509,810 13,964 1,266,445 9,611

Equities, futures and options purchased..... 18,583 1,309 22,203 2,094

Equities options written ............................. 16,235

–

20,920

–

Other contracts........................................... 5,442 197 2,361 51

Total equities contracts .............................. 40,260 1,506 45,484 2,145

Netting ....................................................... (11,156) (8,468)

Total........................................................... 2,406,481 15,233 2,071,476 15,887

*Third party contracts only