HP 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

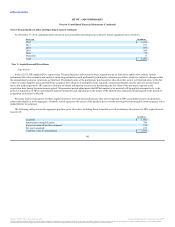

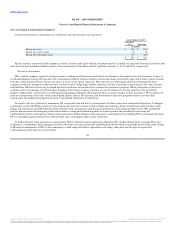

position. Collateral is generally posted within two business days. The fair value of derivatives with credit contingent features in a net liability position was

$173 million and $38 million at October 31, 2015 and 2014, respectively, all of which were fully collateralized within two business days.

Under HP's derivative contracts, the counterparty can terminate all outstanding trades following a covered change of control event affecting HP that

results in the surviving entity being rated below a specified credit rating. This credit contingent provision did not affect HP's financial position or cash flows

as of October 31, 2015 and 2014.

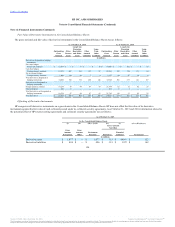

HP issues long-term debt primarily in U.S. dollars based on market conditions at the time of financing. HP may enter into fair value hedges, such as

interest rate swaps, to reduce the exposure of its debt portfolio to changes in fair value resulting from changes in interest rates by achieving a primarily U.S.

dollar London Interbank Offered Rate ("LIBOR")-based floating interest expense. The swap transactions generally involve principal and interest obligations

for U.S. dollar-denominated amounts. Alternatively, HP may choose not to swap fixed for floating interest payments or may terminate a previously executed

swap if it believes a larger proportion of fixed-rate debt would be beneficial.

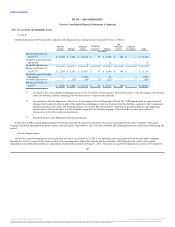

When investing in fixed-rate instruments, HP may enter into interest rate swaps that convert the fixed interest payments into variable interest payments

and may designate these swaps as fair value hedges.

For derivative instruments that are designated and qualify as fair value hedges, HP recognizes the change in fair value of the derivative instrument, as

well as the offsetting change in the fair value of the hedged item, in Interest and other, net in the Consolidated Statements of Earnings in the period of

change.

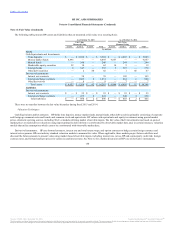

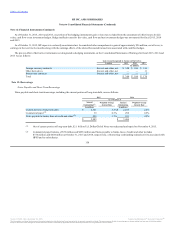

HP uses forward contracts and at times, option contracts designated as cash flow hedges to protect against the foreign currency exchange rate risks

inherent in its forecasted net revenue and, to a lesser extent, cost of sales, operating expenses, and intercompany loans denominated in currencies other than

the U.S. dollar. HP's foreign currency cash flow hedges mature generally within twelve months; however, hedges related to longer term procurement

arrangements extend several years and forward contracts associated with sales-type and direct-financing leases and intercompany loans extend for the

duration of the lease or loan term, which typically range from two to five years.

For derivative instruments that are designated and qualify as cash flow hedges, HP initially records changes in fair value for the effective portion of the

derivative instrument in Accumulated other comprehensive loss as a separate component of stockholders' equity in the Consolidated Balance Sheets and

subsequently reclassifies these amounts into earnings in the period during which the hedged transaction is recognized in earnings. HP reports the effective

portion of its cash flow hedges in the same financial statement line item as changes in the fair value of the hedged item.

154

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.