HP 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

•enterprise IT infrastructure, including enterprise server and storage technology, networking products and solutions, technology support and

maintenance;

•multi-vendor customer services, including technology consulting, outsourcing and support services across infrastructure, applications and

business process domains; and

•software products and solutions, including application testing and delivery, big data analytics, enterprise security, information governance

and IT Operations Management.

As of October 31, 2015, we had seven segments for financial reporting purposes: Personal Systems, Printing, the Enterprise Group ("EG"), Enterprise

Services ("ES"), Software, HP Financial Services ("HPFS") and Corporate Investments. Effective November 1, 2015, we report three segments as part of

continuing operations: Personal Systems, Printing and Corporate Investments.

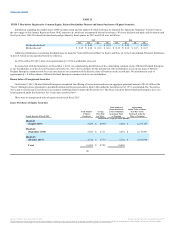

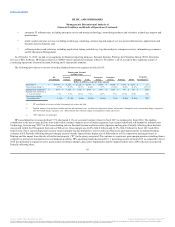

The following provides an overview of our key financial metrics by segment for fiscal 2015:

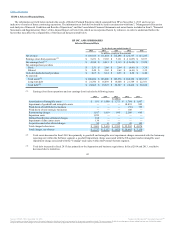

HP consolidated net revenue declined 7.3% (decreased 2.1% on a constant currency basis) in fiscal 2015 as compared to fiscal 2014. The leading

contributors to the net revenue decline were unfavorable currency impacts across all major segments, key account runoff and soft demand in Infrastructure

Technology Outsourcing ("ITO") in ES, lower desktop sales in Personal Systems and lower sales of printers and supplies. Partially offsetting these declines

was growth within the EG segment from sales of ISS servers. Gross margin was 24.0% ($24.8 billion) and 23.9% ($26.6 billion) for fiscal 2015 and 2014,

respectively. The 0.1 percentage point increase in gross margin was due primarily to service delivery efficiencies and improvements in underperforming

contracts in ES. Partially offsetting the gross margin increase was the impact from a higher mix of ISS products in EG, competitive pricing pressures in

Printing and the impact from the sale of intellectual property ("IP") in the prior-year period. We continue to experience gross margin pressures resulting from a

competitive pricing environment across our hardware portfolio. HP's operating margin decreased by 1.1 percentage points in fiscal 2015 as compared to fiscal

2014 due primarily to separation costs, pension plan settlement charges, data center impairments and the impact from the sale of IP in the prior-year period.

Partially offsetting these

45

Net revenue(1) $ 103,355 $ 31,469 $ 21,232 $ 52,701 $ 27,907 $ 19,806 $ 3,458 $ 3,216 $ 27

Year-over-year change % (7.3)% (8.3)% (8.5)% (8.4)% 0.7% (11.6)% (6.6)% (8.1)% (91.1)%

Earnings from operations(2) $ 5,471 $ 1,064 $ 3,865 $ 4,929 $ 3,981 $ 1,051 $ 760 $ 349 $ (565)

Earnings from operations as

a % of net revenue 5.3% 3.4% 18.2% 9.4% 14.3% 5.3% 22.0% 10.9% NM

Year-over-year change

percentage points (1.1)pts (0.3)pts 0.0pts (0.2)pts (0.1)pts 1.7pts (0.4)pts (0.2)pts NM

(1) HP consolidated net revenue excludes intersegment net revenue and other.

(2) Segment earnings from operations exclude corporate and unallocated costs, stock-based compensation expense, amortization of intangible assets, restructuring charges, acquisition

and other related charges, separation costs, defined benefit plan settlement charges and impairment of data center assets.

(3) "NM" represents not meaningful.

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.