HSBC 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

38

The charge for bad and doubtful debts was

US$932 million in 2000, which was US$1,141

million lower than in 1999, reflecting improved

economic conditions, lower interest rates in Asia and

strong liquidity in all markets.

The US$51 million share of operating losses in

joint ventures principally reflects start-up costs of the

new joint venture with Merrill Lynch to establish an

online, investment led, broking and banking service

for the mass affluent.

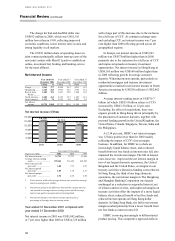

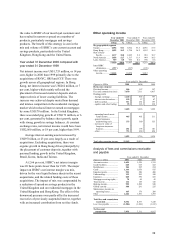

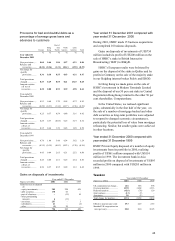

Net interest income

Year ended 31

December 2001

Year ended 31

December 2000

Year ended 31

December 1999

US$m % US$

m

%US$

m

%

Europe ............... 5,563 37.7 4,988 36.3 4,231 35.3

Hong Kong ........ 4,165 28.3 3,997 29.1 3,735 31.2

Rest of Asia-

Pacific ...........

1,482 10.1 1,367 10.0 1,240 10.3

North America ... 2,402 16.3 2,152 15.7 1,687 14.1

Latin America .... 1,113 7.6 1,219 8.9 1,097 9.1

Net interest

income........... 14,725 100.0 13,723 100.0 11,990 100.0

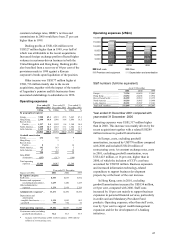

Net interest income (US$m)

Year ended 31 December

Figures in US$m 2001 2000 1999

Net interest income ............... 14,725 13,723 11,990

Average interest-earning

assets................................ 579,665 516,185 419,225

Gross interest yield

(per cent)1 ........................ 6.08 7.31 6.97

Net interest spread

(per cent) 2 ........................ 2.09 2.10 2.31

Net interest margin

(per cent)3 ........................ 2.54 2.66 2.86

1Gross interest yield is the average interest rate earned on average

interest-earning assets (AIEA).

2Net interest spread is the difference between the average interest

rate earned on average interest-earning assets and the average

interest rate paid on average interest-bearing funds.

3Net interest margin is net interest income expressed as a

percentage of average interest-earning assets.

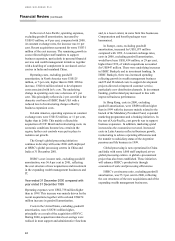

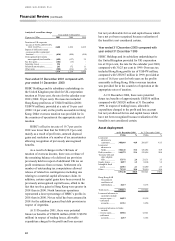

Year ended 31 December 2001 compared with

year ended 31 December 2000

Net interest income in 2001 was US$1,002 million,

or 7 per cent, higher than 2000 at US$14,725 million

with a large part of this increase due to the inclusion

for a full year of CCF. At constant exchange rates

and excluding CCF, net interest income was 7 per

cent higher than 2000 reflecting growth across all

geographical regions.

In Europe, net interest income at US$5,563

million was US$575million higher than in 2000

primarily due to the inclusion for a full year of CCF

and improved spreads on treasury investment

opportunities. Net interest income in Hong Kong at

US$4,165 million was US$168 million higher than

in 2000 reflecting growth in average customer

deposits. Widening interest spreads, particularly on

residential mortgages and treasury investment

opportunities resulted in net interest income in North

America increasing by US$250 million to US$2,402

million.

Average interest-earning assets at US$579.7

billion (of which US$55.4 billion relates to CCF)

increased by US$63.5 billion, or 12 per cent.

Excluding the effect of acquisitions, there was

organic growth in Hong Kong driven principally by

the placement of customer deposits, together with

personal lending growth in the United Kingdom, the

United States, Canada, Singapore, Taiwan, India and

the Philippines.

At 2.54 per cent, HSBC’s net interest margin

was 12 basis points lower than for 2000 mainly

reflecting the impact of CCF’s lower margin

business. In addition, for HSBC as a whole an

increasingly liquid balance sheet, and a reduced

benefit from net free funds as interest rates fell, also

impacted the net interest margin. The fall in interest

rates, however, improved the net interest margin in

two of our largest domestic operations, the United

Kingdom and the United States, as margins in our

treasury activities widened as funding costs reduced.

In Hong Kong, the third of our large domestic

operations, the net interest margin in The Hongkong

and Shanghai Banking Corporation was largely

unchanged as a reduction in suspended interest, net

of releases and recoveries, and improved margins on

treasury activities offset the impacts of a more liquid

balance sheet, reduced benefit of net free funds and

reduced interest spreads on Hong Kong dollar

deposits. In Hang Seng Bank, the fall in net interest

margin resulted primarily from a lower benefit from

net free funds as interest rates fell.

HSBC is moving increasingly to differentiated

product pricing. This competitive approach reflects

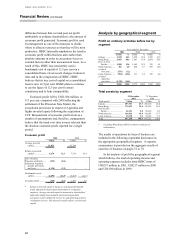

14,725 13,723

11,990

0

3,000

6,000

9,000

12,000

15,000

18,000

2001 2000 1999