HP 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

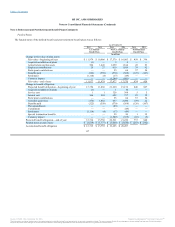

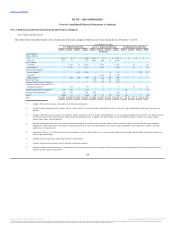

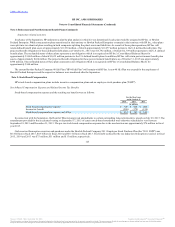

are reviewed by management, including, but not limited to, the timeliness of NAV as reported by the asset manager and changes in general economic and

market conditions subsequent to the last NAV reported by the asset manager. Depending on the amount of management judgment, the lack of near-term

liquidity, and the absence of quoted market prices, these assets are classified in Level 2 or Level 3 of the fair value hierarchy. Further, depending on how

quickly HP can redeem its hedge fund investments, and the extent of any adjustments to NAV, hedge funds are classified in either Level 2 or Level 3 of the

fair value hierarchy. Common collective trusts, interests in 103-12 entities and registered investment companies are valued at NAV. The valuation for some of

these assets requires judgment due to the absence of quoted market prices, and these assets are generally classified in Level 2 of the fair value hierarchy. Cash

and cash equivalents includes money market funds, which are valued based on NAV. Other assets, including insurance group annuity contracts, were

classified in the fair value hierarchy based on the lowest level input (e.g., quoted prices and observable inputs) that is significant to the fair value measure in

its entirety.

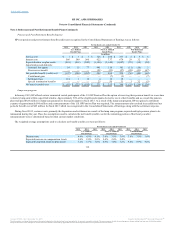

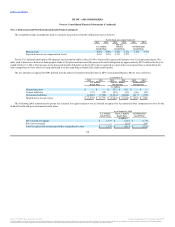

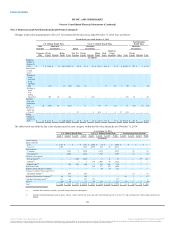

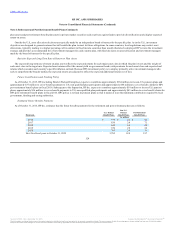

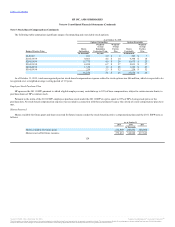

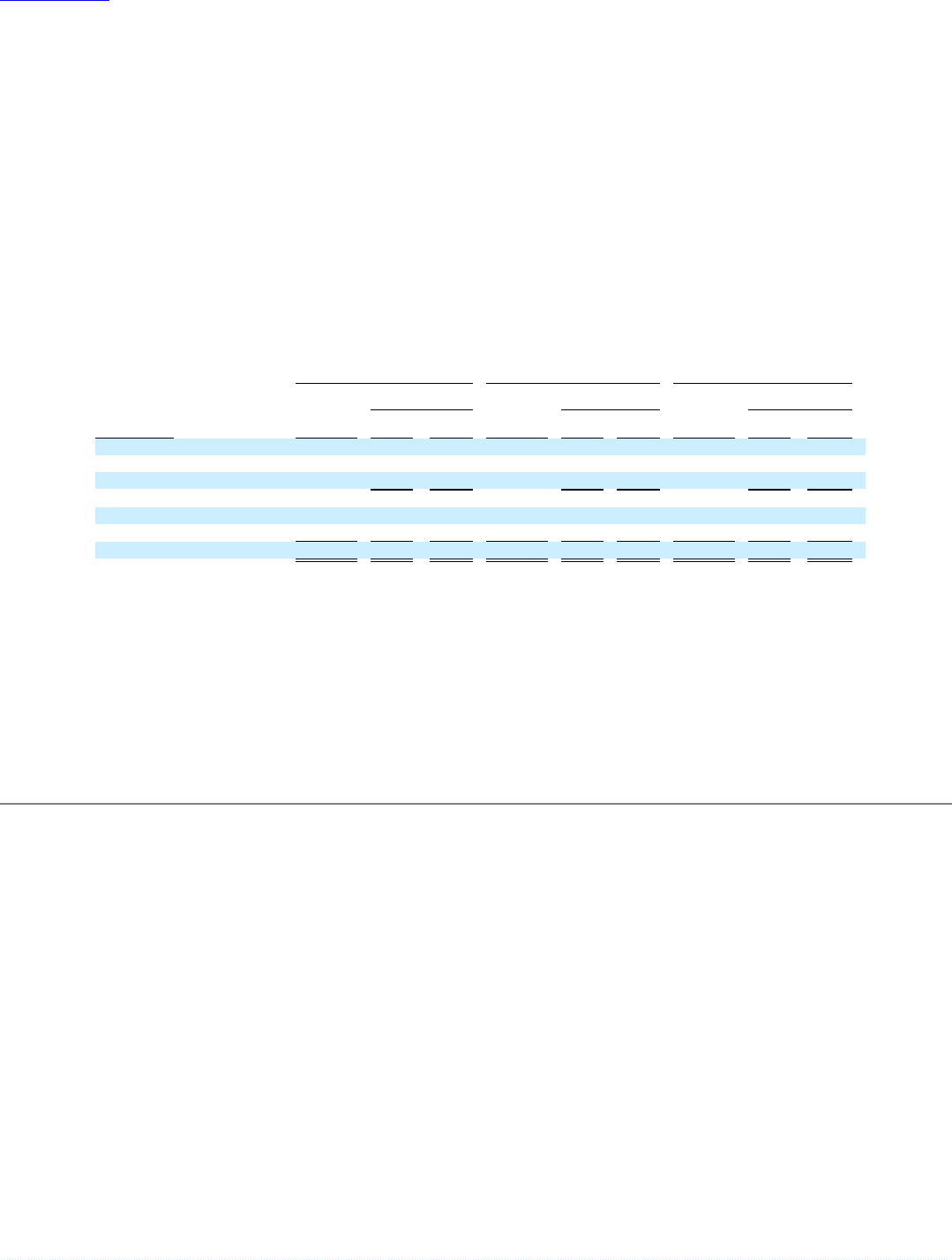

The weighted-average target and actual asset allocations across the benefit plans at the respective measurement dates were as follows:

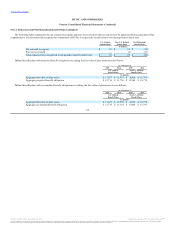

HP's investment strategy is to seek a competitive rate of return relative to an appropriate level of risk depending on the funded status of each plan and the

timing of expected benefit payments. The majority of the plans' investment managers employ active investment management strategies with the goal of

outperforming the broad markets in which they invest. Risk management practices include diversification across asset classes and investment styles and

periodic rebalancing toward asset allocation targets. A number of the plans' investment managers are authorized to utilize derivatives for investment or

liability exposures, and HP may utilize derivatives to effect asset allocation changes or to hedge certain investment or liability exposures.

The target asset allocation selected for each U.S. plan reflects a risk/return profile HP believes is appropriate relative to each plan's liability structure and

return goals. HP conducts periodic asset-liability studies for U.S. plans in order to model various potential asset allocations in comparison to each plan's

forecasted liabilities and liquidity needs. HP invests a portion of the U.S. defined benefit

123

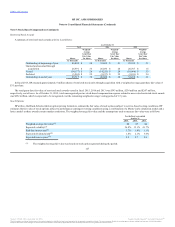

Public equity securities 34.2% 31.3% 45.7% 46.8% 10.7% 10.2%

Private/other equity securities 16.4% 15.8% 15.9% 15.2% 53.4% 58.6%

Real estate and other (1.7)% 0.6% 6.9% 7.1% (1.8)% —

Equity-related investments 53.5% 48.9% 47.7% 66.4% 68.5% 69.1% 66.1% 62.3% 68.8%

Debt securities 46.1% 47.5% 49.2% 33.4% 28.7% 27.6% 32.0% 33.2% 27.5%

Cash 0.4% 3.6% 3.1% 0.2% 2.8% 3.3% 1.9% 4.5% 3.7%

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.