HP 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

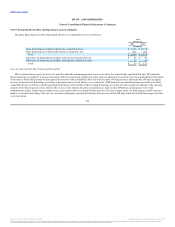

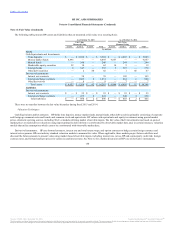

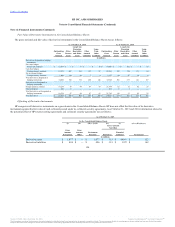

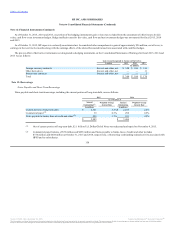

Contractual maturities of investments in available-for-sale debt securities were as follows:

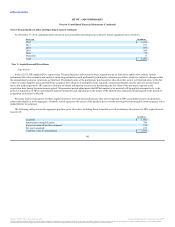

Equity securities in privately held companies include cost basis and equity method investments and are included in Long-term financing receivables and

other assets in the Consolidated Balance Sheets. These amounted to $58 million and $97 million at October 31, 2015 and 2014, respectively.

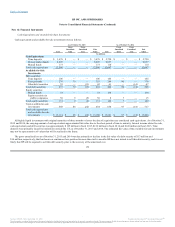

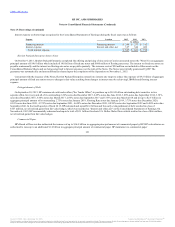

HP is a global company exposed to foreign currency exchange rate fluctuations and interest rate changes in the normal course of its business. As part of

its risk management strategy, HP uses derivative instruments, primarily forward contracts, interest rate swaps, total return swaps and, at times, option contracts

to hedge certain foreign currency, interest rate and, to a lesser extent, equity exposures. HP's objective is to offset gains and losses resulting from these

exposures with losses and gains on the derivative contracts used to hedge them, thereby reducing volatility of earnings or protecting the fair value of assets

and liabilities. HP does not have any leveraged derivatives and does not use derivative contracts for speculative purposes. HP may designate its derivative

contracts as fair value hedges, cash flow hedges or hedges of the foreign currency exposure of a net investment in a foreign operation ("net investment

hedges"). Additionally, for derivatives not designated as hedging instruments, HP categorizes those economic hedges as other derivatives. HP recognizes all

derivative instruments at fair value in the Consolidated Balance Sheets. HP classifies cash flows from its derivative programs with the activities that

correspond to the underlying hedged items in the Consolidated Statements of Cash Flows.

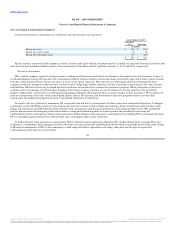

As a result of its use of derivative instruments, HP is exposed to the risk that its counterparties will fail to meet their contractual obligations. To mitigate

counterparty credit risk, HP has a policy of only entering into derivative contracts with carefully selected major financial institutions based on their credit

ratings and other factors, and HP maintains dollar risk limits that correspond to each financial institution's credit rating and other factors. HP's established

policies and procedures for mitigating credit risk include reviewing and establishing limits for credit exposure and periodically reassessing the

creditworthiness of its counterparties. Master netting agreements further mitigate credit exposure to counterparties by permitting HP to net amounts due from

HP to counterparty against amounts due to HP from the same counterparty under certain conditions.

To further mitigate credit exposure to counterparties, HP has collateral security agreements that allow HP to hold collateral from, or require HP to post

collateral to, counterparties when aggregate derivative fair values exceed contractually established thresholds which are generally based on the credit ratings

of HP and its counterparties. If HP's or the counterparty's credit rating falls below a specified credit rating, either party has the right to request full

collateralization of the derivatives' net liability

153

Due in one year $ 104 $ 104

Due in one to five years 14 14

Due in more than five years 319 385

$ 437 $ 503

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.