HSBC 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

72

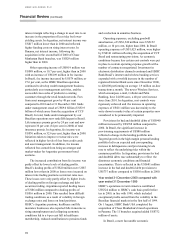

of Banco CCF Brasil SA (‘CCF Brasil’ ). Funds

under management stood at US$10.8 billion as at

December 2000, compared with US$4.1 billion as at

the end of 1999. CCF Brasil contributed US$5.6

billion of this increase. In total, funds under

management by our Brazilian operations now rank

fourth largest in Brazil, as at June 2000, compared to

tenth at December 1999.

Operating expenses at US$1,648 million in 2000

were US$198 million higher than in 1999. Operating

expenses in Brazil were US$56 million higher than

in 1999. Cost increases reflected business growth

and restructuring to achieve operating efficiencies

and integrate CCF Brasil with HSBC’s existing

operations in Brazil. In Argentina, expenses rose by

US$55 million to US$445 million. Staff costs grew

by US$48 million as a result of a higher headcount

and an increase in average salaries and bonuses.

Controls were put in place to restrain operating

expense growth with a number of contracts

renegotiated in areas such as communications and

mailing and marketing campaigns. These initiatives

together with other one off impacts partially offset

the higher staff costs. The cost:income ratio

improved slightly to 73 per cent.

Provisions for bad and doubtful debts increased

by US$71 million compared with 1999. In Brazil,

there was a significant increase in provisioning

requirements in the second half of the year reflecting

changes in asset mix. Strong growth in the consumer

book brought with it a corresponding increase in

delinquencies and provisioning levels rose to reflect

the underlying risks within the consumer portfolio.

Provisioning on consumer lending was adequately

covered by the interest revenue earned on these

products and it is HSBC policy to make a full

provision for delinquent consumer credit after 180

days. In Argentina, provisions for bad and doubtful

debts in 2000 of US$56 million represented 2.1 per

cent of average loans and advances to customers and

were US$18 million lower than 1999 although still

impacted by the weak economic environment. Non-

performing loans at US$579 million were US$215

million higher than December 1999 reflecting the

weak economy.

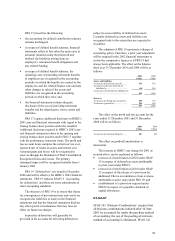

Consistent with HSBC’s strong focus on capital

management, Brazil paid dividends and capital

repatriations of US$179 million during the year,

bringing total dividends and remitted capital since

December 1998 to US$373 million.

CCF Brasil made a small contribution to HSBC

pre-tax profits.

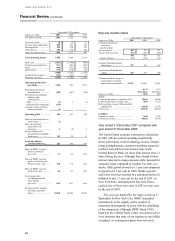

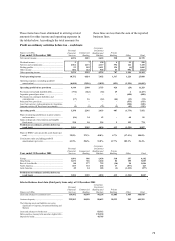

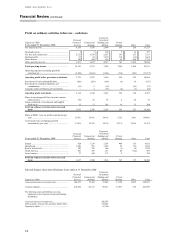

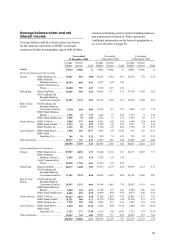

Analysis by line of business

The data presented on pages 73 and 74 reflects an

analysis of HSBC’s results and of certain key

balance sheet amounts, according to the lines of

business described on pages 20 to 24. This provides

additional and complementary analysis to HSBC’s

segmental reporting by geographic region.

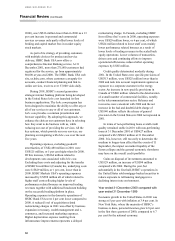

The results are presented in accordance with the

accounting policies used in the preparation of

HSBC’s consolidated financial statements. HSBC’s

operations are closely integrated and, accordingly,

the presentation of line of business data includes

internal allocations of certain items of income and

expenses. These allocations include the costs of

certain support services and head office functions, to

the extent that these can be meaningfully attributed

to operational business lines. While such allocations

have been made on a systematic basis they

necessarily involve a degree of subjectivity.

Where relevant, income and expense amounts

presented include the results of inter-company and

inter-business line transactions. Such transactions are

generally undertaken on arm’s-length terms. Inter-

business line funding and placement of surplus funds

is generally undertaken at market interest rates.The

reported results of each line of business include the

funding benefit of the shareholders’ funds allocated

to that business. Shareholders’ funds are generally

allocated to lines of business on the basis of

economic capital measures including the relative risk

weighted assets of each operation.

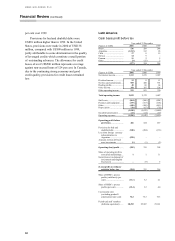

Key balance sheet data is presented below.

Comparative data for line of business reporting

is presented for 2000 only, as it is not practicable to

produce this data for 1999. The data previously

presented analysing HSBC’s performance between

commercial and investment banking is no longer

presented, as this does not reflect the way that HSBC

now analyses its business.

In the analysis of profit by line of business

which follows, total operating income and operating

expenses include intra-HSBC items of US$1,083

million in 2001 and US$940 million in 2000. These

amounts represent the other operating income and

expenses arising from inter-company transactions

within and between HSBC’s geographic regions.