HP 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

was flat for fiscal 2014 as compared to fiscal 2013, due primarily to higher cash utilization for purchases of property, plant and equipment offset by cash

generated from sales of available-for-sale securities.

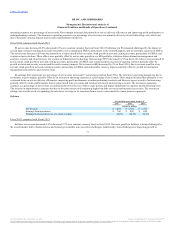

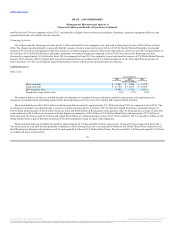

Net cash provided by financing activities was $1.3 billion in fiscal 2015 as compared to net cash used in financing activities of $6.6 billion in fiscal

2014. The change was due primarily to proceeds from the issuance of senior unsecured notes in October 2015 by Hewlett Packard Enterprise in principal

amount of $14.6 billion and higher proceeds from issuance of commercial paper, partially offset by the repayment as a result of early debt extinguishment of

$6.6 billion of U.S. Dollar Global Notes and higher repayment of commercial paper as compared to fiscal 2014. Net cash used in financing activities

decreased by approximately $1.4 billion for fiscal 2014 as compared to fiscal 2013 due primarily to proceeds from the issuance of U.S. Dollar Global Notes in

January 2014, partially offset by higher debt repayments and repurchases of common stock. For more information on our share repurchase programs, see

Item 5 and Note 13 to the Consolidated Financial Statements in Item 8, which are incorporated herein by reference.

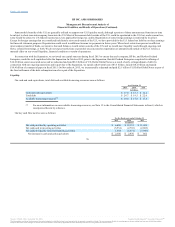

Capital Resources

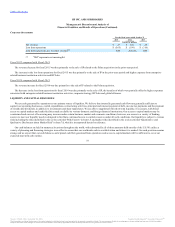

We maintain debt levels that we establish through consideration of a number of factors, including cash flow expectations, cash requirements for

operations, investment plans (including acquisitions), share repurchase activities, our cost of capital and targeted capital structure.

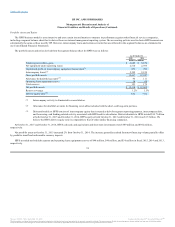

Short-term debt decreased by $601 million and long-term debt increased by approximately $5.7 billion for fiscal 2015 as compared to fiscal 2014. The

net increase in total debt was due primarily to issuance of senior unsecured notes in October 2015 by Hewlett Packard Enterprise in principal amount of

$14.6 billion which includes of $14.0 billion fixed rate notes and $600 million of floating rate notes, partially offset by the payment as a result of early debt

extinguishment of $6.6 billion in connection with the Separation, maturities of $2.5 billion of U.S. Dollar Global Notes and repayment of $3.5 billion of

short-term loan. We also issued $18.2 billion and repaid $18.4 billion of commercial paper in fiscal 2015. On November 4, 2015, we paid $2.1 billion of U.S.

Dollar Global Notes as part of the final settlement of the debt redemption issued as a part of the Separation.

Short-term debt and long-term debt decreased by approximately $2.5 billion and $0.6 billion, respectively, for fiscal 2014 as compared to fiscal 2013.

The net decrease in total debt was due primarily to maturities of debt. During fiscal 2014, we issued $2.0 billion of U.S. Dollar Global Notes under the 2012

Shelf Registration Statement which mature in 2019 and repaid $4.9 billion of U.S. Dollar Global Notes. We also issued $11.6 billion and repaid $11.5 billion

of commercial paper in fiscal 2014.

78

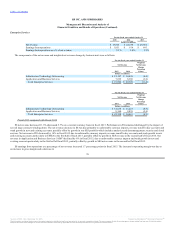

Short-term debt $ 2,885 $ 3,486 $ 5,979

Long-term debt $ 21,780 $ 16,039 $ 16,608

Debt-to-equity ratio 0.88x 0.72x 0.82x

Weighted-average interest rate 3.4% 2.7% 3.0%

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.