HP 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

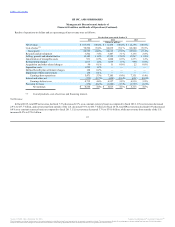

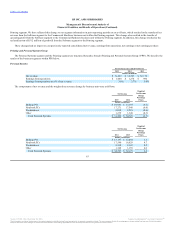

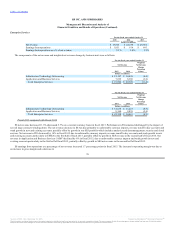

Personal Systems net revenue decreased 8.3% (decreased 3.1% on a constant currency basis) in fiscal 2015. The net revenue decline in Personal Systems

was due primarily to unfavorable currency impacts, particularly in EMEA, and weakening market demand. Personal Systems net revenue decreased as a result

of a 5% decline in average selling prices ("ASPs") and a 3% decline in unit volume. The decline in ASPs was due primarily to unfavorable currency impacts, a

shift in consumer PCs to low end products and a lower mix of commercial PCs within Personal Systems. The unit volume decline was due primarily to a unit

volume decline in desktops, partially offset by a unit volume growth in notebooks, both consumer and commercial.

Net revenue for commercial clients decreased 8% due primarily to unfavorable currency impacts, a decline in commercial desktops as a result of weak

market demand and higher net revenue in the prior-year period resulting from the replacement of the Windows XP operating system. Net revenue for

consumer clients decreased 8% due primarily to unfavorable currency impacts and a decline in consumer desktops. Net revenue declined 17% in Desktop

PCs, 2% in Notebook PCs, 9% in Workstations and 8% in Other. The net revenue decline in Other was due primarily to a decline in consumer tablets, the sale

of IP in the prior-year period, and unfavorable currency impacts, the effects of which were partially offset by increased sales of extended warranties.

Personal Systems earnings from operations as a percentage of net revenue decreased by 0.3 percentage points for fiscal 2015 as a result of a decline in

gross margin combined with an increase in operating expenses as a percentage of net revenue. The decline in gross margin was due primarily to unfavorable

currency impacts and a lower mix of commercial products, partially offset by favorable component costs and operational cost improvements. Operating

expenses as a percentage of net revenue increased due primarily to the size of the net revenue decline, higher administrative expenses as a result of lower bad

debt recoveries as compared to the prior-year period and higher R&D investments in commercial, mobility and immersive computing products, the effects of

which were partially offset by a decline in field selling costs as a result of favorable currency impacts and operational cost improvements.

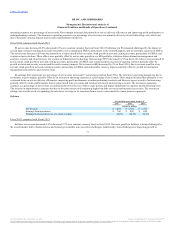

Personal Systems net revenue increased 6.6% (increased 7.2% on a constant currency basis) in fiscal 2014. While the Personal Systems business

continued to be challenged by the market shift towards mobility products, the pace of the PC market decline slowed with signs of stabilization driven by

growth in commercial PCs, the effects of which were partially offset by weakness in consumer PCs. The revenue increase in Personal Systems was due to

growth in commercial PCs, particularly notebooks, along with growth in consumer notebooks. Personal Systems experienced revenue growth across all

regions led by double digit revenue growth in EMEA, which experienced improved demand. The revenue increase was driven by an 8.2% increase in unit

volume, the effects of which were partially offset by a 1.5% decline in ASPs. The unit volume increase was primarily led by growth in commercial notebooks

as well as strength in commercial desktops, consumer notebooks and thin client products. The decline in ASPs was due primarily to a competitive pricing

environment and unfavorable currency impacts, the effects of which were partially offset by a favorable mix of commercial PCs.

Net revenue for commercial clients increased 10% due primarily to the benefits from the delayed installed base refresh cycle, the effects of customers

migrating from the Windows XP operating system and growth in all product categories partly driven by new product introductions, including the HP Elite

64

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.