HP 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

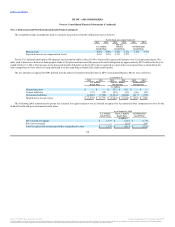

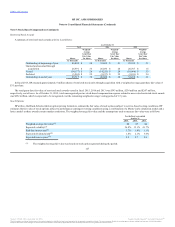

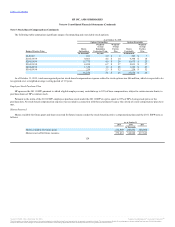

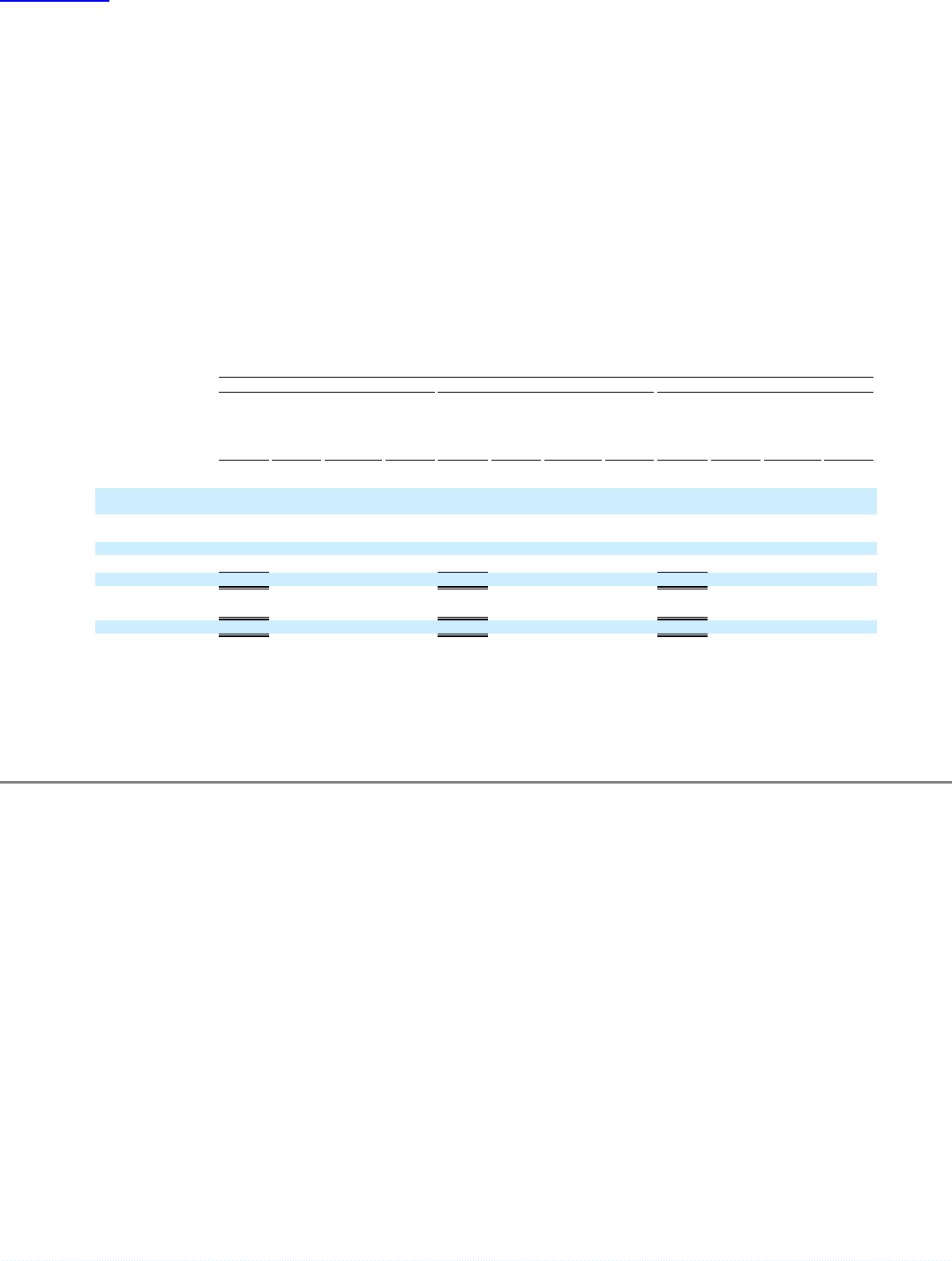

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value that option holders would have received had all option

holders exercised their options on the last trading day of fiscal 2015, 2014 and 2013. The aggregate intrinsic value is the difference between HP's closing

stock price on the last trading day of the fiscal year and the exercise price, multiplied by the number of in-the-money options. The total intrinsic value of

options exercised in fiscal 2015, 2014 and 2013 was $214 million, $151 million and $36 million, respectively. The total grant date fair value of options

vested in fiscal 2015, 2014 and 2013 was $59 million, $53 million and $64 million, respectively, net of taxes.

128

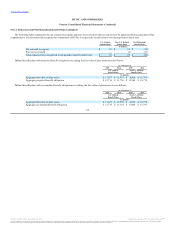

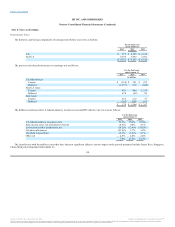

(2) For all awards granted in fiscal 2015 and fiscal 2013, expected volatility was estimated using the implied volatility derived from

options traded on HP's common stock. For awards granted in fiscal 2014, expected volatility for awards subject to service-based

vesting was estimated using the implied volatility derived from options traded on HP's common stock, whereas for performance-

contingent awards, expected volatility was estimated using the historical volatility of HP's common stock.

(3) The risk-free interest rate was estimated based on the yield on U.S. Treasury zero-coupon issues.

(4) The expected dividend yield represents a constant dividend yield applied for the duration of the expected term of the award.

(5) For awards subject to service-based vesting, the expected term was estimated using historical exercise and post-vesting termination

patterns; and for performance-contingent awards, the expected term represents an output from the lattice model.

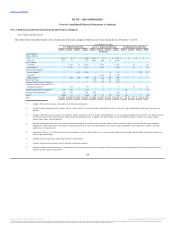

A summary of stock option activity is as follows:

Outstanding at beginning

of year 57,853 $ 27 84,042 $ 27 87,296 $ 29

Granted and assumed

through acquisitions 9,086 $ 36 9,575 $ 28 25,785 $ 15

Exercised (12,845)$ 19 (11,145)$ 18 (10,063)$ 19

Forfeited/cancelled/expired (17,816)$ 40 (24,619)$ 31 (18,976)$ 25

Outstanding at end of year 36,278 $ 26 5.1 $ 153 57,853 $ 27 4.3 $ 629 84,042 $ 27 3.9 $ 303

Vested and expected to

vest at end of year 34,973 $ 26 5.0 $ 152 54,166 $ 27 4.1 $ 571 80,004 $ 27 3.7 $ 274

Exercisable at end of year 25,630 $ 24 4.4 $ 146 30,459 $ 33 2.3 $ 197 49,825 $ 33 1.8 $ 58

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.