HSBC 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

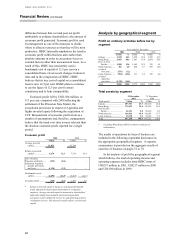

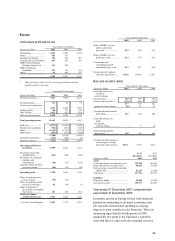

rates, cash earnings were US$925 million higher

than 1999, of which CCF contributed US$169

million, HSBC Republic Suisse, US$290 million and

RNYC and SRH, US$197 million. The following

commentary on Europe's results is based on constant

exchange rates.

Net interest income was US$1,040 million, or 26

per cent, higher at US$4,998 million of which some

US$800 million was attributable to the recent

acquisitions. The underlying increase was principally

attributable to growth in UK Banking and income

earned on funds raised in anticipation of the CCF

acquisition, together with smaller increases in

Offshore Banking and Turkey, the latter due to

increased spreads reflecting local market conditions.

These increases were partly offset by a US$147

million, or 40 per cent, decrease in Treasury and

Capital Markets’ money market business caused by a

flattening of the yield curve and higher short-term

funding costs, together with the maturing of high

yielding assets.

In UK Banking, net interest income at US$3,222

million was 6 per cent higher than 1999 reflecting

balance growth in personal and commercial current

accounts, personal savings and personal and

commercial lending. HSBC Bank plc’s repricing of

variable rate mortgages contributed to mortgage

growth of US$1.7 billion, with a decline in mortgage

spread. Spread was also reduced on savings products

reflecting competitive pricing. The effect on UK

Banking’s margin of the reduction in spread was

partly mitigated by a greater benefit from free funds.

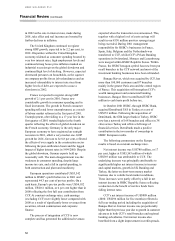

Other operating income was US$1,335 million,

or 29 per cent, higher than in 1999 of which recent

acquisitions accounted for some US$750 million.

The underlying increase reflected growth in UK

Banking, Treasury and Capital Markets and

Investment Banking, together with smaller increases

in Offshore Banking, due to the successful launches

of funds products, and HSBC Trinkaus & Burkhardt

KGaA largely due to increased commission income

on equity transactions.

In UK Banking, other operating income at

US$3,001 million was 8 per cent higher than 1999,

primarily reflecting growth in wealth management

income and higher fee income from cards, corporate

banking and global safe custody fees. Wealth

management income showed a significant increase

compared with 1999, up 14 per cent, from US$673

million to US$764 million. Within this, general

insurance income increased by 7 per cent and private

client income by 18 per cent. Life, pension and

investment income increased by US$56 million, or

16 per cent, of which US$15 million was the benefit

of a reduction in the discount rate, used to calculate

the net present value of future earnings inherent in

policies in force, from 12.5 per cent to 11.5 per cent.

Global safe custody fee income increased by 36 per

cent compared with 1999, benefiting from high

transaction volumes in 2000, the acquisition of new

customers and growth in assets under custody.

Higher fee and other income was also generated by

growth in personal current account and overdraft

fees, increased card income and higher corporate

banking fee income, mainly due to HSBC Bank plc’s

involvement in a buoyant mergers and acquisitions

market.

In Treasury and Capital Markets, other operating

income was US$386 million, 61 per cent higher than

1999. Foreign exchange income increased by 45 per

cent reflecting higher volumes, particularly in respect

of customer activities. Much of this was realised

from an increase in business in the regional treasury

centres, where income increased by 40 per cent.

Fixed income results also improved notably in gilts

and derivatives activity, linking with an increase in

debt origination. The currency options business also

expanded during 2000 with an increased presence in

the euro zone following the absorption of RNYC’s

trading activities.

In Investment Banking, there were higher equity

commissions reflecting increased global equity

volumes. Fee income also rose, reflecting growth in

Corporate Finance where business transacted with

HSBC's corporate client base increased significantly.

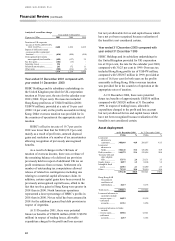

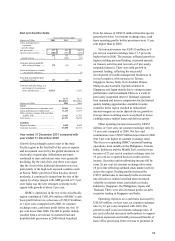

Operating expenses, excluding goodwill

amortisation, were US$1,073 million, or 20 per cent,

higher than in 1999 of which some US$947 million

was due to the recent acquisitions.

In UK Banking, operating expenses increased by

US$258 million, or 8 per cent, to US$3,510 million

and the cost:income ratio remained at 56.4 per cent.

Staff costs increased by US$127 million, or 7 per

cent, to US$1,935 million, reflecting growth in staff

numbers to support growth in the wealth

management business and increased business

volumes, in addition to the effect of annual pay

increases and incentive costs. Additional IT staff

have supported development projects integral to the

continued improvement in customer service,