HSBC 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC Holdings plc Annual Report

and Accounts

Table of contents

-

Page 1

HSBC Holdings plc Annual Report and Accounts -

Page 2

... Securities and Exchange Commission ('SEC' ) for HSBC Holdings plc and its subsidiary and associated undertakings. It contains the Directors' Report and Financial Statements, together with the Auditors' Report thereon, as required by the UK Companies Act 1985. The Annual Review 2001 of HSBC Holdings... -

Page 3

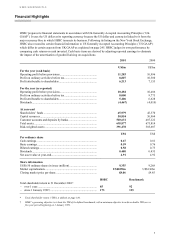

......For the year (as reported) Operating profit before provisions ...Profit on ordinary activities before tax...Profit attributable to shareholders ...Dividends...At year-end Shareholders' funds ...Capital resources...Customer accounts and deposits by banks ...Total assets...Risk-weighted assets...11... -

Page 4

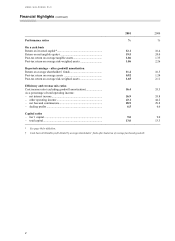

HSBC HOLDINGS PLC Financial Highlights (continued) 2001 Performance ratios On a cash basis Return on invested capital*...Return on net tangible equity†...Post-tax return on average tangible assets...Post-tax return on average risk-weighted assets ...Reported earnings - after goodwill ... -

Page 5

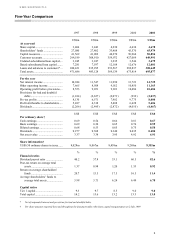

......Customer accounts...Undated subordinated loan capital ...Dated subordinated loan capital...Loans and advances to customers* ...Total assets...For the year Net interest income ...Other operating income...Operating profit before provisions ...Provisions for bad and doubtful debts...Pre-tax profits... -

Page 6

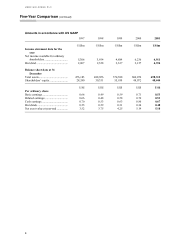

HSBC HOLDINGS PLC Five-Year Comparison (continued) Amounts in accordance with US GAAP 1997 US$m Income statement data for the year Net income available for ordinary shareholders ...Dividend ...Balance sheet data at 31 December Total assets...Shareholders' equity ...1998 US$m 1999 US$m 2000 US$m ... -

Page 7

... operates; increased competition resulting from legislation permitting new types of affiliations between banks and financial services companies, including securities firms, particularly in the United States; expropriation, nationalisation, confiscation of assets and changes in legislation relating... -

Page 8

... unenforceable in the United Kingdom. Exchange Controls and Other Limitations Affecting Security Holders There are currently no UK laws, decrees or regulations which would prevent the transfer of capital or remittance of dividends and other payments to holders of HSBC Holdings' securities who are... -

Page 9

... customer needs. In addition, in certain key locations - London, Hong Kong, New York, Geneva, Paris and Düsseldorf - HSBC has significant investment and private banking operations which, together with its commercial banks, enable HSBC to service the full range of requirements of its high net worth... -

Page 10

... customers worldwide have available to them a dedicated team of relationship managers, HSBC Premier centres in selected locations around the world, and 24-hour call centre support. To further service its high net worth customers, HSBC has successfully integrated its major private banking operations... -

Page 11

... of the United Kingdom' s principal clearing banks. In 1991, HSBC Holdings plc was established as the parent company of HSBC and, in 1992, HSBC Holdings purchased the remaining interests in Midland. In connection with this acquisition, HSBC' s head office was transferred from Hong Kong to London in... -

Page 12

... Development Capital Holdings Limited ('CDC' ), the management company for the Charterhouse venture capital funds, was sold to the existing CDC management team. In August 2001, HSBC completed its acquisition of a 97 per cent interest in China Securities Investment Trust Corporation ('CSIT... -

Page 13

... various components. International Managers, a group of approximately 400 mobile executives with wide international experience and committed to long-term careers overseas within HSBC, are key to this integration process. E-banking In recent years, HSBC has been reconfiguring its operations for the... -

Page 14

...HSBC Private Banking Holdings (Suisse) S.A. HSBC Bank plc In the United Kingdom, HSBC Bank plc provides a comprehensive range of banking and related financial services to personal, commercial and corporate customers. Headquartered in London, HSBC Bank plc has over 6 million personal current accounts... -

Page 15

... links customer savings, cheque and home loan accounts. HSBC Bank plc's commercial banking operation offers an extensive range of services including current accounts, deposits, lending, asset finance and leasing, trade services, equity finance, cross-border payments and cash management. The bank... -

Page 16

... stock custody services to the 50 largest French institutional and corporate groups and to international clients. The Corporate Banking division is very active in providing trade financing, export credit facilities and financing backed by public and private sector credit support. CCF provides equity... -

Page 17

... HSBC name, has a network of 168 branches and offices in 38 cities providing personal, corporate, treasury, capital markets, stockbroking, fund management and investment banking services across the Turkish market, through a multi-channel delivery system including the internet, ATMs and call centres... -

Page 18

... sales of unit trusts with the promotion of 13 guaranteed/capital-secured funds designed to meet customers' demands to protect their investment capital but maximise their potential return in the low interest rate environment. Insurance business is a key focus in HSBC's wealth management strategy... -

Page 19

... banking services in mainland China is planned. Hang Seng Securities Limited has submitted applications for the purpose of obtaining B share-trading seats on the Shanghai and Shenzhen stock exchanges and setting up a representative office in Shanghai. HSBC' s strategy elsewhere in Asia-Pacific... -

Page 20

... customers. HSBC Bank USA is engaged in general commercial banking business, offering a full range of banking products and services to individuals, including high-net-worth individuals, corporations, institutions and governments. Through HSBC Bank USA, HSBC has the largest branch network in New York... -

Page 21

..., funds management and leasing services. HSBC operates the eighth-largest insurance business in Brazil, offering life, auto, property, casualty and health insurance. As part of HSBC's overall cross-selling strategy, the staff of HSBC Bank Brasil' s insurance and banking offices are being located... -

Page 22

... banking and related financial services to its personal customers. Principal products and services for personal customers include current chequing and savings accounts, loans and home finance, cards, insurance and investment services, including securities trading. Services are increasingly delivered... -

Page 23

... 130 years of trade services experience and expertise. This core business is supported by HSBC' s branch network throughout the Asia-Pacific region, Europe, the Americas and the Middle East, making HSBC one of the world's largest trade finance and services organisations. Offering a complete range... -

Page 24

... HSBC' s treasury and capital markets businesses, investment banking, merchant banking, private banking, asset management and private equity operations. The business employs more than 17,000 staff and has offices in 55 countries with principal dealing rooms located in London, New York, the Hong Kong... -

Page 25

... with mergers and acquisitions, asset disposal, equity capital, stock exchange listings, privatisation and capital restructuring. In addition to a wide variety of equity research, sales and trading services available to institutional, corporate and retail clients, HSBC's investment banking business... -

Page 26

... banks capable of competing directly with HSBC in an increasing number of markets worldwide in which previously only HSBC and a few other global banks offered the full range of banking services. Limited market growth In HSBC' s key markets, the United Kingdom, France, the United States and Hong Kong... -

Page 27

... typically focused on trade finance and servicing branches of multinational companies. Nevertheless, foreign banks can attract a disproportionate share of high net-worth and professional customers due to their extensive range of services, international connections, advanced technology and financial... -

Page 28

... United Kingdom, Hong Kong, the United States and France. The UK Financial Services Authority ('FSA' ) supervises HSBC on a consolidated basis. Additionally, each operating bank within HSBC is regulated by local supervisors. Thus, The Hongkong and Shanghai Banking Corporation Limited and Employees... -

Page 29

... Regulatory Organisation, which regulated HSBC Bank plc' s collective investment scheme trusteeship activities. From N2, the FSA assumed responsibility for regulating all investment business in the UK from retail life and pensions business to custody, branch share dealing and treasury and capital... -

Page 30

... returns and other information and establishes certain minimum standards and ratios relating to capital adequacy (see below), liquidity, capitalisation, limitations on shareholdings, exposure to any one customer, unsecured advances to persons affiliated with the bank and holdings of interests in... -

Page 31

... holds direct or indirect investments. HSBC is generally prohibited from acquiring, directly or indirectly, ownership or control of more than 5 per cent of the voting shares of any company engaged in the United States in activities other than banking and certain activities closely related to banking... -

Page 32

... the capital adequacy requirements applicable to intermediate bank holding companies owned and controlled by a financial holding company. HSBC Bank USA, like other FDIC-insured banks, is required to pay assessments to the FDIC for deposit insurance under the FDIC' s Bank Insurance Fund (calculated... -

Page 33

...minimum capital ratio requirements, equity and permanent resources (certain long-term assets denominated in euros) ratios, risk diversification and liquidity, as well as monetary policy, restrictions on equity investments and reporting requirements. CCF' s commercial banking operations in France are... -

Page 34

... number of employees, client accounts and branches. All credit institutions operating in France are required by law to operate a deposit guarantee mechanism for customers of commercial banks, except branches of European Economic Area banks which are covered by their home country' s guarantee system... -

Page 35

..., HSBC Bank plc, a subsidiary of HSBC Holdings, entered into an agreement to lease a building being developed by Canary Wharf Limited. The construction of the building has been completed. This building, located at Canary Wharf, London, will accommodate under one roof approximately 8,500 staff from... -

Page 36

..., 2001, HSBC USA Inc. announced that it had settled civil law suits brought by 51 of the 53 Japanese plaintiffs who have asserted claims arising from the involvement of its subsidiary, Republic New York Securities Corporation ('RNYSC' ), with its customers Princeton Global Management Ltd. and... -

Page 37

...; Hong Kong; Rest of Asia-Pacific, including the Middle East and Africa; North America; and Latin America. Each of these businesses operates domestic banking operations in its region providing services to personal, commercial and corporate customers. In key locations including London, New York, Hong... -

Page 38

... on certain banking activities, as well as make more general changes in governmental policy, which may significantly impact HSBC by reducing available business opportunities, increasing HSBC's cost of compliance and, in some markets where HSBC operates, eroding investor confidence. HSBC has economic... -

Page 39

... Lynch HSBC, now operational in the UK, Canada and Australia. The charge for amounts written-off fixed asset investments arose mainly from venture capital investments and holdings of emerging technology stocks. Gains on disposal of investments of US$754 million included profit on the sale of HSBC... -

Page 40

..., reduced benefit of net free funds and reduced interest spreads on Hong Kong dollar deposits. In Hang Seng Bank, the fall in net interest margin resulted primarily from a lower benefit from net free funds as interest rates fell. HSBC is moving increasingly to differentiated product pricing. This... -

Page 41

...to HSBC of our most loyal customers and has resulted in narrower spread on a number of products, particularly mortgages and savings products. The benefit of this strategy is seen in the mix and volume of HSBC' s core current account and savings products, particularly in the United Kingdom, Hong Kong... -

Page 42

...As part of HSBC's competitive positioning and consistent with the pricing changes on loan and deposit products referred to above, our customers also benefited from a number of fee reductions during 2001, particularly in HSBC Bank plc' s UK Banking. In the United Kingdom, eliminating mortgage loan to... -

Page 43

.... Increased foreign exchange profits reflected higher volumes in customer-driven business in both the United Kingdom and Hong Kong. Dealing profits also benefited from a recovery of 69 per cent of the provisions made in 1999 against a Korean corporate' s bonds upon liquidation of the position... -

Page 44

... accounted for US$947 million. There were underlying increases in HSBC Bank plc and in investment banking. In HSBC Bank plc, there was increased spending reflecting growth in wealth management business and IT and IT-related costs to support development projects directed at improved customer service... -

Page 45

... to an energy sector corporate and HSBC Bank USA's principal airline exposure. New specific provisions were higher in Canada following the deterioration of a small number of commercial facilities. Although in terms of non-performing loans, overall credit quality in North America remained stable... -

Page 46

...provisions for other personal lending and corporate accounts. Delinquency rates for residential mortgages remained low. Non-performing customer advances decreased in the rest of Asia-Pacific due to a combination of write-offs, credit upgrades and recoveries. The net charge for bad and doubtful debts... -

Page 47

... to customers Hong Kong Rest of Asia North Pacific America Latin America Year ended 31 December 2001 compared with year ended 31 December 2000 During 2001, HSBC made 15 business acquisitions and completed 10 business disposals. Total Europe % Year ended 31 December 2001 New provisions...Releases... -

Page 48

HSBC HOLDINGS PLC Financial Review (continued) Analysis of overall tax charge Figures in US$m Taxation at UK corporate tax rate of 30.0% (2000:30.0% 1999: 30.25%)...Impact of differently taxed overseas profits in principal locations...Unrecognised (previously unrecognised) tax benefits ...Tax ... -

Page 49

... the year, both our asset management and private banking businesses attracted net funds inflows. However, the sale of specialised CCF fund managing businesses, the fall in global equity markets and the impact of the continued strengthening of the US dollar on our sterling and euro denominated funds... -

Page 50

HSBC HOLDINGS PLC Financial Review (continued) difference between that cost and post-tax profit attributable to ordinary shareholders is the amount of economic profit generated. Economic profit is used by management as one of the measures to decide where to allocate resources so that they will be... -

Page 51

... charge...Customer bad debt charge as a percentage of closing gross loans and advances . Year ended 31 December 2001 2000 1999 Figures in US$m Net interest income...Dividend income ...Net fees and commissions ...Dealing profits...Other income...Other operating income . Total operating income Staff... -

Page 52

... capital markets, growth in UK Banking and Turkey, the latter on short-term money market business due to volatile local market conditions. These increases were partly offset by a fall in net interest income in HSBC Republic Suisse reflecting a reduction in the benefit of net free funds from falling... -

Page 53

... number of products, particularly savings accounts and residential mortgages. HSBC Bank plc's mortgage advances were US$2.5 billion, or 13 per cent, higher than 2000 reflecting an increase in new lending and improved retention of existing customers. Net interest income earned in treasury and capital... -

Page 54

... increased to support business development and higher business volumes, including wealth management activities and customer telephone services. Additional IT staff numbers have supported service improvement projects, particularly relating to expanding delivery channels including the internet. Profit... -

Page 55

...-term funding costs, together with the maturing of high yielding assets. In UK Banking, net interest income at US$3,222 million was 6 per cent higher than 1999 reflecting balance growth in personal and commercial current accounts, personal savings and personal and commercial lending. HSBC Bank plc... -

Page 56

... investment in building its digital interactive television services, 'Open...' . In July 2000, HSBC Bank plc agreed to sell its investment in BiB to BSkyB. Hong Kong Figures in US$m Net interest income...Dividend income ...Net fees and commissions...Dealing profits...Other income ...Other operating... -

Page 57

... securities, growth in lower-cost customer deposits and a wider gap between the Hong Kong best lending rate ('BLR' ) and interbank rates. These positive effects were partly offset by a further decline in mortgage yields and reduced spreads on term deposits. The contribution from net free funds... -

Page 58

... 2001, which supported business expansion in credit card advances and Mandatory Provident Fund products and salary increments were the main contributors to this increase. In addition, US$42 million of the increased staff costs related to higher retirement benefit costs mainly in Hang Seng Bank where... -

Page 59

... and a fall in the average advances-to-deposits ratio more than outweighed the benefits of growth in lower cost savings accounts, an improvement in the spreads earned on time deposits, and the widening of the gap between the Hong Kong best lending rate ('BLR' ) and interbank rates. Continued price... -

Page 60

... exchange profits as a result of increased corporate business volumes, partly offset by mark-to-market losses on bonds in the Investment Bank and the bank in Hong Kong. Operating expenses increased by US$91 million, or 5 per cent, and included US$87 million in costs, mainly attributable to staff... -

Page 61

...There was solid growth in personal lending, reflecting the successful development of wealth management businesses in several countries, with increases in Taiwan, Singapore, Korea, India, New Zealand, Brunei, Malaysia and Australia. Spreads widened in Singapore and Japan mainly due to strong treasury... -

Page 62

... exposure to an energy sector related company. Advances to customers grew by US$125 million, or 9 per cent, with strong growth in personal lending and to the commercial and industrial and public sectors. In mainland China, HSBC's operations returned to profitability reporting pre-tax profit of US$33... -

Page 63

... basis pre-tax profits were US$40 million, 23 per cent higher than in 2000. Net interest income was in line with 2000 as the benefit of increased levels of average interest-earning assets offset a fall in net interest margin. Intense competition for the limited quality lending opportunities resulted... -

Page 64

... reduction in the level of new specific provisions and increased releases of bad and doubtful debt provisions. Loan demand remained subdued, although there was encouraging growth in corporate deposits. In India, our operations benefited from the expansion of the personal banking business. Pre-tax... -

Page 65

... reported an increase in pre-tax profits of US$19 million, 12 per cent higher than in 1999. Growth in personal lending, credit card advances and commercial overdrafts contributed to an overall increase in net interest income of 6 per cent during the year. However, strong growth in customer deposits... -

Page 66

...end of 2001. The year was marked by the tragic events on 11 September. In New York City, HSBC responded immediately to the tragedy with a number of donations and programs to assist with the rebuilding of the community. Although HSBC Bank USA' s branch at Five World Trade Center was destroyed we were... -

Page 67

... of US$164 million incurred on HSBC' s 'e' commerce platform hsbc.com in its development centre in New York caused reported profit before tax to fall by US$369 million, or 43 per cent, to US$481 million. HSBC Bank USA' s operations in the United States reported an increase of US$402 million, or 46... -

Page 68

... as a 13 per cent increase in personal and commercial services revenues only partly offset lower levels of broking and capital market fees in weaker equity stock markets. As part of its strategy of providing customers with multiple choices for product and service delivery, HSBC Bank USA now offers... -

Page 69

... year. Mutual fund fee income also increased due to higher net sales volumes and increases in market values. Corporate finance fees also benefited from the favourable market conditions in 2000. A lower contribution from structured equity transactions led to lower dealing profits in Canada compared... -

Page 70

... of investments and tangible fixed assets ...(Loss)/profit on ordinary activities before tax ...Share of HSBC' s pre-tax profits (cash basis) (per cent)...Share of HSBC' s pre-tax profits (per cent) ...Cost:income ratio (excluding goodwill amortisation) (per cent) Period-end staff numbers (full-time... -

Page 71

... bills ...Total assets...Liabilities Deposits by banks...Customer accounts ... Year ended 31 December 2001 compared with year ended 31 December 2000 The main focus in Latin America has been Argentina, where following the inability to secure a financing package from the International Monetary Fund... -

Page 72

... US$6 million compared to dealing profits of US$16 million in 2000. This resulted from difficult trading conditions as a result of volatility in foreign exchange rates and losses on bond positions. HSBC' s Argentine pensions, healthcare and life insurance businesses also reported falls in income as... -

Page 73

... allowed interest rates to fall by nearly 300 basis points from December 1999. HSBC' s strategy of embracing internet technology in the delivery of its services has developed rapidly in Brazil. HSBC Brasil has offered internet banking since 1998 to its personal and small business customers and has... -

Page 74

... of HSBC' s consolidated financial statements. HSBC' s operations are closely integrated and, accordingly, the presentation of line of business data includes internal allocations of certain items of income and expenses. These allocations include the costs of certain support services and head office... -

Page 75

... ended 31 December 2001 Europe...Hong Kong...Rest of Asia-Pacific...North America...Latin America...Profit/(loss) on ordinary activities before tax (cash basis) ... Personal Financial Services 1,091 1,631 80 653 49 3,504 Commercial Banking 986 726 277 372 24 2,385 Private Banking 310 84 (16 ) 37... -

Page 76

... 2000 Europe ...Hong Kong ...Rest of Asia-Pacific ...North America ...Latin America ...Profit on ordinary activities before tax (cash basis) ... Personal Financial Services 624 1,680 189 507 37 3,037 Commercial Banking 1,139 781 376 376 108 2,780 Corporate, Investment Banking and Markets 1,501... -

Page 77

... benefit of customer deposit growth was offset by the impact on margins of competitive pricing initiatives in mortgages and savings accounts. In Hong Kong net interest income rose by US$41 million as the benefits of increased credit card lending and wider spreads on non-Hong Kong dollar lending were... -

Page 78

...interest income in Hong Kong fell slightly, by US$44 million, due to lower margins on current account deposits. The Rest of Asia-Pacific saw a small rise in net interest income as the benefit of lower funding costs in the Middle East offset lower margins in Singapore. North America saw strong growth... -

Page 79

... treasury was positioned to take advantage of falling rates, treasury also improved its yield by shifting part of its holding of liquid assets from government bonds to high quality corporate bonds. Increased equity swap activity generated additional cash deposits and in a number of emerging markets... -

Page 80

... and HSBC's holding company and financing operations. The results include net interest earned on free capital held centrally and operating costs incurred by the head office operations in providing stewardship and central management services to HSBC. A number of exceptional items are also reported in... -

Page 81

... an employer' s retirement benefit obligations and any related funding; in respect of defined benefit schemes, the operating costs of providing retirement benefits to employees are recognised in the accounting period(s) in which the benefits are earned by the employees, and the related finance costs... -

Page 82

...million. The increase in net income due to the nonamortisation of goodwill would have been US$1.3 billion for the year ended 31 December 2001. HSBC is currently reviewing the impact of applying impairment testing in accordance with SFAS 142. SFAS 143 'Accounting for Asset Retirement Obligations' was... -

Page 83

... to customers Europe HSBC Bank plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA... -

Page 84

...) Trading securities Europe HSBC Bank plc (i) ...HSBC Republic Holdings (Suisse)...Crédit Commercial de France ...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC USA Inc ...HSBC Bank... -

Page 85

... plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA Inc...HSBC Bank Canada ...HSBC... -

Page 86

... HSBC Bank plc (i) ...HSBC Republic Holdings (Suisse)...Crédit Commercial de France ...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East. HSBC USA Inc ...HSBC Bank Canada... -

Page 87

... Latin America Other operations ... Customer accounts * Europe HSBC Bank plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia... -

Page 88

... HSBC Bank plc (i) ...HSBC Republic Holdings (Suisse)...Crédit Commercial de France ...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East. HSBC USA Inc ...HSBC Bank Canada... -

Page 89

... plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA Inc...HSBC Bank Canada ...HSBC... -

Page 90

...HSBC Republic Holdings (Suisse)...23,699 Crédit Commercial de France ...44,549 Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East. HSBC USA Inc ...HSBC Bank Canada ...HSBC... -

Page 91

... 2001 Net interest margin Europe HSBC Bank plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East... -

Page 92

... Rate US$m 199 - - 144 1999 US$m 772 - - 1,108 2001 compared with 2000 Increase/(decrease) Interest income Short-term funds and loans to banks Europe HSBC Bank plc (i) ...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation... -

Page 93

...) Trading securities Europe HSBC Bank plc (i)...HSBC Republic Holdings (Suisse)...Crédit Commercial de France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad . HSBC USA Inc...HSBC Bank... -

Page 94

... Latin America Other operations... Customer accounts Europe HSBC Bank plc (i) ...HSBC Republic Holdings (Suisse)...Crédit Commercial de France...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia... -

Page 95

...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad . HSBC Bank Middle East ...HSBC USA Inc...HSBC Bank Canada ...HSBC Bank Brasil...HSBC Bank Argentina S.A... 2001 compared with 2000 Increase... -

Page 96

... from lending, trade finance, treasury and leasing activities. HSBC has dedicated standards, policies and procedures to control and monitor all such risks. Within Group Head Office, Group Credit and Risk is mandated to provide high level centralised management of credit risk for HSBC on a global... -

Page 97

... a credit process involving credit policies, procedures and lending guidelines conforming with HSBC requirements, and credit approval authorities delegated from the Board of Directors of HSBC Holdings to the local Chief Executive Officer. The objective is to build and maintain risk assets of high... -

Page 98

...billion in Hong Kong. Strong growth was also achieved in consumer lending in the United Kingdom, in France by both organic growth and from acquisitions, and in personal lending in Singapore and several other countries in Asia-Pacific. These increases reflected the greater focus on this sector of the... -

Page 99

... East and HSBC Bank USA operations, by the location of the lending branch. Europe US$m 31 December 2001 Personal: Residential mortgages ...Hong Kong SAR Government Home Ownership Scheme...Other personal ...Total personal...Corporate and commercial: Commercial, industrial and international trade... -

Page 100

HSBC HOLDINGS PLC Financial Review (continued) Europe †US$m 31 December 2000 Personal: Residential mortgages ...Hong Kong SAR Government Home Ownership Scheme...Other personal...Total personal ...Corporate and commercial: Commercial, industrial and international trade...Commercial real estate... -

Page 101

... advances to customers...General provisions...Suspended interest...Total...31 December 1997 Personal: Residential mortgages ...Hong Kong SAR Government Home Ownership Scheme ...Other personal ...Total personal...Corporate and commercial: Commercial, industrial and international trade ...Commercial... -

Page 102

... Asia-Pacific and Latin America Commercial, industrial and international trade and other US$m Residential mortgages US$m Other Personal US$m Propertyrelated US$m Total US$m 31 December 2001 Loans and advances to customers (gross) Singapore ...Australia and New Zealand ...Malaysia ...Middle East... -

Page 103

... Latin America US$m 2,367 45,072 57,154 11,197 9,279 3,362 (30 ) 29,395 53,778 10,024 4,503 2,402 (24 ) 22,713 44,938 11,433 4,523 1,740 (31 ) 22,471 36,725 11,993 10,563 4,827 (46 ) Provisions for bad and doubtful debts It is HSBC' s policy that each operating company will... -

Page 104

... basis are credit cards and other unsecured consumer lending products. HSBC has in place a minimum provisioning standard for all consumer lending products based on time of delinquency. For portfolios of non-mortgage personal lending, the policy, which is based on historical loss experience, is to... -

Page 105

... previous years: Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Residential mortgages ...Other personal...Total recoveries...Charge to profit and loss account: Banks ...Commercial, industrial and international trade... -

Page 106

... ...Charge to profit and loss account: Banks...Commercial, industrial and international trade...Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages...Other personal ...General provisions...Total charge...Foreign exchange and other movements... -

Page 107

... recoveries...Charge to profit and loss account: Banks ...Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Residential mortgages ...Other personal...General provisions ...Total charge ...Foreign exchange and other... -

Page 108

... ...Charge to profit and loss account: Banks...Commercial, industrial and international trade...Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages...Other personal ...General provisions...Total charge...Foreign exchange and other movements... -

Page 109

... recoveries...Charge to profit and loss account: Banks ...Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Residential mortgages ...Other personal...General provisions* ...Total charge ...Foreign exchange and other... -

Page 110

...71 2.82 2.17 Â- 0.75 2.92 31 December 2000 % with the new terms. In addition, US banks typically write off problem lending more quickly than is the practice in the United Kingdom. This practice means that HSBCÂ's reported level of credit risk elements is likely to be higher than for a comparable US... -

Page 111

... but suspended: Europe...Hong Kong...Rest of Asia-Pacific...North America...Latin America...Total suspended interest loans ...Assets acquired in exchange for advances: Europe...Hong Kong...Rest of Asia-Pacific...North America...Total assets acquired in exchange for advances ...Total non-performing... -

Page 112

... accounts), amounts receivable under finance leases, acceptances, commercial bills, certificates of deposit and debt and equity securities (net of short positions), and exclude accrued interest and intraHSBC exposures. Outstandings to counterparties in the United Kingdom, HSBC HoldingsÂ' country... -

Page 113

....6 11.3 9.3 7.6 Banks 31 December 1999 United States...Germany ...France ...Hong Kong ...Japan...Canada ...The Netherlands...Italy...As at 31 December 2001, HSBC had in-country foreign currency and cross-border outstandings to counterparties in Australia of between 0.75% and 1% of total assets. The... -

Page 114

...ability to sell securities together with its access to alternative funding sources such as inter-bank markets or securitisation, would be the routes through which HSBC would meet unexpected outflows in excess of available liquid assets. • • • Current accounts and savings deposits payable on... -

Page 115

... term assets of US$5.5 billion, consisting mainly of cash at bank and money market deposits of US$3.4 billion, and other amounts due from HSBC undertakings (including dividends) of US$1.8 billion, exceeded short term liabilities and no additional funding was required. HSBC Holdings actively manages... -

Page 116

... other securities. Trading risks arise either from customer-related business or from position taking. HSBC manages market risk through risk limits approved by the Group Executive Committee. Traded Markets Development and Risk, an independent unit within the Investment Banking and Markets operation... -

Page 117

...: Combined HSBC At 31 December 2000 US$m Total trading activities ...Foreign exchange trading positions ...Interest rate trading positions ...Equities trading positions ...Excluding former Republic operations At 31 Minimum Maximum Average December during during For the 2000 The year The year year US... -

Page 118

... exposure HSBCÂ's main operations are in the United Kingdom, Hong Kong, France, the United States and Brazil, although it also has operations elsewhere in Europe, the rest of Asia-Pacific, North America and Latin America. The main operating (or functional) currencies in which HSBCÂ's business is... -

Page 119

... assumption that all positions run to maturity. In practice, these exposures are actively managed. Equities exposure HSBCÂ's equities exposure comprises trading equities, forming the basis of VAR, and long-term equity investments. The latter are reviewed annually by the Group Executive Committee and... -

Page 120

HSBC HOLDINGS PLC Financial Review (continued) monitored by the subsidiariesÂ' ALCOs. VAR on equities trading positions is set out in the trading VAR table on page 115. Operational risk management Operational risk is the risk of loss arising through fraud, unauthorised activities, error, ... -

Page 121

... or guarantees. Trading book risk-weighted assets are determined by taking into account market-related risks, such as foreign exchange, interest rate and equity position risks, as well as counterparty risk. HSBC capital management It is HSBCÂ's policy to maintain a strong capital base to support the... -

Page 122

... Limited and subsidiaries...HSBC Bank plc (excluding CCF and HSBC Private Banking Holdings (Suisse) S.A.)...HSBC Private Banking Holdings (Suisse) S.A.* ...CCF HSBC Bank plc ...HSBC USA Inc ...HSBC Bank Middle East ...HSBC Bank Malaysia Berhad HSBC Bank Canada ...HSBC Latin American operations HSBC... -

Page 123

... customers - Commercial, industrial and international trade .. - Real estate and other property related ...- Non-bank financial institutions ...- Governments ...- Other commercial ...Hong Kong SAR Government Home Ownership Scheme...Residential mortgages and other personal loans ...Loans and advances... -

Page 124

...customers - Commercial, industrial and international trade .. - Real estate and other property related ...- Non-bank financial institutions ...- Governments ...- Other commercial ...Hong Kong SAR Government Home Ownership Scheme ...Residential mortgages and other personal loans ...Loans and advances... -

Page 125

... balances with HSBC companies. The 'Other' category includes securities sold under agreements to repurchase. 2001 Average Average Balance Rate US$m Deposits by banks Europe Demand and other - non-interest bearing...Demand - interest bearing ...Time...Other ...Total...Hong Kong Demand and other... -

Page 126

HSBC HOLDINGS PLC Other information (continued) 2001 Average Balance US$m Customer accounts Europe Demand and other - non-interest bearing...Demand - interest bearing...Savings...Time ...Other ...Total ...Hong Kong Demand and other - non-interest bearing...Demand - interest bearing...Savings...... -

Page 127

... of deposit ...Time deposits: - banks ...- customers...Total...Hong Kong Certificates of deposit ...Time deposits: - banks ...- customers...Total...Rest of Asia-Pacific Certificates of deposit ...Time deposits: - banks ...- customers...Total...North America Certificates of deposit ...Time deposits... -

Page 128

HSBC HOLDINGS PLC Other information (continued) Short-term borrowings HSBC includes short-term borrowings within customer accounts, deposits by banks and debt securities in issue and does not show short-term borrowings separately on the balance sheet. Short-term borrowings are defined by the SEC ... -

Page 129

....com corporation. A non-executive Director since 1998. Chairman of HSBC Private Equity (Asia) Limited and a Director of MTR Corporation Limited, Inchcape plc and Inmarsat Ventures Plc. A member of the Executive Council of the Hong Kong SAR. Chairman of the Hong Kong/Japan Business Cooperation... -

Page 130

...46. Group Finance Director. An executive Director since 1995. A Director of HSBC Investment Bank Holdings plc, HSBC Bank Malaysia Berhad, HSBC USA Inc. and HSBC Bank USA. A member of The Accounting Standards Board and the Standards Advisory Council of the International Accounting Standards Committee... -

Page 131

... Rose from 1973 to 1998. A Director of HSBC Investment Bank Holdings plc and HSBC Private Banking Holdings (Suisse) S.A. Age 54. Chief Executive Officer, The Hongkong and Shanghai Banking Corporation Limited, India. Joined HSBC in 1968. Appointed a Group General Manager in August 2001. V H C Cheng... -

Page 132

... HOLDINGS PLC Board of Directors and Senior Management (continued) E W Gill Age 55. Chief Executive Officer, The Hongkong and Shanghai Banking Corporation Limited, Singapore. Joined HSBC in 1968. Appointed a Group General Manager in 2000. M J G Glynn Age 50. President and Chief Executive Officer... -

Page 133

... range of banking and related financial services through an international network of some 7,000 offices in 81 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. Taken together, the five largest customers of HSBC do not account for more... -

Page 134

... 2001, HSBC QUEST Trustee (UK) Limited, the corporate trustee of the QUEST, subscribed for 3,343,173 ordinary shares of US$0.50 each at market values ranging from £6.65 to £10.84, using funds from those employees who exercised options under the HSBC Holdings Savings-Related Share Option Plan. In... -

Page 135

... retirement at age 50 or over, the transfer of employing business to another party, or a change of control of employing company, options may be exercised before completion of the relevant savings contract. Under the HSBC Holdings Savings-Related Share Option Plan and the HSBC Holdings SavingsRelated... -

Page 136

HSBC HOLDINGS PLC Report of the Directors (continued) HSBC Holdings Savings-Related Share Option Plan: Overseas Section HSBC Holdings ordinary shares of US$0.50 each Exercise price (£) 1.8060 3.0590 4.5206 5.2212 5.3980 6.0299 6.7536 6.7536 Exercisable from 1 Aug 2000 1 Aug 2001 1 Aug 2002 1 Aug... -

Page 137

... closing price of the securities immediately before the dates on which options were exercised was £8.60. The HSBC Holdings Executive Share Option Scheme was replaced by the HSBC Holdings Group Share Option Plan on 26 May 2000. No options have been granted under the Scheme since that date. HSBC... -

Page 138

HSBC HOLDINGS PLC Report of the Directors (continued) Crédit Commercial de France shares of â,¬5 each Exercise price... Options at 1 January 2001 5,000 5,000 5,000 5,000 5,000 Options exercised during year Options lapsed during year Options at 31 December 2001 5,000 5,000 5,000 5,000 5,000 Date ... -

Page 139

...2003 22 Dec 2005 1 January 2001 28,500 11,500 Options exercised during year Â- Â- Options lapsed during year Â- Â- Options at 31 December 2001 28,500 11,500 Netvalor shares of â,¬415 each Options at Exercise Date of award 22 Dec 1999 19 Dec 2000 price(€) 415 415 Exercisable from 22 Dec 2004 19 Dec... -

Page 140

... under the leadership of the Group Chief Executive. The Board meets regularly and Directors receive information between meetings about the activities of committees and developments in HSBCÂ's business. All Directors have full and timely access to all relevant information and may take independent... -

Page 141

...integrated into HSBCÂ's systems. HSBCÂ's key internal control procedures include the following: • Authority to operate the various subsidiaries is delegated to their respective chief executive officers within limits set by the Board of Directors of HSBC Holdings or by the Group Executive Committee... -

Page 142

...; computer systems and operations; property management; and for certain global product lines. Policies and procedures to guide subsidiary companies and management at all levels in the conduct of business to avoid reputational risk are established by the Board of HSBC Holdings, the Group Executive... -

Page 143

... cooperation between head office departments and businesses ensures a strong relationship between HSBCÂ's risk management system and its corporate social responsibility practices. Internal controls are an integral part of how HSBC conducts its business. HSBCÂ's manuals and statements of policy are... -

Page 144

... form of long-term share plan for new employees only, since 1996, to follow a policy of moving progressively from defined benefit to defined contribution Group pension schemes. pressures. Allowances and benefits are largely determined by local market practice. Annual performance-related payments... -

Page 145

... to purchase HSBC Holdings shares from pre-tax salary, was established during the year. In addition, employees in France may participate in a Plan d' Epargne Entreprise through which they may subscribe for HSBC Holdings shares. Directors and Senior Management HSBC HoldingsÂ' Board is currently... -

Page 146

... Plan 2000 and the HSBC Holdings Group Share Option Plan. Participants in these plans are also eligible to participate in the HSBC Holdings savings-related share option plans on the same terms as other eligible employees. In line with prevailing practice in France and arrangements made at the time... -

Page 147

...are normal within the location in which he is employed. Of the amount shown, 50 per cent has been awarded in cash and 50 per cent will be awarded in Restricted Shares with a three-year restricted period. Includes fees as non-executive Chairman of HSBC Private Equity (Asia) Limited. Retired on 25 May... -

Page 148

...& Co., Lloyds TSB Group plc, Oversea-Chinese Banking Corporation Limited, Mitsubishi Tokyo Financial Group Inc., Standard Chartered PLC, The Bank of East Asia, Limited) weighted by market capitalisation; 2. the five largest banks from each of the United States, the United Kingdom, continental Europe... -

Page 149

... the period since the date of grant. Awards will vest immediately in cases of death or if the business is no longer part of HSBC Holdings. The Remuneration Committee retains discretion to recommend early release of the shares to the Trustee in the event of redundancy, retirement on grounds of injury... -

Page 150

...Service contracts and terms of appointment No executive Director has a service contract with HSBC Holdings or any of its subsidiaries with a notice period in excess of one year or with provisions for predetermined compensation on termination which exceeds one yearÂ's salary and benefits in kind save... -

Page 151

...S K Green, A W Jebson and K R Whitson to contractual retirement age of 60 are provided under the HSBC Bank (UK) Pension Scheme. The pensions accrue at a rate of one-thirtieth of pensionable salary per year of pensionable service in the United Kingdom. In addition, supplementary provision is made for... -

Page 152

... 352 1,093 The transfer value represents a liability of HSBC' s pension funds and not a sum paid or due to the individual; it cannot therefore meaningfully be added to annual remuneration. On attaining age 60, Sir John Bond has been able, under the terms of the scheme, to retire at any time with an... -

Page 153

... companies. Sir John Bond has a personal interest in £290,000 of HSBC Capital Funding (Sterling 1) L.P. 8.208 per cent Non-cumulative Step-up Perpetual Preferred Securities, which he held throughout the year. D G Eldon has a personal interest in 300 Hang Seng Bank Limited ordinary shares of HK... -

Page 154

... the Hong Kong Composite Consumer Price Index, 35 per cent of the UK Retail Price Index and 15 per cent of the USA All Urban Consumer Price Index) plus 2 per cent per annum. This condition has been satisfied. Options awarded under the HSBC Holdings Savings-Related Share Option Plan. Options awarded... -

Page 155

...year. At 31 December 2001, executive Directors and Senior Management held, in aggregate, options to subscribe for 1,866,530 ordinary shares of US$0.50 each in HSBC Holdings under the HSBC Holdings Executive Share Option Scheme, HSBC Holdings Group Share Option Plan and HSBC Holdings savings-related... -

Page 156

... tests described in the 'Report of the Directors' in the 1998, 1999 and 2000 Annual Report and Accounts being satisfied. 1 Based on performance over the four-year period to 31 December 2000, 50 per cent of share awards vested and 50 per cent were forfeited. At the date of vesting, 14 March... -

Page 157

... Whitson increased following the acquisition by Computershare Trustee Limited of 31 HSBC Holdings ordinary shares of US$0.50 each through contributions to the HSBC UK Share Ownership Plan. There have been no other changes in DirectorsÂ' interests from 31 December 2001 to the date of this Report. Any... -

Page 158

... Stock Exchange of Hong Kong Limited. In September 2001, HSBC CCF Asset Management Group SA, a subsidiary of HSBC Holdings, acquired 16.3 per cent of the capital of Sinopia Asset Management S.A. (Â'SinopiaÂ') from three of its corporate directors for a consideration of €30.344 million, increasing... -

Page 159

... the 2002 Annual General Meeting. Annual General Meeting The Annual General Meeting of HSBC Holdings will be held at the Barbican Hall, Barbican Centre, London EC2 on Friday 31 May 2002 at 11.00 am. An informal meeting of shareholders will be held at Level 28, 1 QueenÂ's Road Central, Hong Kong on... -

Page 160

... to be applicable have been followed. The Directors have responsibility for ensuring that HSBC Holdings keeps accounting records which disclose with reasonable accuracy the financial position of HSBC Holdings and which enable them to ensure that the financial statements comply with the Companies Act... -

Page 161

...to consider whether the board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of HSBC' s corporate governance procedures or its risk and control procedures. We read the other information contained in the Annual Report and Accounts, including the... -

Page 162

HSBC HOLDINGS PLC Financial Statements Consolidated profit and loss account for the year ended 31 December 2001 Note Interest receivable - interest receivable and similar income arising from debt securities...- other interest receivable and similar income ...Interest payable ...Net interest income... -

Page 163

... - equity...- non-equity...Called up share capital ...Share premium account...Other reserves ...Revaluation reserves ...Profit and loss account ...Shareholders' funds ...Total liabilities ...MEMORANDUM ITEMS Contingent liabilities...- acceptances and endorsements ...- guarantees and assets pledged... -

Page 164

......NET ASSETS ...CAPITAL AND RESERVES Called up share capital ...Share premium account...Revaluation reserve...Reserve in respect of obligations under CCF share options...Profit and loss account ...Sir John Bond, Group Chairman. The accompanying notes are an integral part of the Financial Statements... -

Page 165

...297) 3,273 - - 679 (185) 6,006 27,402 33,408 Profit for the financial year attributable to shareholders ...Dividends...Other recognised gains and losses relating to the year ...New share capital subscribed, net of costs...New share capital issued in connection with the acquisition of CCF ...Reserve... -

Page 166

HSBC HOLDINGS PLC Financial Statements (continued) Consolidated cash flow statement for the year ended 31 December 2001 Note Net cash inflow from operating activities Dividends received from associates Returns on investments and servicing of finance: Interest paid on finance leases and similar ... -

Page 167

... Insurers ('ABI' ) 'Accounting for insurance business' does not address the present valuation of internally generated long-term assurance business. HSBC is primarily a banking group, rather than an insurance group, and, consistent with other banking groups preparing consolidated financial statements... -

Page 168

... Statements (continued) the costs of a continuing service to, or risk borne for, the customer, or is interest in nature. In these cases, it is recognised on an appropriate basis over the relevant period. (b) Loans and advances and doubtful debts It is HSBC' s policy that each operating company... -

Page 169

...are being hedged. Other treasury bills, debt securities, equity shares and short positions in securities are included in the balance sheet at market value. Changes in the market value of such assets and liabilities are recognised in the profit and loss account as 'Dealing profits' as they arise. For... -

Page 170

... 20 years or less to expiry. Investment properties are included in the balance sheet at their open market value and the aggregate surplus or deficit, where material, is transferred to the investment property revaluation reserve. (f) Finance and operating leases (i) Assets leased to customers under... -

Page 171

... benefits HSBC operates a number of pension and other post-retirement benefit schemes throughout the world. For UK defined benefit schemes annual contributions are made, on the advice of qualified actuaries, for funding of retirement benefits in order to build up reserves for each scheme member... -

Page 172

... as any related hedges. Transactions undertaken for trading purposes are marked-to-market value and the net present value of any gain or loss arising is recognised in the profit and loss account as 'Dealing profits' , after appropriate deferrals for unearned credit margin and future servicing costs... -

Page 173

... are determined annually in consultation with independent actuaries and are included in 'Other assets' . Changes in the value placed on HSBC' s interest in long-term assurance business are calculated on a post-tax basis and reported in the profit and loss account as part of 'Other operating income... -

Page 174

..., HSBC is reviewing its funding plan in consultation with the independent Scheme Actuary. The next actuarial valuation is due as at 31 December 2002. In Hong Kong, the HSBC Group Hong Kong Local Staff Retirement Benefit Scheme covers employees of The Hongkong and Shanghai Banking Corporation Limited... -

Page 175

... discount rate of 7.75% per annum and average salary increases of 5.15% per annum. The HSBC Bank (UK) Pension Scheme, The HSBC Group Hong Kong Local Staff Retirement Benefits Scheme and the HSBC Bank USA Pension Plan cover 42% (2000: 45%, 1999: 46%) of HSBC' s employees. The pension cost for defined... -

Page 176

... in HSBC Group Hong Kong Local Staff Retirement Benefit Scheme and a deficit of US$48 million in HSBC Bank USA Pension Plan. The net pension liability will have a consequent effect on reserves when FRS17 is fully implemented. HSBC Bank (UK) Pension Scheme HSBC notes that the shortfall of assets... -

Page 177

(iii) Post-retirement healthcare benefits HSBC also provides post-retirement healthcare benefits under schemes, mainly in the United Kingdom and also in the United States, Canada and Brazil. The charge relating to these schemes, which are unfunded, is US$39 million for the year (2000: US$42 million;... -

Page 178

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) 2001 US$m Independent attestation Audit reports for US and other non-UK reporting...Review of information for publication including work in connection with securities issuance ...Reviews and reporting under regulatory requirements (... -

Page 179

...before tax (a) Profit on ordinary activities before tax is stated after: 2001 US$m (i) Income Aggregate rentals receivable, including capital repayments, under - finance leases and hire purchase contracts...- operating leases...Income from listed investments ...Profits less losses on debt securities... -

Page 180

... and overseas branches provide for taxation at the appropriate rates in the countries in which they operate. The tax charge in 2001 benefited from increased tax-free gains in Hong Kong, a material capital gain in the UK covered by previously unrecognised capital losses, prior year tax credits as... -

Page 181

...10 - 8,374 Average number of shares in issue ...Savings-Related Share Option Plan ...Executive Share Option Scheme...Restricted Share Plan ...CCF share options...Average number of shares in issue assuming dilution ... Of the total number of employee share options existing at year-end, the following... -

Page 182

... of gross unrealised gains and losses for available-for-sale treasury bills and other eligible bills: Carrying value 31 December 2001 US Treasury and Government agencies ...UK Government...Hong Kong SAR Government ...Other governments...Corporate debt and other securities...US$m 2,303 3,013 2,181... -

Page 183

...are secured by the deposit of funds in respect of which the Government of the Hong Kong Special Administrative Region certificates of indebtedness are held. 14 Credit risk management HSBC' s credit risk management process is discussed in the 'Financial Review' section in the paragraph headed 'Credit... -

Page 184

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) 15 Loans and advances to banks 2001 US$m Remaining maturity: - repayable on demand...- 3 months or less but not repayable on demand...- 1 year or less but over 3 months...- 5 years or less but over 1 year ...- over 5 years ...Specific... -

Page 185

... by HSBC from Clover Funding have been deducted from 'Loans and advances to customers' . Clover Securitisation Limited has entered into swap agreements with HSBC under which Clover Securitisation Limited pays the floating rate of interest on the loans and receives interest linked to 3 month LIBOR... -

Page 186

... years ...Charge/(credit) to profit and loss account...Interest suspended during the year...Suspended interest recovered...Acquisition of subsidiaries ...Exchange and other movements ...At 31 December 2000 ...Included in: Loans and advances to banks (Note 15)...Loans and advances to customers... -

Page 187

... previous years...Charge/(credit) to profit and loss account ...Interest suspended during the year...Suspended interest recovered ...Acquisition of subsidiaries ...Exchange and other movements ...At 31 December 1999...Included in: Loans and advances to banks...Loans and advances to customers... 185 -

Page 188

... advances to customers: Residential mortgages ...Hong Kong SAR Government Home Ownership Scheme...Other personal ...Total personal ...Commercial, industrial and international trade ...Commercial real estate ...Other property related...Government ...Other commercial* ...Total corporate and commercial... -

Page 189

...3,261 41,216 38,535 3,337 41,872 Other securities - government securities and US government agencies ...- other public sector securities ...Issued by other bodies Investment securities - bank and building society certificates of deposit ...- other debt securities... 27,366 1,091 73,308 22,134 545... -

Page 190

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) 2001 Book value Investment securities - listed on a recognised UK exchange...- listed in Hong Kong ...- listed elsewhere ...- unlisted ...Other securities - listed on a recognised UK exchange...- listed in Hong Kong ...- listed ... -

Page 191

... unrealised losses US$m (62) - (2) (158) (6) (153) (381) Market valuation US$m 17,627 1,892 518 16,365 4,574 48,472 89,448 Available-for-sale 31 December 2001 US Treasury and Government agencies ...UK Government...Hong Kong SAR Government ...Other governments...Asset-backed securities ...Corporate... -

Page 192

... within five years Amount Yield After five but within ten years Amount Yield After ten years Amount Yield No fixed maturity Amount Yield Available-for-sale US Treasury and Government agencies...UK Government ...Hong Kong SAR Government ...Other governments Asset-backed securities ...Corporate debt... -

Page 193

... value is not disclosed as it cannot be determined without unreasonable expense. Included within 'Investment securities - listed on a recognised UK exchange' are US$555 million (2000: US$564 million) shares in HSBC Holdings as explained in note 26(a). Included in the above are 1,369,901 (2000: 5,871... -

Page 194

... France Principal activity Commercial banking Asset management Leasing All of the above interests in joint ventures are owned by subsidiaries of HSBC Holdings. All of the above make their financial statements up to 31 December. The principal countries of operation are the same as the countries... -

Page 195

...Exchange and other movements...At 31 December 2001 ...There was no goodwill included in the interests in associates at either 31 December 2001 or 2000. 2001 US$m 718 338 1,056 Listed shares (all listed outside the United Kingdom and Hong Kong)...Unlisted shares...521 535 1,056 (a) Shares in banks... -

Page 196

... HK$1 million trading as Laiki Group issued equity capital is less than US$1 million. All the above interests in associates are owned by subsidiaries of HSBC Holdings. The principal countries of operation are the same as the countries of incorporation except for World Finance International Limited... -

Page 197

...386) 14,581 15,089 Accumulated amortisation at 1 January 2001 ...Charge to the profit and loss account...Exchange and other movements...Accumulated amortisation at 31 December 2001 ...Net book value at 31 December 2001...Net book value at 31 December 2000 ... Additions represent goodwill arising on... -

Page 198

... 1 January 2001...Disposals ...Reclassification...Transfer of accumulated depreciation arising on revaluation ...Charge to the profit and loss account...Exchange and other movements ...Accumulated depreciation at 31 December 2001...Net book value at 31 December 2001 ...Net book value at 31 December... -

Page 199

...671 (1,356) 6,315 - - - - - - HSBC values its non-investment properties on an annual basis. In September 2001, except as noted below, HSBC' s freehold and long leasehold properties, together with all leasehold properties in Hong Kong, were revalued on an existing use basis or open market value as... -

Page 200

... HSBC properties leased to customers, none of which was held by HSBC Holdings, included US$522 million at 31 December 2001 (2000: US$518 million) let under operating leases, net of accumulated depreciation of US$27 million (2000: US$32 million). (f) Land and buildings occupied for own activities... -

Page 201

26 Investments (a) HSBC Holdings Shares in HSBC Undertakings US$m At 1 January 2001 ...Additions ...Repayments and redemptions .. Amortisation ...Transfers to other HSBC companies...Write-up of subsidiary undertakings to net asset value, including attributable goodwill (Note 36) ...At 31 December ... -

Page 202

... Hong Kong Hong Kong Hong Kong Bermuda Banking Banking Insurance Investment banking Retirement benefits and life assurance HK$9,559m HK$16,254m HK$125m HK$850m HK$327m Rest of Asia-Pacific HSBC Bank Egypt S.A.E. (formerly Egyptian British Bank S.A.E.) (94.53% owned)...HSBC Bank Australia Limited... -

Page 203

... activity Banking Banking Investment banking Holding company Banking Banking Insurance Issued equity capital C$935m US$205m -3 -3 ARS237m BRL912m BRL244m Canada United States United States United States Argentina Brazil Brazil Argentina Argentina Insurance Pension fund management ARS43m... -

Page 204

..., HSBC Asset Management (Europe) Limited, a wholly owned subsidiary of HSBC, acquired 97 per cent of China Securities Investment Trust Corporation for a cash consideration of US$187 million. Goodwill of US$163 million arose on this acquisition. vii. On 2 October 2001, HSBC Republic Bank (UK) Limited... -

Page 205

... in course of collection from other banks ...Treasury bills and other eligible bills...Loans and advances to banks...Loans and advances to customers ...Debt securities ...Equity shares...Tangible fixed assets...Other asset categories ...Deposits by banks ...Customer accounts...Items in the course of... -

Page 206

...rate, exchange rate and equities contracts which are marked to market ...Current taxation recoverable...Deferred taxation (Note 32) ...Long-term assurance assets attributable to policyholders (Note 31)...Other accounts ... Loans and advances to banks - with HSBC companies...Debt securities ...Equity... -

Page 207

...Total US$m 43,888 2,220 4,080 7,221 2,644 60,053 The geographical analysis of deposits is based on the location of the office in which the deposits are recorded and excludes balances with HSBC companies. 29 Customer accounts 2001 US$m 209,634 205,231 26,591 7,519 1,016 449,991 Amounts include: Due... -

Page 208

... public sector securities...- other debt securities ...Equity shares...Liabilities, including losses, resulting from off-balance-sheet interest rate, exchange rate and equities contracts which are marked-to-market ...Current taxation ...Obligations under finance leases...Dividend payable by HSBC... -

Page 209

... assets' (Note 27) ...Net deferred taxation provision ...Comprising: Short-term timing differences ...Leasing transactions...Relief for tax losses...Provision for additional UK tax on profit remittances from overseas ...Other items...1,109 (730) 379 2000 US$m 1,251 (340) 911 HSBC Holdings 2001... -

Page 210

... in finding new tenants and the timing of rental reviews. (ii) Labour, civil and fiscal litigation provisions in HSBC Bank Brasil S.A.- Banco Múltiplo of US$230 million (2000: US$331 million). This relates to labour and overtime litigation claims brought by employees after leaving the bank. The... -

Page 211

...- HSBC Holdings ...- Other HSBC...Dated subordinated loan capital: - HSBC Holdings ...- Other HSBC...Total subordinated liabilities: - HSBC Holdings ...- Other HSBC...Dated subordinated loan capital is repayable: - within 1 year ...- between 1 and 2 years ...- between 2 and 5 years ...- over 5 years... -

Page 212

... - HSBC Capital Funding (Euro 1) LP...7.525% subordinated loan 2003 - HSBC Finance Nederland B.V... 1,350 900 725 531 350 3,856 6,676 1,350 900 746 558 349 3,903 6,763 HSBC Holdings' dated subordinated loan capital is repayable: - within 1 year ...- between 1 and 2 years ...- between 2 and 5 years... -

Page 213

... used to support development of HSBC Bank plc' s capital base. The interest rate on the 9.25 per cent Step-up Undated Subordinated Notes changes in December 2006 to become, for each successive five year period, the rate per annum which is the sum of the yield on the then five year benchmark UK gilt... -

Page 214

... floating rate. There are limitations on the payment of distributions if prohibited under UK banking regulations or other requirements, if a payment would cause a breach of HSBC' s capital adequacy requirements, or if HSBC Holdings has insufficient distributable reserves (as defined). HSBC Holdings... -

Page 215

... Dutch auction rate transferable securities preferred stock, Series A and B The preferred stock of each series is redeemable at the option of HSBC USA Inc., in whole or in part, on any dividend payment date at par. 5 7.20% Series A cumulative preference shares The preference shares are redeemable... -

Page 216

... subsidiary undertaking of HSBC Holdings. Options outstanding to subscribe for HSBC Holdings' ordinary shares under the HSBC Holdings Group Share Option Plan, HSBC Holdings Executive Share Option Scheme, and HSBC Holdings Savings-Related Share Option Plans are as follows: Number of shares US$0.50 31... -

Page 217

......Unrealised deficit on revaluation of properties ...Transfer of depreciation from profit and loss account reserve Transfer to investment property revaluation reserve ...Net increase in attributable net assets of subsidiary undertakings (Note 26(a)) ...Exchange and other movements ...At 31 December... -

Page 218

...the Financial Statements (continued) HSBC US$m Profit and loss account: At 1 January 2001 ...Retained profit for the year...Revaluation reserve realised on disposal of properties...Arising on shares issued in lieu of dividends ...Transfer of depreciation to revaluation reserve ...Exchange and other... -

Page 219

... account reserve Transfer to investment property revaluation reserve ...Net increase in attributable net assets of subsidiary undertakings...Exchange and other movements ...At 31 December 2000...Total revaluation reserves ...Profit and loss account: At 1 January 2000 ...Retained profit for the year... -

Page 220

...increase in attributable net assets of subsidiary undertakings...Exchange and other movements ...At 31 December 1999 ...Total revaluation reserves ...Profit and loss account: At 1 January 1999 ...Retained profit/(deficit) for the year...Transfer arising on redenomination of share capital ...Transfer... -

Page 221

... (2000: 23,412,488 shares) were transferred from the HSBC QUEST to participants in HSBC' s Savings-Related Share Option Plan in the UK on exercise of their options. US$39 million (2000: US$64 million) was received from the share option plan participants. The price paid by option holders, ranged from... -

Page 222

... notional) principal. HSBC may enter a swap transaction either as an intermediary or as a direct counterparty. Interest rate futures are typically exchange-traded agreements to buy or sell a standard amount of a specified fixed income security or time deposit at an agreed interest rate on a standard... -

Page 223

... of equities in the form of published indices. Equities futures are typically exchange-traded agreements to buy or sell a standard quantity of a specific equity at a future date, at a price decided at the time the contract is made, and may be settled in cash or through delivery. Credit derivatives... -

Page 224

... values of third party and internal trading derivatives by product type. The replacement cost shown is the positive mark-to-market value and represents the accounting loss HSBC would incur if the counterparty to a derivative contract failed to perform according to the terms of the contract and the... -

Page 225

... within analyses of non-trading positions in the tables below. The following table summarises the contract amount and replacement cost of derivatives used for risk management purposes by product type. The replacement cost shown represents the accounting loss HSBC would incur if the counterparty... -

Page 226

...rate, interest rate and equities contracts with positive mark-to-market gains, after netting where possible, by maturity and by category of counterparty at 31 December 2001 and 31 December 2000. The table shows that the replacement cost of derivatives is predominantly with banks and under five years... -

Page 227

...,926 Liabilities: Short positions in securities ...Debt securities in issue ...Deposits by banks and customer accounts ...2000 Mark-tomarket values US$m 7,269 28,830 45,864 3,466 85,429 31,937 578 32,432 64,947 23,040 477 22,561 46,078 The net trading assets above are funded by liabilities whose... -

Page 228

... market prices at the balance sheet date. - Deposits by banks and customer accounts Deposits by banks and customer accounts which mature or reprice after six months are grouped by residual maturity. Fair value is estimated using discounted cash flows, applying either market rates, where applicable... -

Page 229

...: Documentary credits and shortterm trade-related transactions ...Forward asset purchases and forward forward deposits placed Undrawn note issuing and revolving underwriting facilities Undrawn formal standby facilities, credit lines and other commitments to lend: - over 1 year ...- 1 year and under... -

Page 230

... a specified time horizon and to a given level of confidence. Trading VAR for HSBC for 2001was: At 31 December 2001 US$m Total trading activities ...Foreign exchange trading positions ...Interest rate trading positions...Equities trading positions...122.0 13.3 111.7 45.5 Minimum during the year US... -

Page 231

... HSBC At 31 December 2000 US$m Total trading activities ...Foreign exchange trading positions ...Interest rate trading positions.. Equities trading positions...75.0 19.1 58.9 39.9 Excluding former Republic operations At 31 Minimum Maximum December during the during the Average for 2000 year year... -

Page 232

...Debt securities and equity shares...Other assets ...Total assets ...Liabilities Deposits by banks...Customer accounts .. Debt securities in issue...Other liabilities...Loan capital and other subordinated liabilities...Minority interests and shareholders' funds...Internal funding of the trading book... -

Page 233

...Debt securities and equity shares...Other assets ...Total assets...Liabilities Deposits by banks ...Customer accounts .. Debt securities in issue ...Other liabilities...Loan capital and other subordinated liabilities...Minority interests and shareholders' funds...Internal funding of the trading book... -

Page 234

... dollars...Total liabilities ...(d) Structural currency exposures HSBC' s structural foreign currency exposure is represented by the net asset value of its foreign currency equity and subordinated debt investments in subsidiary undertakings, branches, joint ventures and associates. Gains or losses... -

Page 235

...Euros ...Hong Kong dollars ...Sterling...Swiss francs ...Canadian dollars...Singapore dollars...UAE dirham ...Brazilian reais ...Argentine pesos...Malaysian ringgit ...Saudi riyals...Australian dollars... than US$100 million.. Total ... Net investments in overseas operations US$m 14,363 9,808 7,993 ... -

Page 236

... other assets...Change in deposits by banks...Change in customer accounts...Change in items in the course of transmission to other banks ...Change in debt securities in issue ...Change in other liabilities* ...Elimination of exchange differences†...Net cash inflow from operating activities * The... -

Page 237

... ...Costs incurred with share issue...Repaid during the year ...Own shares acquired by employee share ownership trust†...Net cash inflow/(outflow) from financing ...Capitalised on issue of shares to QUEST...Own shares acquired by employee share Ownership trust†...Exchange and other movements... -

Page 238

..., 2001, HSBC USA Inc. announced that it had settled civil law suits brought by 51 of the 53 Japanese plaintiffs who have asserted claims arising from the involvement of its subsidiary, Republic New York Securities Corporation ('RNYSC' ), with its customers Princeton Global Management Ltd. and... -

Page 239

... for sale in Japan. Following the acquisition by HSBC, RNYSC ceased active business during the year 2000, and the employment of all the RNYSC executives associated with RNYSC' s misconduct was terminated. The United States Attorney' s Office in its public filing acknowledged HSBC' s 'exemplary... -

Page 240

... and Shanghai Banking Corporation Limited, HSBC Bank plc, HSBC Bank Middle East and HSBC Bank USA operations, by the location of the branch responsible for reporting the results or for advancing the funds. Due to the nature of HSBC' s structure, the analysis of profits and net assets shown below... -

Page 241

...814 9,905 569,139 In 2000 included within total assets in Europe, Latin America and the rest of Asia-Pacific are amounts of US$67,484 million, US$2,967 million and US$1,130 million, respectively in relation to businesses acquired that year. Net assets: At 31 December 2001 US$m % 28,609 62.2 9,630... -

Page 242

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) Profit on ordinary activities before tax: Hong Kong US$m 8,971 (4,806) 4,165 26 1,358 (186) 218 436 6,017 (2,140) 3,877 (197) 6 - (18) 3,668 - 17 198 3,883 Rest of AsiaPacific US$m 3,612 (2,130) 1,482 3 ... -

Page 243

... commitments ...Amounts written off fixed asset investments...Operating profit ...Share of operating loss in joint ventures ...Share of operating (loss)/profit in associates...Gains on disposal of investments and tangible fixed assets...Profit on ordinary activities before tax...* Total US$m 39,404... -

Page 244

... million; 1999: US$198 million). (b) By country of domicile HSBC Holdings is registered and domiciled in the United Kingdom. (i) Profit on ordinary activities before tax in the United Kingdom 2001 US$m Operating income...Profit on ordinary activities before tax ...8,394 3,147 2000 US$m 8,596 3,162... -

Page 245